Mortgage lenders and originators thrive on a steady flow of customer leads and referrals. Staying afloat in the competitive housing market might be impossible without this constant stream of prospects. A good customer relationship management (CRM) tool is invaluable to your technology stack.

Utilizing a mortgage CRM software lets you streamline lead management strategies, automate outreach efforts and track customer activity.

What is mortgage CRM software?

At its core, a CRM is like a digital filing system for all your contacts and is an integral mortgage sales tool. It contains detailed information about leads and past customers, such as the date and result of each interaction. You don’t have to remember if you called the borrower last week and have not received a response.

CRM mortgage software has evolved from the simple contact management systems introduced in the early 2000s to powerful platforms that offer a range of critical functionalities. The software addresses the challenges faced by mortgage professionals.

By centralizing and automating customer relationship management process, this software enable you to scale operations. Moreover, with its advanced analytics and reporting capabilities, the software provides clear insights to help refine your work and drive business success.

Why Originators Need a Mortgage CRM

Organization

A CRM software lets you manage each loan application’s complex web of tasks in one place. Every piece of communication – whether a phone call, email, or meeting, can be recorded and logged within the CRM – ensuring no meaningful conversations or follow-ups fall through the cracks. A CRM also provides a comprehensive history of borrower interactions, allowing you to see exactly where the borrower stands within the pipeline.

Efficiency

A mortgage CRM system eliminates manual inefficiencies and reduces delays in the loan origination process. Documents remain readily accessible and secure in the centralized hub. Other features, such as task automation and automated follow-ups, add convenience and keep tasks on time.

Benefits of CRM Software

Integrating CRM software into your mortgage operations unlocks several benefits.

The most glaring benefit is enhanced customer relationships and satisfaction. Mortgage sales tools help build meaningful relationships with borrowers by providing personalized service. Automated lead follow-ups also ensure that all leads get the attention they need, resulting in better customer experiences.

CRMs boost revenue generation by streamlining operations and organization. Automation lets you respond to customers. Rapid replies result in improved close rates and increased ROI. CRMs can increase conversion rates by 300%.

Moreover, CRM software helps teams stay better organized. Everyone can access customer information anytime, anywhere, without waiting for others to update their records. This accessibility gives everyone on the team a unified view of the loan pipeline, promoting better collaboration and improved decision-making.

Ready to supercharge your lending business? Explore our CRM Software and schedule a demo today!

Critical components of a CRM software

Mortgage CRM software comprises several vital components that work together to enhance the efficiency of the mortgage pipeline.

Customer Data Management

A CRM provides a centralized database where lenders can store and access detailed customer information, including contact details, communication history, loan preferences, and more. Interactions are logged as well, facilitating personalized communication and informed decision-making.

Lead Management

Nothing powers sales like a supply of fresh leads. Your mortgage CRM allows you to prioritize and focus on high-quality leads. You can qualify prospects, score leads, and distribute them to the right people.

With the software, you can nurture leads through automated and personalized communication, ensuring they remain engaged and guided through the conversion process.

Sales and Pipeline Management

You can set distinct sales goals and monitor your progress using a CRM software. If potential borrowers drop out of the pipeline, you’ll see when the contact was lost and can assess a reason.

The mass of data combined with analytical tools enables sales and revenue forecasting. You can view these forecasts in real-time and make adjustments as needed.

Marketing Automation

A mortgage CRM automates lead generation and marketing campaigns, saving time and reducing costs. Track the performance of your campaigns, deploy email templates, and segment audiences based on their interactions with past campaigns. All these metrics help focus outreach efforts on optimal prospects and increase the success rate of each campaign.

Reporting and Analytics

The CRM aggregates data from customer interactions, generating informative reports for you to monitor operations. You can track KPIs like conversion rates and revenue per lead and view custom dashboards with all activity in one place.

The holistic view can spotlight problems that may have otherwise remained invisible.

Integration and Customization

CRM software can scale with you as your business grows. A proper system integrates seamlessly with other services, allowing easy data sharing between platforms.

