What does it take to close a mortgage deal?

For many years, the answer to that question was simple. You needed a good loan officer who could find clients, and then you needed a team of processors and underwriters who could get the job done.

These days, the answer is a bit more complicated. The mortgage industry has changed dramatically in recent years, thanks in part to new technology. In order to stay competitive, you need to make sure that your software is up-to-date and efficient. That’s why so many brokers are turning to mortgage originator software.

Mortgage Software For Every Deal

Mortgage originator software is a collection of products used to handle various aspects of the loan process, from origination and underwriting to closing and post-closing. The tech stack is designed to make your process faster, more accurate, and more profitable. Here are some of the commonly used loan officer tools:

POS (Point of Sale)

Mortgage point-of-sale software is used to accept applications from consumers applying for a mortgage. It allows users to input all the necessary data for an application with a seamless flow. A clunky, error-prone POS will alienate customers, so it’s necessary to have a robust and user-friendly system.

Explore the benefits of a mortgage POS system.

LOS (Loan Origination System)

LOS (loan origination system) helps you manage the entire loan process. It can be used to quickly process applications, generate disclosures, analyze data, and monitor compliance. A good LOS will help you create efficient workflows and close deals faster.

See what Sonar’s LOS software can do for you business.

Product Pricing Engine (PPE)

A product pricing engine (PPE) is used to quickly compare loan products, rates, and costs to determine the most cost-effective ones for your clients. These calculators save time and let you provide better service to borrowers by providing concise information right at your fingertips.

Ready to say goodbye to pricing loans the old fashioned way? Discover Sonar’s PPE.

CRM (Customer Relationship Management)

CRM technology allows you to keep track of your leads, stay in touch with current and potential borrowers, and automate outreach campaigns. CRM tools were built to enhance the customer experience.

Explore how you can manage relationships effortlessly with Sonar.

Database Monitoring

Database monitoring is a tool to keep track of your loans, identify problems, and quickly find any errors or inconsistencies. This is especially important when dealing with multiple lenders or loan programs.

Automated Asset Verification

One of the most time-consuming parts of the loan process is verifying a borrower’s assets. Automated asset verification software can help speed up this process by automatically verifying the information provided by a borrower.

Document Manager

A document manager organizes and stores documents in one centralized location so that nothing gets lost in the shuffle. It ensures that all of your documents are securely stored, easily accessible, and compliant with all mortgage regulations.

e-Signature Software

E-signature software eliminates the need for in-person signings, making it simple to quickly and securely collect e-signatures from borrowers.

Credit Reporting

In order to determine a borrower’s creditworthiness, you need access to their credit report. Credit reporting software can help you quickly pull up the relevant information, so you can make an informed decision and avoid costly errors.

What Makes a Good Tech Stack

The key to a successful tech stack is cohesion. Too often, individual tools and applications don’t mesh well with each other, causing inefficiencies and delays. A good tech stack will have tools that seamlessly integrate with one another for maximum accuracy.

For example, if your POS is integrated with your LOS, you can quickly transfer data between the two. Automated asset verification software that works in tandem with credit reporting software will speed up the process even further.

The right mortgage tech stack will help you close more loans faster and with less hassle. Look for tools that are designed to work together and make sure they have the features your business needs. With the right software, you’ll be able to provide a better experience for your customers and increase your profits.

Mortgage Software for Modern Originators

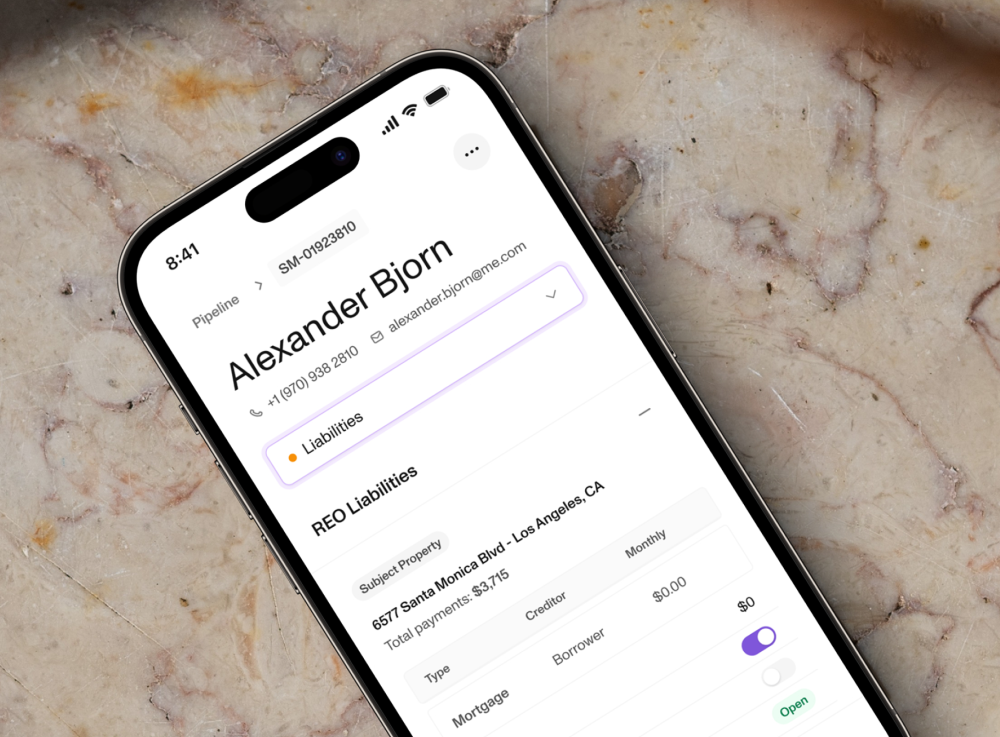

Sonar is an all-in-one mortgage tech stack that combines key pieces of software, such as LOS, POS, and CRM. It’s crafted for modern originators who need a system that’s easy to adopt and fast to implement.

Sonar offers a single platform with the tools and integrations you need to manage your business. It helps you save time, reduce costs, and close more loans.

It also provides a secure system that’s compliant with all mortgage regulations. And best of all, it provides clear communication between tools so you can have complete confidence in the accuracy of your data.

Make your origination process even simpler with our all-in-one mortgage experience platform. Schedule a demo now and embark on a journey of unparalleled efficiency.