The state of the housing market in 2023 is a mix of good news and caution.

As of January 2023, the average 30-year fixed mortgage rate has dropped to 6.47%, significantly below the highs seen in 2022. Experts predict mortgage rates will continue to fall throughout the year, offering some relief to homeowners by Q3 and Q4.

The better news is that inflation is dropping too. The inflation rate in December 2022 was 6.5%, down from 7.1% in November.

As a lender, it’s essential to stay informed about market trends and ensure your team stays prepared for the changes in 2023. There are a few key aspects to look out for this year: falling mortgage and inflation rates and a potential increase in home prices.

Knowing this information will allow you to inform your clients about their options better and help them make decisions based on their financial situation.

The state of the economy

The economy is currently in flux. Some analysts see a recession on the horizon.

Home prices have not returned to pre-pandemic levels, barring some would-be buyers from entering the market. Prices may continue to rise and further shrink the pool.

The Mortgage Bankers Association (MBA) anticipates that mortgage purchase originations will fall three percent in 2023.

At the same time, if mortgage rates remain low throughout 2023, it presents an excellent opportunity for homeowners to refinance their existing mortgages.

Will rates continue to rise?

As the financial world recovers from 2021’s rampant inflation and meteoric costs, rates are finally decreasing.

Inflation has declined for six months, down to 6.5% in December.

Mortgage rates are impossible to predict. However, many experts believe that the massive rate increases witnessed last year are over. The average 30-year mortgage rate is still extremely high at 6.43%, but there’s evidence that it’s stabilizing.

With inflation and mortgage rates declining, the housing market should benefit. Home prices may remain high, but buyers will have more purchasing power.

“As inflation continues to moderate, mortgage rates declined again,” explained Sam Khater, Freddie Mac’s chief economist.

“Rates are at their lowest level since September last year, boosting homebuyer demand and home builder sentiment. Declining rates are providing a much-needed boost to the housing market, but the supply of homes remains a persistent concern.”

Will prices rise or fall?

The housing market forecast for 2023 is murky. It’s hard to tell if home prices will rise or fall.

The slow decline in mortgage rates could lead to more buyers entering the market, driving up demand for homes and, thus, prices. A recession, however, might damper housing sales and cause some sellers to lower their listing(s).

An influx of cash buyers may also manipulate the market. Older homes have appreciated so much that homeowners who purchased in the early 90s or earlier can become overnight millionaires when they sell their properties, then they can turn around and use their wealth to buy a new home mortgage-free.

Home prices are currently still higher than we’re used to. November’s median existing-home sales price was $370,700, a year-over-year increase of 3.5%. It marked the 129th straight month of YOY price hikes (10.75 years).

Home prices are, however, far below June 2022’s $413,800 peak – despite the historic run. Existing home sales have also been steadily slipping, sliding 7.7% from October to November. The drop was the tenth month of falling sales.

The biggest changes in the housing market

The mortgage industry outlook says lenders may see the most significant market changes in Q2 and Q3 when many believe that interest rates will be lower and home prices may be slightly higher.

Those conditions are suitable for current homeowners looking to refinance. If this proves true, lenders should prepare for an uptick in their workload.

Mortgage applications may decline further as those relying on conventional mortgages may be outbid by cash buyers. Home supply is still low in many neighborhoods and could remain so.

Preparing for 2023 housing trends

You can prepare your business for the upcoming housing market predictions in 2023.

Stay Informed

You can’t adjust to market changes if you don’t know what they are. Keep your team up-to-date with inflation, home sales, and current mortgage rates.

You’ve already taken the first step by reading this blog. Identifying additional resources such as the MBA and National Mortgage News can further enhance your knowledge.

Build relationships with real estate professionals

Real estate professionals have knowledge from being in this industry day in and day out. They can feel the pulse of the housing market.

Developing solid relationships with real estate agents, brokers, and other industry professionals can help you stay on top of news and trends.

Enhance your customer service

Everyone in the mortgage industry needs to focus on customer service. Buyers have many options and little patience. Issues like a long, tedious application process or a slow wait for a loan decision can be fatal for your business.

Clients expect efficiency and professional customer service. Your good reputation can help you get business even if loan originations drop.

Diversify your products

If mortgage applications remain low, diversify your offerings to attract more customers. Think about introducing loans for different property types or adding new product types like government-backed loans.

Use technology to your advantage

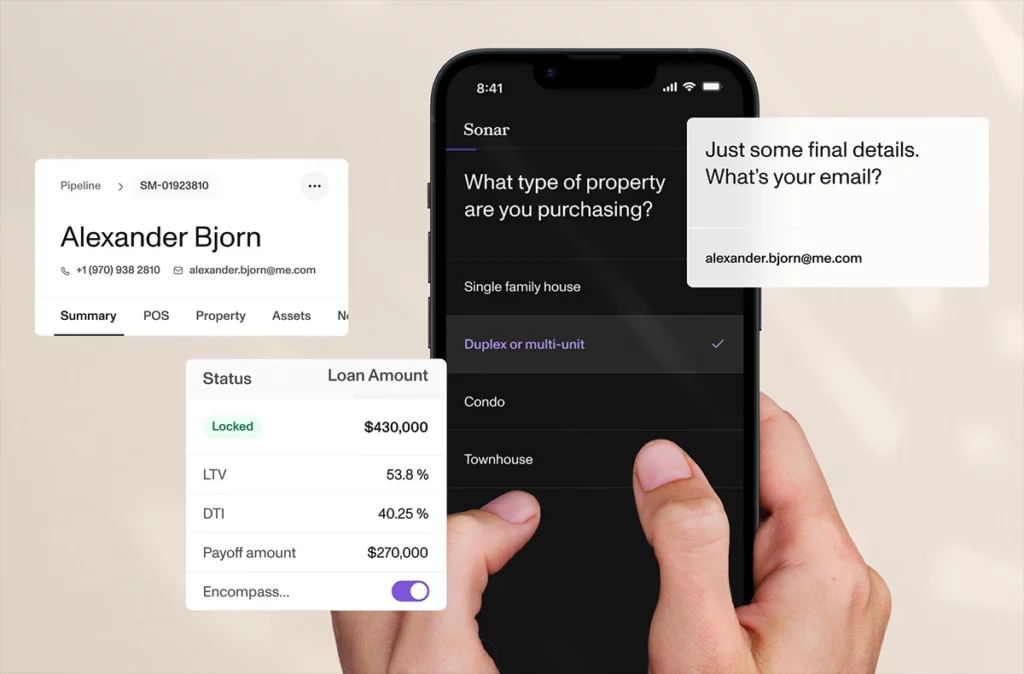

Technology, like Sonar, can streamline your work, so you have more time to process loans. The more efficient you become, the more customers you can successfully service, and the easier it is to scale.

With Sonar, you can save money and prepare for these real estate market predictions. If loan originations remain lackluster, the decrease in expenses helps protect your cash flow.

If loan originations see an uptick, your efficiency will help you handle the workload. Sonar makes your job easier by automating rote, time-consuming tasks like verifying documents.

A better 2023 includes Sonar

If prepared, your business can handle a changing real estate market. Use our strategies to stay informed of news and trends while you focus on upgrading your technology and branching out into new lending products.

Sonar can equip you to handle every market fluctuation to stride. Our platform helps lenders quickly and accurately process loans with minimized effort. Let Sonar help you ride the wave of a changing market.

Elevate your mortgage game with our all-in-one mortgage experience platform. Request a demo today!