It’s no secret that having a solid loan process and managing your pipeline is essential to success in the mortgage industry.

Borrowers crave efficiency, and an optimized loan process can help them close quickly, while originators benefit from increased customer flow. Borrowers demand results, and an efficient loan process will ensure your business is set up for success.

Thankfully, there are several strategies you can use to strengthen your loan process and optimize your mortgage pipelines.

What does the mortgage process look like?

The mortgage loan cycle is a series of steps a borrower takes when applying for and obtaining a mortgage. During the process, mortgage originators play several key roles to ensure everything goes smoothly.

Application

Loan applications are evaluated by the originator to determine if they meet the lender’s criteria. The originator helps guide the borrower through the application process, providing advice and answering any questions.

Processing

Once a loan application is submitted, it moves into processing. The originator verifies the borrower’s information and ensures that all documentation is in order.

Underwriting

Loan underwriting evaluates borrowers’ creditworthiness and capacity to repay a loan. The originator works with the lender’s underwriter to collect and analyze all necessary documents. The underwriter ultimately decides if the loan will be approved.

Closing

Closing is the essential step in the loan origination process. The originator helps arrange closing details, such as the signing of documents by the borrower and ensuring funds are available for disbursement.

Servicing

Once a loan is closed, a mortgage originator can continue to work with the borrower. They can assist in making sure you are properly set up for auto-pay or provide advice on how to make payments. They also remain your point of contact should any issues arise after you close.

How does the mortgage life cycle affect pipeline management?

Managing your pipeline is important to ensure you give the best service possible while maintaining consistency when dealing with a variety of borrowers. It also plays a large part in how your originators and lenders handle each step of the process.

By understanding the various steps in the mortgage life cycle, mortgage originators can better plan and allocate resources to ensure that the process is as smooth and efficient as possible. For example, during the pre-qualification stage, few resources would need to be allocated to this borrower until they decided to move forward with the process and complete an application. A single loan officer can be assigned to routinely check in on the customer and ensure they don’t fall out of the pipeline.

With a proper understanding of the process and pipeline management, the loan officer can also anticipate and prepare for potential challenges or delays that may arise at different stages in the pipeline.

Pipeline management strategies

Robust pipeline management requires follow-up and updating the system to reflect real-time status. This ensures efficiency and allows for realistic projections and setting goals. There are a few strategies you can implement to effectively manage your pipeline.

Set clear expectations and deadlines

A key element of successful mortgage pipeline management is setting clear expectations and deadlines for each step in the process. This includes establishing clear communication channels between all parties involved, as well as setting deadlines for tasks such as loan application submissions, appraisals, and closing.

With multiple parties involved in the mortgage process, knowing deadlines and the next steps for the life cycle of the mortgage is crucial to providing a seamless experience to your customers. Using tools like an automated LOS can make it even easier to meet the deadlines and expectations set for each loan application in the pipeline. Simply manage documents, pricing, and any other information needed to move an application from start to closing with as few hiccups as possible.

Monitor and track loan officer progress

Regularly reviewing and assessing the progress of your lenders and brokers can help optimize the process further. Any delays or inefficiencies in the mortgage loan process can have a negative impact on both the borrower and the lender. By regularly identifying strengths and weaknesses amongst lenders and brokers, organizations can more effectively decide who should work on different applications to make the process move as smoothly as possible.

Communicate effectively

Effective communication is critical for mortgage pipeline management. This includes keeping all parties informed about the status of the loan process and addressing any questions or concerns that may arise.

You can reduce your risk of pipeline fallout by equipping yourself with the right tools such as an organized CRM. These tools make it easier and faster to communicate with all parties, push loans onto closing, increase customer satisfaction, and reduce the likelihood that borrowers will choose another lender at the last minute.

Automate with tools

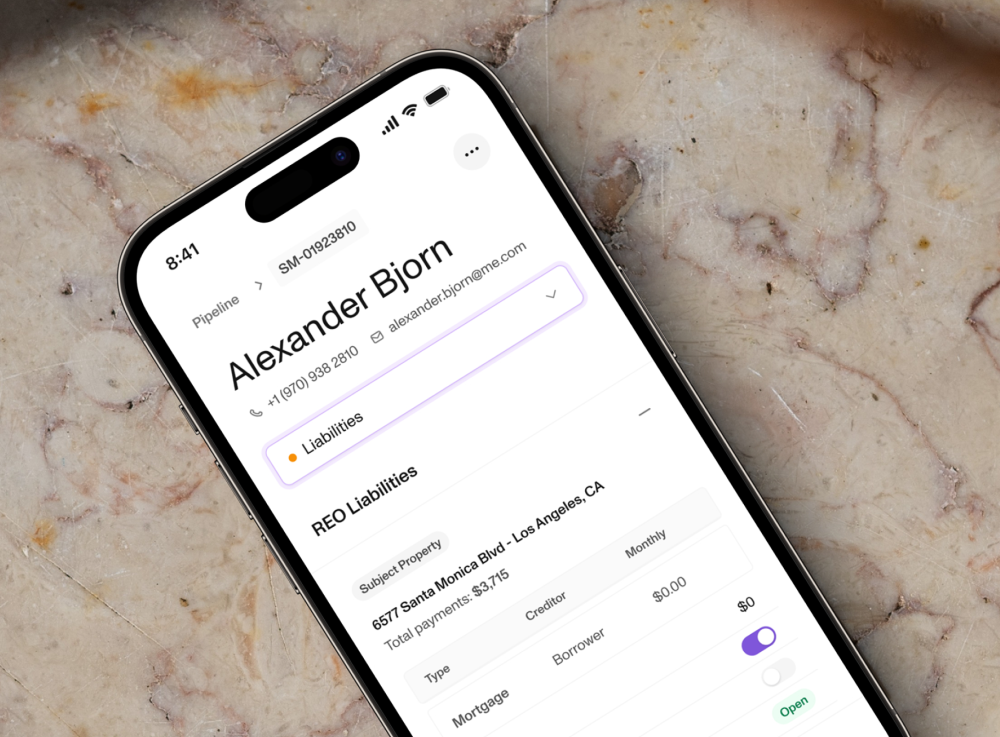

Utilizing a stack of mortgage software, such as Sonar’s all-in-one automated system, enables originators to effectively monitor and nurture their mortgage pipeline throughout every step of the loan process. Sonar will help you maintain reliable data and organize clients by their status, giving you an edge over your competition and allowing you to make informed decisions.

By implementing these and other pipeline management strategies, you can better manage your goals, reduce fallout, and deliver an improved experience for everyone involved.

Lend with confidence with an optimized pipeline

The mortgage cycle consists of many moving parts, so managing it is a complex but necessary task. By leveraging Sonar’s platform, you can confidently navigate the loan life cycle and invigorate your process.

Sonar provides an end-to-end platform that’s with you from open house to closing. Loan officers can track their clients, streamline loan processing, and use predictive data to make informed decisions. Throughout the life cycle, Sonar’s comprehensive mortgage pipeline management platform puts you in control.

Take your mortgage process from start to finish faster with our all-in-one mortgage solution. Get started today by scheduling a demo!