Customization options tailor the CRM according to your specific business needs. You can create custom workflows and automation rules that fit your work style.

Collaboration and Communication

CRM software encourages collaboration between teams. Internal messaging boards keep everyone on the same page, while shared documents and calendars create an efficient workflow. You can also assign tasks to team members straight from the CRM dashboard.

Evaluating Your Current CRM Process

Before deciding if you need a CRM and starting the search for which one is right for your business, evaluate your current process to see where it is lacking.

Look at the main criteria, such as loan speed and management, customer service, and reporting. Are there gaps in these areas? What are the pain points or bottlenecks that cost time or money? CRMs range in price and capability, so determining what you need is worth it.

For example, if your originators or loan officers get burdened with a slow, cumbersome process, look at mortgage CRMs prioritizing loan speed and task automation. If marketing automation is a priority, then platforms with strong lead-nurturing capabilities are ideal.

Choosing the right CRM requires both strategic and tactical decisions. Evaluating your current process will help you decide which features are necessary for your business.

Choosing a mortgage CRM software for your originators

Selecting a mortgage CRM software is a crucial decision that should not be rushed. The market is saturated with CRM and mortgage sales tools, but there are several considerations to keep in mind, including:

- Scalability: A good CRM will scale with your business, whether you’re a small team or a large enterprise. Choose software that’s flexible and can accommodate growth.

- Pricing: Different CRMs have different pricing models. You need one that fits with your financial goals.

- Data Migration: Will you need to migrate data from your old platform to the new one? Make sure you understand the process and any costs associated with it.

- Set Up and Onboarding: Look for a CRM that offers an easy set-up experience.

Learn how Sonar Mortgage CRM software can lead to high-quality conversions. Request a demo now!

Create a better lending experience with the right mortgage CRM

Mortgage CRMs change the way you do business. Your team can benefit greatly from implementing a CRM including:

- Improved processes and productivity

- Optimized customer experiences

- Increased lead conversions and ROI

- Enhanced client retention

Choosing a CRM for your mortgage origination team is an important decision. Think about your current process to identify features and capabilities you need. Are you working with a large customer base?

Ideally, your CRM will integrate with your existing suite of mortgage tools, including your loan origination system (LOS) and product pricing engine (PPE). The integration promotes speed and efficiency.

