Creditworthiness is a crucial aspect for mortgage lenders when evaluating potential borrowers. In order to secure the best terms and rates on a mortgage for clients and eliminate the risk of default, it is essential to understand what creditworthiness entails and the key factors that lenders look for before approval. This article aims to provide a comprehensive overview of creditworthiness and its significance in mortgage lending.

What is Creditworthiness?

Creditworthiness refers to an individual’s ability to repay debt and the likelihood of fulfilling financial obligations. It is a crucial factor that mortgage lenders assess to determine the level of risk associated with lending money. Several factors come into play when evaluating creditworthiness, including:

- credit history

- income

- employment

- debt-to-income ratio

- and collateral value

Having good creditworthiness is essential when it comes to obtaining favorable mortgage terms. Lenders want to ensure that borrowers have a solid track record of managing their finances and repaying debts on time. By assessing creditworthiness, lenders can determine the level of risk involved in lending money and make informed decisions.

The Basics of Creditworthiness

Creditworthiness primarily revolves around an individual’s credit history and credit score. A credit history provides a track record of past borrowing and repayment behavior, giving lenders insight into how responsible an individual has been with credit in the past. On the other hand, a credit score is a numerical representation of creditworthiness based on various factors such as payment history, credit utilization, length of credit history, types of credit used, and new credit applications.

Creditors use credit scores to assess how likely an individual is to repay debt. Higher credit scores indicate a lower risk, making it easier to obtain favorable mortgage terms. A good credit score demonstrates responsible financial behavior and gives lenders confidence that the borrower will make timely payments.

Importance of Creditworthiness in Financial Transactions

Creditworthiness extends beyond mortgage lending and plays a vital role in various financial transactions. Lenders consider creditworthiness when approving credit cards, personal loans, and auto loans. A strong creditworthiness makes it easier to access credit at favorable terms, such as lower interest rates and higher credit limits.

Furthermore, creditworthiness can also impact insurance premiums. Insurance companies often use credit-based insurance scores, which are derived from creditworthiness, to determine the premiums for auto, home, and other types of insurance. Individuals with good creditworthiness may benefit from lower insurance premiums, while those with poor creditworthiness may face higher rates.

Even job opportunities can be influenced by creditworthiness. Some employers may conduct credit checks as part of the hiring process, particularly for positions that involve financial responsibilities. While creditworthiness alone may not determine a person’s suitability for a job, a negative credit history or low credit score could raise concerns about financial responsibility.

Therefore, maintaining good creditworthiness is essential for overall financial well-being. It involves managing debts responsibly, making timely payments, and avoiding excessive credit utilization. By doing so, individuals can enhance their financial standing, access better credit opportunities, and enjoy various benefits in different aspects of their lives.

The Role of Creditworthiness in Mortgage Lending

Mortgage lenders place significant emphasis on creditworthiness when evaluating a potential borrower due to the substantial amount of money involved in mortgage loans. They want assurance that borrowers can repay their loans in a timely manner to minimize the risk of default.

Why Mortgage Lenders Care About Your Creditworthiness

For mortgage lenders, creditworthiness of a client is directly tied to the probability of repayment. Lenders want to ensure that borrowers have a strong financial track record, as it demonstrates their ability and commitment to repaying debts. A borrower’s creditworthiness is indicative of their financial responsibility and reliability.

How Creditworthiness Affects Your Mortgage Terms

The creditworthiness of a borrower significantly influences the terms and conditions offered by mortgage lenders. Higher creditworthiness can result in lower interest rates, reduced down payment requirements, and more favorable loan terms. Conversely, lower creditworthiness may lead to higher interest rates and stricter lending criteria.

Understanding how creditworthiness impacts mortgage terms can motivate borrowers to improve their credit standing before applying for a mortgage.

Key Factors Determining Creditworthiness

Several key factors contribute to determining an individual’s creditworthiness. Lenders assess these factors to gauge the risk associated with granting a loan.

Credit History and Credit Score

A strong credit history and a high credit score are essential for favorable creditworthiness. Lenders review payment history, types of credit used, length of credit history, and any negative marks, such as late payments or collections. Maintaining a good credit history by paying bills on time and managing credit responsibly is crucial for improving creditworthiness. Lenders typically favor applicants with higher credit scores, as they demonstrate a history of responsible financial management.

Current Income and Employment Status

Lenders evaluate a borrower’s current income and employment status to determine their ability to afford monthly mortgage payments. A stable job and a consistent income source significantly enhance creditworthiness. A steady income demonstrates financial stability and the capacity to fulfill financial obligations.

Debt-to-Income Ratio

The debt-to-income ratio is another crucial factor in assessing creditworthiness. This ratio compares a borrower’s monthly debt obligations to their monthly income. Lenders prefer a lower debt-to-income ratio, as it indicates a lower risk of default. Keeping debt levels manageable and increasing income can improve creditworthiness in this regard.

Collateral Value

In some cases, the value of collateral, typically a property, is taken into account when determining creditworthiness. The collateral provides lenders with security in case of default. Higher collateral value can enhance creditworthiness and potentially lead to more favorable loan terms.

