Simply put, today’s mortgages get built through technology. Gone are the days of old-fashioned, manual loan origination that stresses internal teams and causes a workflow bottleneck. Loan officers need a robust tech stack to help them remain competitive, efficient, and compliant.

You can utilize software to manage the loan origination process—from the initial contact to closing. Loan officer tools simplify the process for everyone involved.

Loan Officer Tools From Introduction to Closing

Software for loan officers consists of multiple tools used throughout the mortgage cycle. Let’s look at some essential loan officer tools available and what they offer.

Loan Origination System (LOS)

A loan origination system (LOS) tracks mortgages throughout the mortgage cycle. It allows lenders to manage contacts, create customized documents, keep up with compliance regulations, and connect with other stakeholders.

See what Sonar’s LOS software can do for you business.

Point of Sale system (POS)

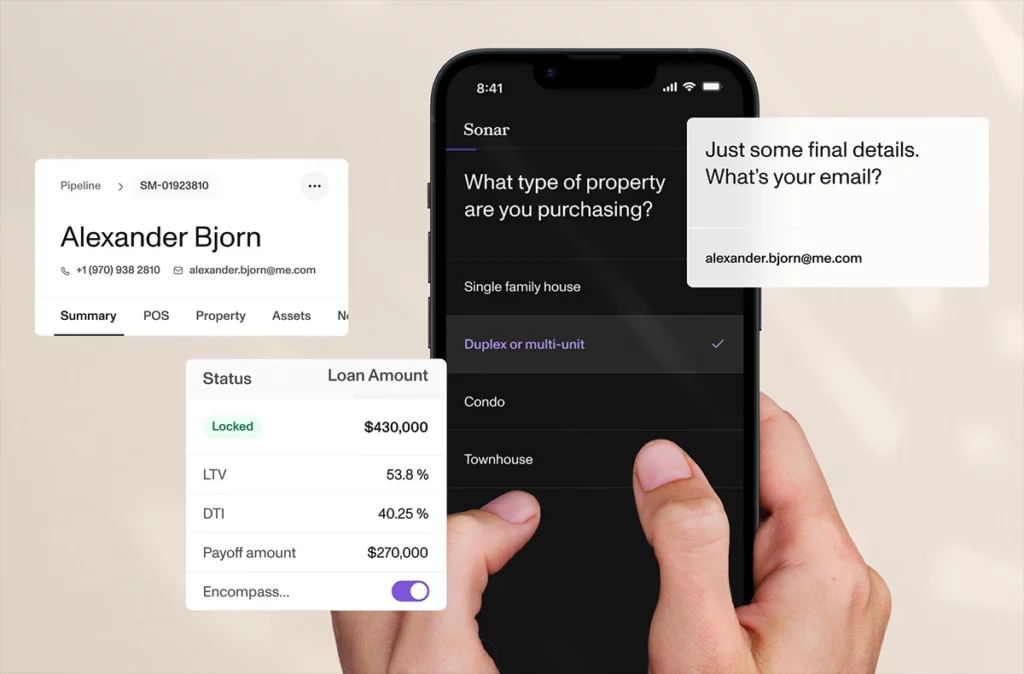

The point of sale system (POS) is customer-facing software that makes it easier for clients to apply for mortgages. The benefit of a technology like Sonar is the integrated relationship we’ve created between a LOS and POS system that saves time once lost to bifurcated LOS and POS processes.

Explore the benefits of a mortgage POS system.

CRM (client relationship management)

A CRM is a customer relationship management tool that can help loan officers stay organized and build strong relationships with their clients. CRM software lets you track leads and manage customer data throughout the relationship’s lifetime.

Explore how you can manage relationships effortlessly with Sonar.

Automated Underwriting System (AUS)

An automated underwriting system (AUS) automates the underwriting process and leads to faster decisions.

Product Pricing Engine (PPE)

You can use a product pricing engine (PPE) to compare multiple mortgage products and rates and find the best product for your customer’s needs and financial situation.

Ready to say goodbye to pricing loans the old fashioned way? Discover Sonar’s PPE.

Credit Reporting Software

Credit reporting software gives you up-to-date credit information on potential borrowers. It helps you make informed decisions when assessing the creditworthiness of your customers.

Asset Verification Software

Asset verification software verifies a customer’s assets and income for Loan Quality Assurance (LQA) purposes. This verification helps to ensure that applicants provide accurate data that meet all requirements.

Document Manager and eSignature

Document manager and eSignature software simplify the document management process, allowing you to store all your documents in one place. You and your clients can securely send and upload documents for digital signature.

Digitizing the Mortgage Stack

A well-executed tech stack simplifies the loan origination process. Traditionally, closing a mortgage has required a significant time investment. Loan officers had to chase down leads, manually enter data into spreadsheets, and juggle files stored across disparate systems.

Loan officers now have a combination of software tools to digitize the mortgage process. Mortgage origination software allows one or two employees to do work that would have required a team previously. Additional benefits include:

- Central document storage: All documents can get stored in one place for easy access. No more remembering where something was saved or what folder to look up.

- Less room for human error: Mortgage tools have a much lower error rate than human employees. The software is never tired or distracted.

- Better customer experience: Tools like POS software make the mortgage process less daunting for borrowers.

A complete mortgage tech stack utilizes multiple software programs, so testing for compatibility is essential. A multi-tool stack that can’t communicate is useless. Loan officers should evaluate how the software integrates.

Loan Officer Tools for Modern Times

Today’s loan officer tools are comprehensive and have the power to transform the mortgage industry.

Sonar is a digital loan origination system that combines LOS and POS software into one efficient solution. It’s been designed for the modern mortgage industry, with cloud-based storage and more than 30 API integrations.

With Sonar, you can access all the software resources you need to close loans quickly and accurately. Ready to revolutionize your mortgage business? Schedule a demo now to unlock the full potential of Sonar’s all-in-one mortgage experience platform.