The crux of your business is loan origination, where borrowers meet lenders and mortgages are born. The quality of this interaction determines the trajectory of customer retention and success.

Within the mortgage industry, origination includes distinct stages: pre-qualification, application processing, underwriting, and closing. Historically, these stages involved significant paperwork and manual data entry, tedious responsibilities requiring substantial time investment.

Today’s originators can utilize technology. Mortgage loan origination software (LOS) makes your processes more efficient and eliminates traditional hurdles. In this post, we’ll explore the path toward loan optimization.

Challenges in Loan Origination

Mortgage professionals battling for customers face constant challenges, including:

- Stringent Regulations: Everything from communicating with borrowers to preparing loan packages must comply with strict regulations. Staying compliant leads to time-consuming origination protocols.

- Manual Operations: Many origination teams still rely on manual work.

- Rising Customer Expectations: Borrowers expect speed, real-time updates, and digital accessibility—factors that traditional origination methods often struggle to provide.

A modern loan origination system (LOS) can significantly boost customers’ perception of your service. A convoluted experience, meanwhile, may lead to attrition.

Strategies for Optimization

Technology allows for specific optimization strategies.

Streamlining Application Processes

- Implementing User-Friendly Interfaces: Choose an application and underwriting software like Sonar that suits the borrower. Think intuitive, easy to navigate, and structured to cater to broad consumer segments.

- Utilizing Technology for a Seamless Experience: Deploying modern solutions like AI-driven chatbots and cloud storage makes the application process faster for borrowers. Good loan origination and point-of-sale (POS) systems do even more.

Enhancing Communication Channels

Borrowers are used to constant contact. If they send a message during the workweek, they typically expect an answer within 48 hours. And if you want to keep them satisfied, try for same-day responses.

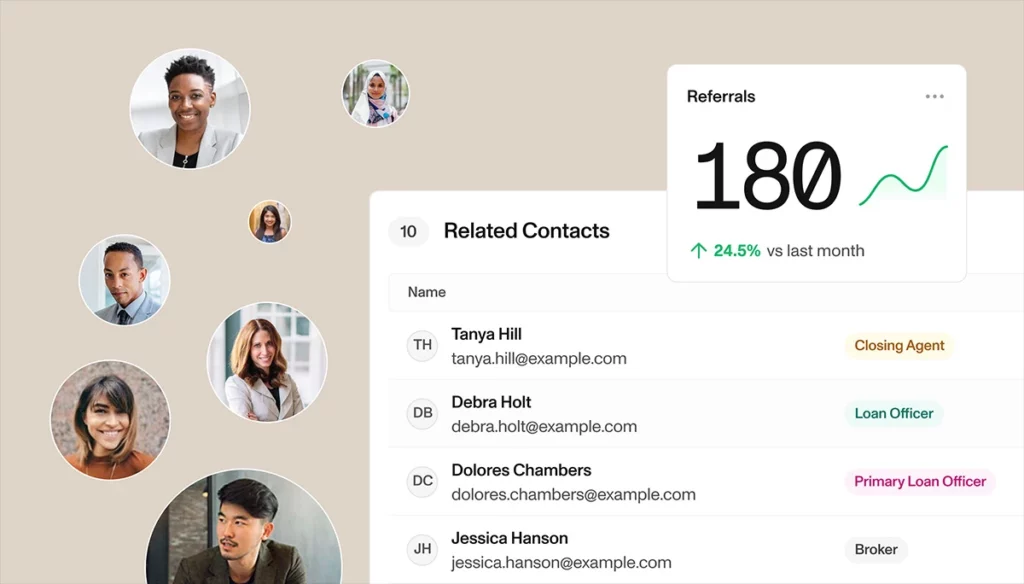

Integrating technology like customer relationship management (CRM) software can make a big difference. It allows for auto-responses, regular milestone updates, and client portals that display pertinent information.

Driven Decision-Making

Leveraging data helps build a better-conceived loan origination strategy, ensuring that decisions are based on varied and reliable data points.

For example, data analytics can reveal insights into the performance of various operational streams, from application processing times to underwriting turnarounds. You get a clear look at areas needing improvement.

This data also lends itself to predictive modeling. You can anticipate borrower needs and create customized products.

Adapting to Industry Trends

Integrating technology isn’t a one-time process. You’ll need to constantly update your systems as new and better solutions become available.

- Mobile Optimization: People are on the go; mobile optimization means flexibility. Borrowers can apply and submit documents with their phones.

- Increased Automation: Automating repetitive tasks reduces manual errors and prompts fast procedure times—increasing borrower satisfaction.

- AI and Machine Learning: These technologies can expedite decision-making processes and allow for more precise borrower profiles.

Mortgage industry trends align with your optimization goals. AI and machine learning, for instance, help you make sense of data.

Considerations for the Ever-Evolving Landscape

Technology isn’t the only constantly evolving force affecting the mortgage industry. Market dynamics and financial regulations also change frequently. Your systems need to accommodate fluctuations while remaining compliant.

Here are a few ideas to future-proof your operations:

- Ease of Integration: Consider how your software integrates with other systems. You don’t want to be stuck with siloed solutions that communicate poorly.

- Scalability and Flexibility: As you grow, so will the volume of applications. Ensure that your LOS can handle growth without sacrificing speed or quality.

- Customization Options: Every lending company is different, meaning a one-size-fits-all system won’t cut it. Look for solutions that allow for customization to fit your specific needs.

- Automation and Streamlining: Continuously review your processes to identify areas for automation and streamlining.

Measuring Success: Key Performance Indicators (KPIs)

You need to know if your origination optimization efforts are working. KPIs can help you measure success if they point to specific goals and areas of focus, such as:

- Application Completion Time: How long does it take for a borrower to complete the application process?

- Conversion Rates: What percentage of applications turn into closed loans? How does this compare to industry averages?

- Customer Satisfaction: How satisfied are your customers with their borrowing experience?

- Time to Close: How long does it take for a loan to close from the application date?

Once KPIs get set, they become benchmarks for your future efforts. They are also an excellent way to identify areas that require further optimization.

Improving your mortgage operations is continuous, but beginning with the right tools and direction is essential. A cloud-based loan origination platform that integrates all team members to help your business grow is vital.

Make the most of technology and see how it impacts your operations and strategies. And remember to measure your success using KPIs. This way, you can stay on top of industry trends while meeting borrower expectations. By continuously adapting to new technology, you’ll be well-positioned to succeed.

Connect with our experts at Sonar to discuss tailored solutions for your mortgage operations.