Finding a working point-of-sale (POS) system is a top priority for most mortgage brokers. These systems offer a streamlined and simplified experience for borrowers and originators, transforming modern lending.

The power granted by advanced mortgage POS systems is so great that it’s disrupting the industry. Nearly 70 percent of originations were by nonbank lenders in 2020, a percentage surging due to digital innovations.

Switching from a clunky legacy solution to more sophisticated technology helps you scale your business without increasing overhead costs or hiring additional staff. Observations by McKinsey & Company show that the most successful digital mortgage operations have “cycle times that are at least 30 percent lower than the industry average and costs that are at least 25 percent lower than the industry average.”

The advancement of POS systems is a significant driver of these trends. You can revolutionize your business by adopting a platform like Sonar. With its modern design, you can create a dream-scenario experience for your borrowers: they can securely input all their information and documents in one spot and keep track of the progress from loan application to closing.

Still, POS systems aren’t all created equal. At the same time, the industry has seen tremendous progress, and specific, vital components set apart exceptional POS systems. That’s why it’s essential to research and find the right system for your business goals.

Let’s talk about what to look for.

Seamless Applications

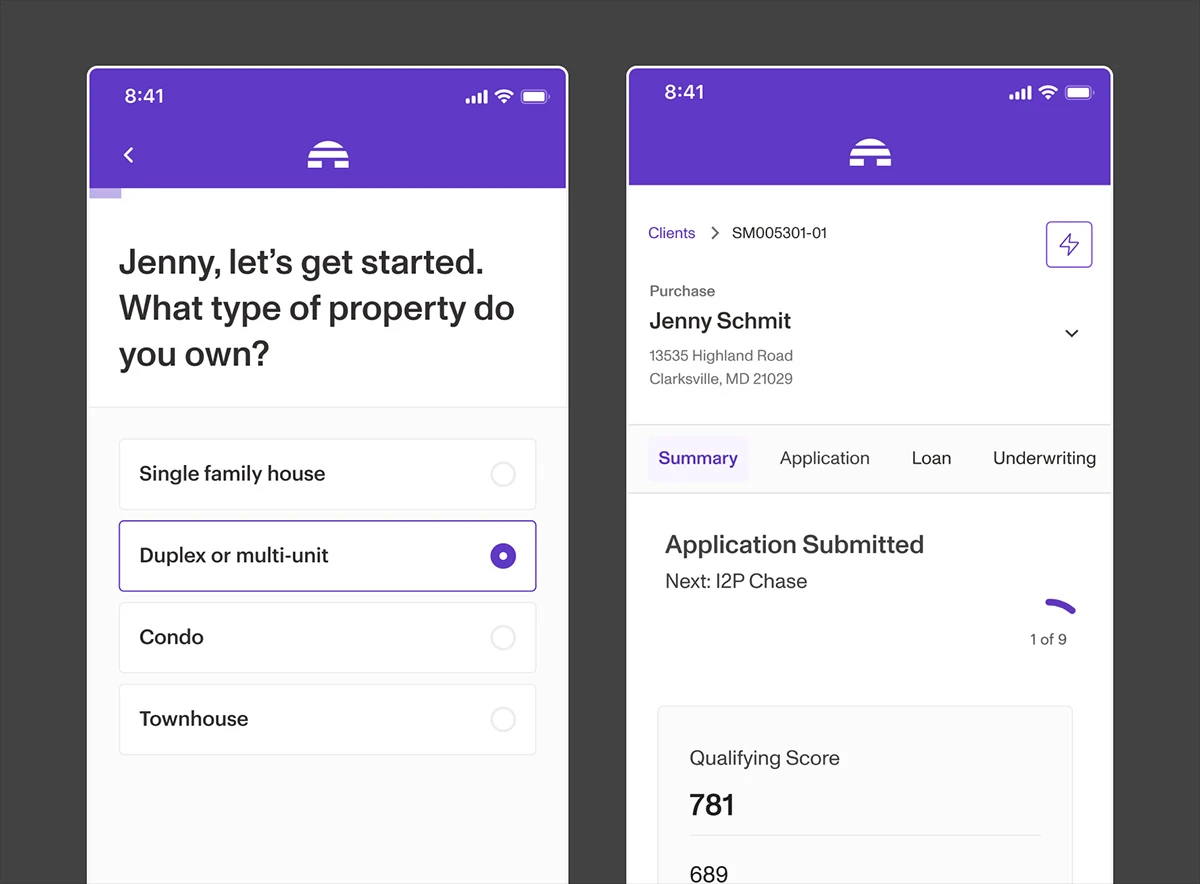

POS systems should make applying for a loan quick and easy. This means providing an intuitive user experience with online application forms that are easy to fill out, usually with drop-down menus or other interactive features.

Sonar’s advanced technology automates data extraction from application forms, reducing manual data entry and potential errors. The platform also performs data validation, ensuring that the information borrowers provide is accurate and complete.

Ready to see what modern digital mortgage solutions can do for your business? Request a demo today!

Document Collection and Verification

Simple document collection is one of the key advantages of going digital. Borrowers can securely upload required documents directly to the Sonar platform. We employ robust security measures to protect sensitive information and facilitate a paperless process.

Integration with third-party verification services is necessary for instant verification. With Sonar, this integration is seamless.

Real-Time Communication and Collaboration

Regarding mortgage POS systems, real-time communication and collaboration tools are a boon. In real-time, borrowers and originators can communicate through Sonar’s built-in instant messaging and chat features. Chatting allows for quick clarification when queries arise and keeps everyone on the same page throughout the application process.