How to Improve Your Creditworthiness

For mortgage professionals assisting customers with less-than-stellar creditworthiness, it’s essential to provide guidance on how they can improve their credit standing.

Tips for Building a Strong Credit History

Building a strong credit history requires responsible credit management. This includes making payments on time, avoiding excessive borrowing, and refraining from maxing out credit limits. Consistency and discipline are key to developing a favorable credit history.

a) Paying Bills on Time: Encourage borrowers to make timely payments on all outstanding debts to demonstrate credit responsibility.

b) Reducing Debt: Suggest borrowers pay down existing debts to lower their credit utilization ratio, thus improving their creditworthiness.

c) Avoiding New Credit Applications: Multiple credit inquiries within a short period can lower a borrower’s credit score. Advise customers to avoid unnecessary credit applications during the mortgage process.

d) Checking Credit Reports: Mortgage professionals should recommend that borrowers regularly review their credit reports for errors and discrepancies that may negatively impact their creditworthiness.

In conclusion, creditworthiness is a critical factor for mortgage lenders to look at and accurately assess when evaluating borrowers.By understanding the key factors that determine creditworthiness and guiding customers on improving their credit standing, mortgage professionals can better serve their clients and foster a successful mortgage lending process.

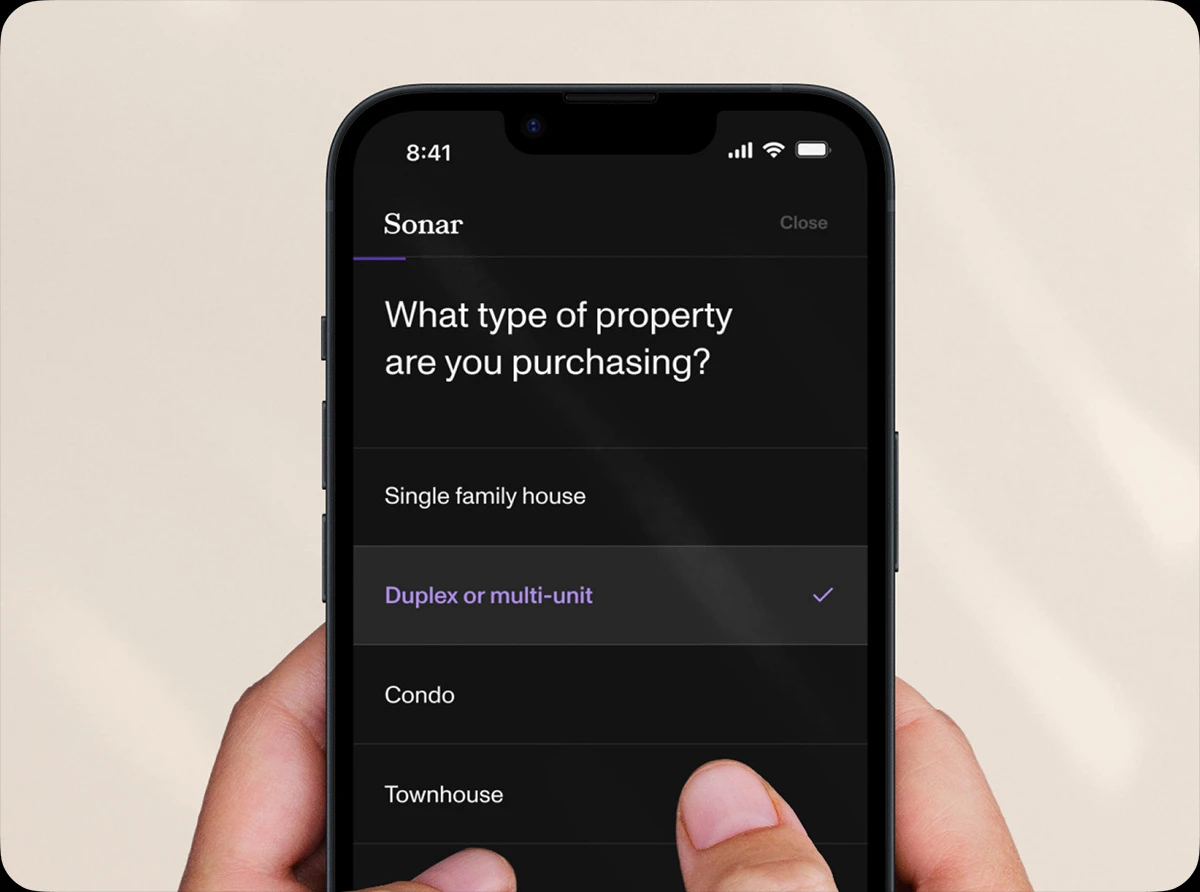

Ready to revolutionize your mortgage business? Sonar’s all-in-one mortgage origination software streamlines operations, saves time, and boosts productivity. Seize the opportunity to transform your mortgage business into a thriving powerhouse of efficiency. Schedule a demo today.