When backend mortgage technology was first introduced, many originators hesitated to try it. Their reluctance wasn’t penalized harshly, as they could still keep up with most of their peers.

We’re in a different era now. An originator who’s still using legacy systems can’t truly thrive. Being able to embrace new tools is imperative because these changes are not merely cosmetic; they represent a seismic shift in the industry.

Technological Transformation in Mortgage Origination

Today, getting a mortgage is more manageable for all parties- originator, lender, and borrower. This positive change is due to technology. The same technology that’s altering the rest of the world is also carving an impact on mortgage professionals.

Why? Because the difference between manual and digital operations within origination is enormous. Manual efforts are time-consuming and error-prone, leaving your team overwhelmed when juggling many customers.

Technology introduces a new way of doing things. A fully digital process cuts the time in half, and that’s only one of the benefits. Automation has been a game-changer, reshaping the industry by streamlining processes and reducing manual work. As a result, lenders can now handle a higher volume of loans without adding more staff.

Artificial intelligence and machine learning further revolutionize the mortgage origination process and allow for advanced data analysis and decision-making, improving efficiency and accuracy.

Challenges and Opportunities in Tech Integration

Switching to software after relying on manual methods represents a complete overhaul. The change will have Multiple benefits, but it may not be 100% hassle-free.

Traditional lenders can run into obstacles with new technology, however beneficial it is. One of the biggest obstacles is simply attitude. Originators on your team who are comfortable with legacy origination may not see a reason for an upgrade. Convincing them is likely only possible with specific numbers relating to your company.

The only thing you can do is wait out the hesitation.

Another problem might appear during implementation. The new software may not connect with your current technology, or there may be a learning curve for your originators. These difficulties can be settled through customer onboarding and support. If they aren’t, you should consider more user-friendly software.

Enhancing Customer Experience through Technology

With lending technology, the customer journey becomes far more organized and pleasant. It guarantees a smoother experience for all involved parties.

From a borrower’s perspective, technology means faster approvals and less stress. Buying a home may be the biggest purchase in someone’s life, and anything that makes it easier helps them breathe easier.

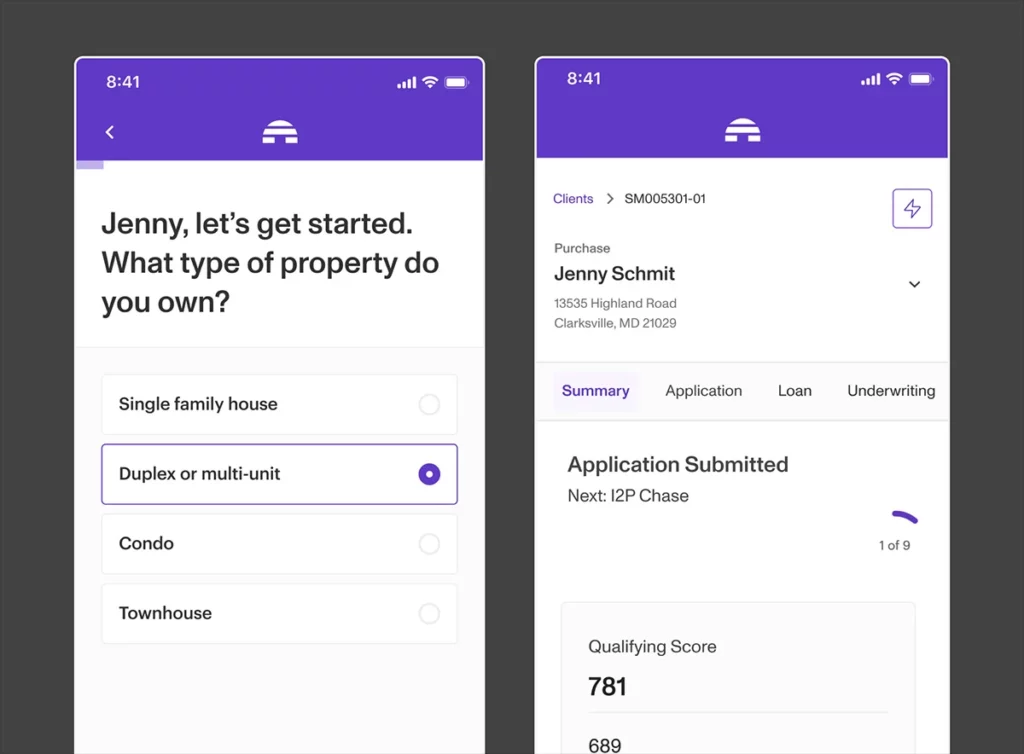

Technology also adds personalization. Loan offerings can reflect borrowers’ actual needs and circumstances. Choosing a user-friendly interface comes into play here, too. The customer-side software must be even more explicit because they’ll simply give up.

From an originator’s perspective, a software update enables you to simplify your entire backend process. You can interact with their customers through portals that are available 24/7. Milestone communications can be fully automated.

Moreover, automation means fewer chances of human error–yet another way tech enhances the customer experience in mortgage origination.

Ensuring Security and Compliance in Tech-Enabled Origination

Data security is a moral, legal, and practical concern. It’s a pressing issue because of the amount of sensitive data handled.

When choosing new mortgage technology, compliance should be at the forefront of your mind. Fortunately, most platforms handle these complex and numerous rules. Your digital origination platform can update instantly when new regulations come up, leaving you with minimal compliance work.

The best way to ensure security and compliance is to look for a platform that values these issues as much as you do. Pay attention to features like data encryption, secure file-sharing capabilities, and user permissions settings.

Also, consider partnering with technology companies with extensive mortgage industry experience. This will provide added assurance and peace of mind.

When doubt does creep in, you can view audit trails to trace any action on all users.

Strategies for Traditional Lenders to Stay Competitive

It’s undeniable that technology is changing the game in mortgage origination. But what about traditional lenders needing more resources or know-how to integrate technology into their processes fully? How can they stay competitive in a rapidly evolving industry?

One strategy is to adapt and embrace technology gradually. You can incorporate a loan origination system (LOS), a point-of-sale (POS) interface, and advanced tools like artificial intelligence. By taking small steps, you can slowly improve efficiency and customer experience.

A better approach is to implement an integrated tool, such as Sonar. Sonar offers a comprehensive suite of features designed specifically for lenders to maximize the benefits of technology while mitigating disruption. Sonar offers free onboarding and dedicated support so you can feel comfortable making the switch no matter how tech-forward your team is.

Both strategies will only work with an investment in staff training and development. With the right resources, even old-school lenders and originators can learn to utilize technology effectively in their day-to-day operations.

The mortgage industry is growing, and technology will continue to play a driving role in the future of lending. Some experts predict that artificial intelligence and machine learning will become more prevalent. It’s essential to adapt and stay ahead of the curve proactively.

Mortgage technology is here to stay, changing the game for lenders, originators, and borrowers alike. From enhanced operational efficiency to improved compliance, integrating technology into mortgage origination processes helps you manage a large and growing customer pipeline.

Remain up-to-date with Sonar. We’re a trusted partner for lenders ready to accept technology. Let us be your guide.

Ready to revolutionize your mortgage origination process? Schedule a Sonar demo today!