If chat is too impersonal, look for a POS with video conferencing capabilities. Face-to-face interactions foster stronger relationships and provide a more human lending experience.

Internal collaboration may be even more valuable. Within the Sonar platform, internal teams can share files directly and assign and track specific tasks. The organization helps maintain a structured workflow.

Data Integration Across Systems

Modern mortgage POS systems must integrate easily with your existing loan origination system (LOS) and customer relationship management (CRM) platform. Sonar’s platform combines a LOS, POS, and product pricing engine (PPE) into one frictionless tool.

In addition, Sonar allows you to integrate external data sources through its API. You gain access to reliable and up-to-date information on your borrowers and real-time pricing information.

Advanced Analytics and Reporting

Your POS should provide a 360-degree view of your origination operations. Advanced analytics and reporting provide visibility into key performance metrics like loan volume and average loan size.

Sonar’s customizable dashboards provide real-time performance monitoring. You can easily create custom reports and use the insights to improve your team’s efficiency.

Explore how Sonar’s integrated LOS & POS can benefit your business.

Compliance and Security Measures

Regarding compliance and security measures, look for a platform with built-in features that protect your organization from fraud and ensure you meet applicable regulations.

For example, audit trails show who has accessed borrower data, and version control ensures that only the most recent documents are available. These features keep borrowers safe and help you stay compliant.

Encryption and secure storage are also important factors to consider. Sonar employs bank-grade encryption and industry-standard data security measures, so you can feel confident that your borrowers’ information is safe.

Mobile Accessibility

Real estate transactions happen on the go, so having a mobile-responsive POS design is imperative. An ugly, slow, or error-prone site will damage your reputation and potentially cost customers.

With Sonar, borrowers can access the platform from any device and have an easy user experience. Our intuitive interface makes it easy for loan officers to manage their pipelines regardless of location.

Mortgage POS systems have come a long way. The right system provides mortgage lenders with the tools to offer an efficient and compliant loan origination process. With Sonar, you’ll get advanced technology without sacrificing user-friendliness or mobile accessibility.

Putting your borrowers at the center of your digital mortgage experience can be extremely rewarding, and a POS system like Sonar can help you get there. We offer an easy-to-use interface, reliable document collection and storage, communication tools, and advanced analytics and data verification.

Ready to revolutionize your mortgage businesses with an integrated point-of-sale system? Request a demo to step into the future of lending success.