Selecting a suitable point-of-sale (POS) vendor provides you with the efficiency and accuracy you need to strengthen your mortgage business. However, navigating the plethora of options available can be a difficult task. The POS system is vital in streamlining operations, enhancing customer experience, and ensuring regulatory compliance. Ignoring these advantages in favor of a legacy solution isn’t a viable option for originators who want to win the business of today’s borrowers.

Your old POS system may be comfortable and familiar, but it lacks the features necessary to keep up with evolving customer needs and industry regulations. Modern mortgage origination requires a more efficient and integrated approach. Poor customer experience, difficulty tracking multiple systems, and lack of flexibility are all warning signs that you need to switch POS providers.

What is a POS?

A mortgage point-of-sale system (POS) is a digital interface for borrowers. It allows them to submit applications and receive their loan documents from lenders. Borrowers appreciate the convenience of online applications and document uploads, leading to higher satisfaction rates.

Legacy point-of-sale (POS) systems were designed for basic transaction processing. They often rely on manual data entry, paper-based processes, and disparate systems. You likely need to juggle data from multiple platforms if you’re still using a traditional POS system.

By contrast, today’s advanced POS systems include document management, workflow customization, reporting capabilities, AI-powered tools, and more. Many of these features help to reduce processing times and minimize errors.

Explore the benefits of a mortgage point-of-sale system.

How to Choose a Mortgage Point of Sale System

Sorting through myriad options to find the best mortgage software may seem tedious, but it’s the only way to ensure you pick the right platform.

Every POS seems appealing if you read its marketing material. It’s essential to look beyond the buzzwords and understand what makes a POS system suitable for your business.

Will it support your growing business? Is it easy for borrowers and loan officers to use? These questions make a big difference.

Here are key features to look for in a modern mortgage POS:

- Unified Technology

- Fully Digital Borrower Experience

- Pricing Integration

- Reliability and Security

- Two-way Communication

- White-labeled

Experience the Sonar difference firsthand! Request a demo now.

6 Criteria To Look for When Choosing a Mortgage POS Software

As you look for the best mortgage, keep these seven criteria in mind:

1. Unified Technology

A unified technology solution that integrates the point-of-sale (POS) and loan origination system (LOS) is crucial for optimizing the end-to-end mortgage process. A unified system allows data to flow seamlessly between the POS and LOS, eliminating the need for manual data entry and significantly reducing errors.

If your budget allows, look for a system offering PPE and CRM capabilities. Without unified technology, you might face challenges managing borrower information across multiple systems.