Why Originators & Lenders Choose Sonar CRM

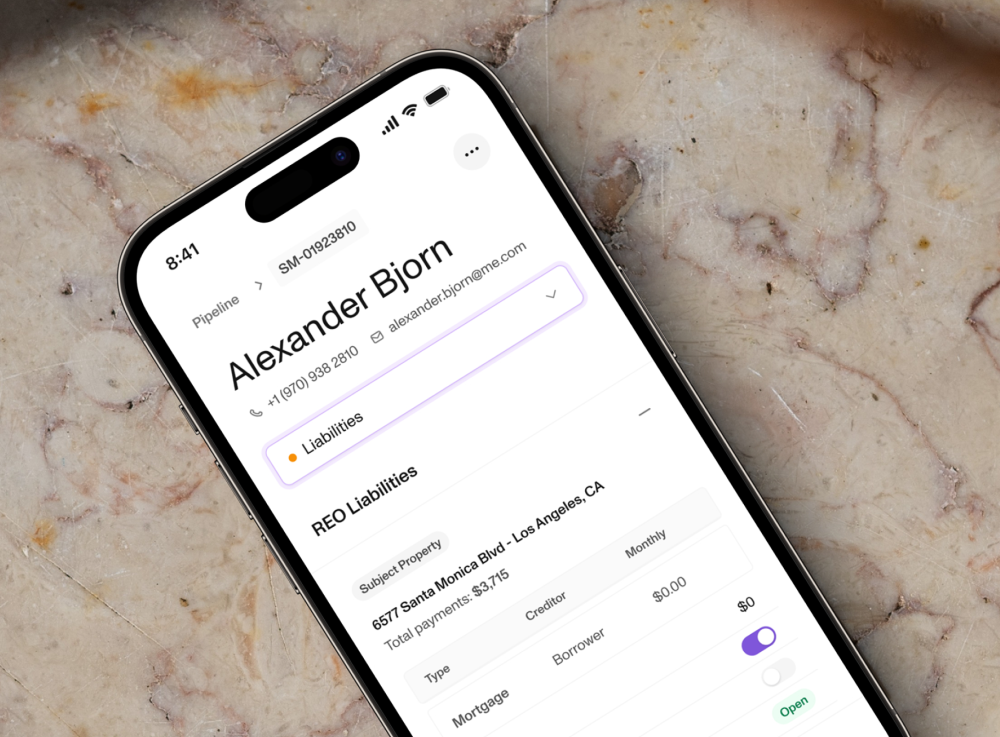

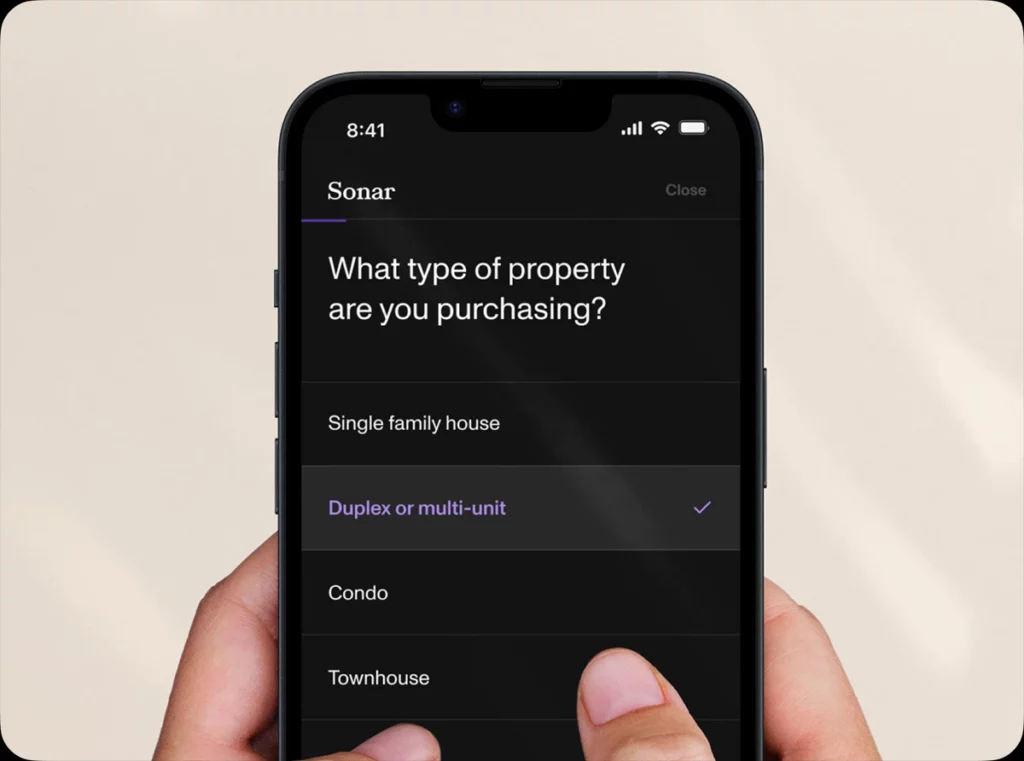

Sonar CRM is a loan origination system built specifically for mortgage professionals. The platform streamlines the loan process, from lead capture to post-closing reaction. Sonar CRM is already integrated with a powerful LOS, PPE, and point-of-sale system (POS).

Save time with Sonar. Our automation tools track originators’ day-to-day performance and create a digestible report you can use to fuel business strategy.

With Sonar CRM, you can quickly convert high-quality leads and accelerate the speed of loan origination. Improve your customer experience, increase efficiency, and make smarter decisions.

Unleash the potential of seamless customer relationship management with Sonar’s integrated mortgage origination software. Take the first step towards a transformative lending experience – request your demo now!