Success in the mortgage industry involves the interplay of various tools and technologies. While a dedicated mortgage CRM provides the backbone for a great borrower experience, it’s merely one facet of the puzzle. In this landscape, tools such as Loan Origination Software (LOS), Point-of-Sale (POS) systems, and Product Pricing Engine (PPE) solutions are indispensable components.

However, the days of managing separate systems in silos are giving way to a more comprehensive and holistic approach. Efficiency in mortgage operations lies in weaving essential components together into a unified ecosystem.

The Evolution of Mortgage Origination Processes

Traditionally, mortgage origination processes have used multiple tools that don’t always ‘talk’ to each other. Efforts to keep track of loans across different departments became labor-intensive and vulnerable to error.

Sonar emerged to eradicate these problems. Our all-in-one platform creates an integrated environment where mortgage professionals house data, documents, and transactions under a singular digital roof.

With Sonar, the once-disparate technologies can unite, changing the entire mortgage origination process. By leveraging Sonar’s comprehensive capabilities, mortgage professionals can say goodbye to the past and focus more on providing exceptional service to their borrowers.

Integrating Your Mortgage CRM Software with POS

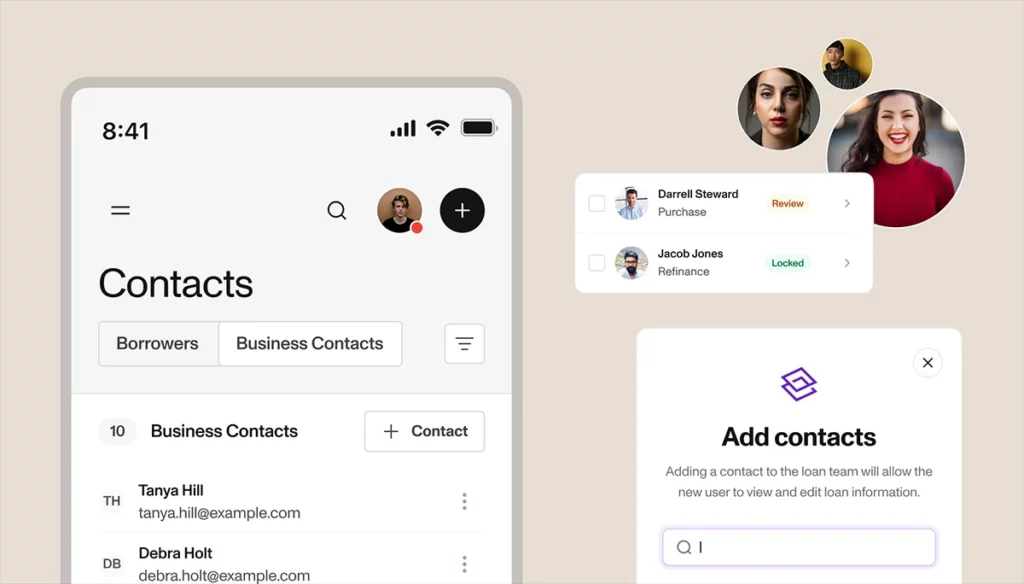

Integrating your mortgage CRM with a point-of-sale (POS) system is an evolution. From automated reminders to streamlined document collection, point-of-sale integration improves the borrower experience. It’s a fusion of borrower-centricity and operational prowess.

Automating borrower application reminders becomes simple with the integration of your mortgage CRM and POS system. Imagine this: no more manual follow-ups or missed opportunities; the system automatically sends out timely reminders, helping borrowers stay on track throughout the application process. And relevant documents are automatically routed to the right place when uploaded, so you never have to hunt for information.

An integrated system maps data from your POS in your CRM, giving you easy access to all relevant data. Documents can be organized, and tasks assigned without manual intervention.

Sonar, our comprehensive mortgage origination platform, was explicitly designed to provide support at every loan process step. Our POS integration is a shining example of this commitment. Lenders gain the advantage of up-to-the-minute insights, enabling them to make informed decisions and accelerate the origination process.

Without POS integrations, a lender’s workflow is slower and less effective. But with the power of integration, you can supercharge your mortgage origination process, deliver an exceptional borrower experience, and stay competitive.

See what a CRM with integrated POS system can do for your business

Integrating Your Mortgage CRM Software with LOS

Integrating a mortgage CRM with your loan origination system (LOS) introduces various advantages.

First, the integration harmonizes loan processing, underwriting, and borrower approval workflows. Data flows smoothly between the CRM and LOS, reducing manual work and accelerating critical processes. Loan professionals can navigate a consolidated environment, swiftly moving from application to funding.

Next, the fusion of a mortgage CRM with LOS establishes a centralized data hub. This centralization eliminates the need to juggle multiple systems and makes manual data entry a relic of the past. Your team gains 24/7 access to reliable and up-to-date information about the loan.

Of course, comprehensive reporting also comes with integration. This integration helps you track performance areas and measure real-time progress against key metrics. If an adjustment is necessary, you can spot it instantly.

Finally, integration simplifies communication between loan officers, processors, and underwriters. Everyone can view and share the same data.

Discover the benefits of a Mortgage CRM integrated with LOS

Integrating Your Mortgage CRM Software with PPE

Product and pricing engine (PPE) integration is the latest development in the mortgage origination ecosystem. It marks a leap in precision and convenience in mortgage origination. The powerful connection provides borrowers with real-time product comparison and loan recommendations while simplifying the path to a fully digital checkout.

Through integration, borrowers receive accurate loan pricing tailored to their unique circumstances. Loan officers do not need to corral data from multiple systems, saving significant time and giving borrowers fast options.

Accessing up-to-date product and pricing information through a PPE helps mortgage teams make better and faster decisions, leading to a more responsive and agile mortgage operation.

Sonar’s robust PPE supports pricing from more than 75 lenders and lets customers lock in their rates. Customized filters further refine the borrower experience.

Explore the benefits of integrating your CRM with PPE

The advantages of a unified system are self-evident. However, manual integration can be time-consuming and costly. That’s why Sonar integrates essential mortgage tools into one intuitive platform.

Harnessing technology to gain insights from your CRM, POS, LOS, and PPE systems empowers mortgage professionals to provide an improved customer experience and close more loans. The unified ecosystem consolidates data, documents, and transactions.

With Sonar, you’re not just adopting software – you’re embracing a transformative mindset that can shift your business toward unprecedented efficiency, agility, and success. Sonar’s secure and reliable mortgage origination software is your gateway to a seamless, integrated future.

So don’t wait – discover the power of integrating your CRM with other mortgage systems. Schedule a demo today.