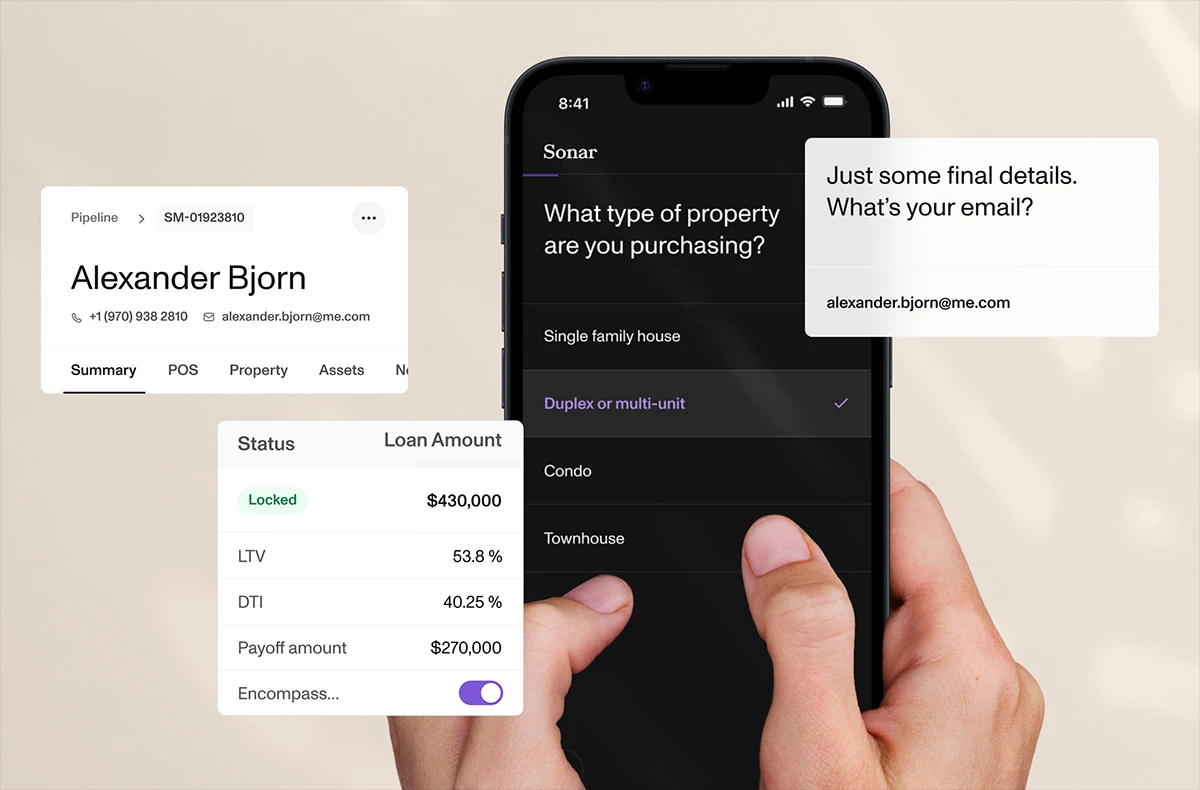

Many modern POS systems don’t fully integrate with other systems but still allow you to work with your other tools. That’s what sets Sonar apart from other POS options on the market. Experience the complete mortgage experience platform that combines POS, LOS, PPE, and CRM capabilities in a single dashboard to provide an optimal experience for all stakeholders.

2. Fully Digital Experience

The best mortgage POS software enables borrowers to complete the loan process online, including application submission, e-signatures, and communication with loan officers. The application should be accessible from any device for ultimate convenience.

Failing to provide a fully digital, user-friendly experience will frustrate many customers who are used to fast, easy application processes.

3. Pricing Integration

Integrating pricing into your POS system can improve customer experience and ensure accuracy and compliance.

Traditional methods of pricing loans often involve manual calculations and separate systems, leading to frequent errors. Integrating pricing with your POS brings accurate and real-time loan pricing, so you can consistently offer borrowers the most sensible options. Refer to our detailed product pricing engine page to learn more about the benefits of pricing integration.

4. Reliability & Security

In today’s technology-forward world, the importance of reliability and security cannot be overstated, especially when safeguarding customer data. You need a mortgage POS with various technical and organizational protections against bad actors.

You risk data breaches, reputational damage, and potential regulatory penalties if your security is too lackluster.

5. Two-Way Communication

Fast communication between borrowers and originators is critical for a smooth mortgage process. Borrowers are often anxious and need answers to their questions ASAP to feel at ease. If you wait too long to reply to an urgent customer inquiry, they may become angry and leave a negative review.

Only consider POS systems that can handle instant, on-the-go communication.

6. Fully White-Labeled

A fully white-labeled mortgage POS solution allows for visual customization of the platform. You can control elements like dark mode, brand colors, and logos to create a consistent professional borrower experience.

If you don’t add personal brand touches, you will miss out on opportunities to grow your presence.

Making the Final Decision

After evaluating a POS software’s features, pricing, support, and customer feedback, you should have enough information to make an informed decision. No matter which solution you choose, consistency and user experience are essential.When making your final selection between mortgage POS options, remember the needs of both borrowers and loan officers. Do you want to see your team weighed down with endless paperwork, or do you want to free them to focus on more pressing tasks?

Regardless of the size of your business, investing in a modern mortgage POS system will save time and money while helping you provide an improved customer experience. Take the time to do research and evaluate different options for the best possible outcome.

Why Originators & Lenders Choose Sonar for their Point of Sale Vendor

When originators and lenders are looking at different point-of-sale vendors, one name stands out – Sonar. Our POS system offers a digital checkout experience fully integrated with loan origination software (LOS), customer relationship management (CRM), and a pricing engine (PPE). This integration means no manual data entry and automated pre-approvals or rate locks.

Plus, Sonar is built by originators and comes with no implementation fee. Our configurable platform allows you to tailor the system to your specifications to create an approachable mortgage experience for your customers. With Sonar’s POS solution, loan officers have everything they need in one simple system.

Ready to revolutionize your mortgage businesses with an integrated point-of-sale system? Request a demo to step into the future of lending success.