Any business that handles mortgage origination needs the support of a robust loan origination system (LOS). The wrong LOS can disrupt your pipeline and lead to errors in communication and customer experience.

For many businesses, searching for the right solution is motivated by an existing system that needs to deliver efficient processes or consistent accuracy in data management. Others may be looking to replace multiple systems with a single platform that offers more features and better integration.This blog will explore what to look for in loan origination system vendors, including key features.

What is an LOS?

A loan origination system (LOS) is a software platform that helps originators and financial institutions manage, process and distribute loans. It automates the entire mortgage production workflow, from customer data input to document processing and post-closing.

Traditionally, LOSs have been complex legacy applications with manual processes and large hardware footprints. Many used proprietary systems and required expensive staff training, making them costly. Lenders who relied on these outdated systems often spent hours reconciling data and documents.

The emergence of cloud-based technology has simplified everything. Modern LOSs are agile applications that allow companies to manage workflow in real-time from any device. They also offer advanced analytics capabilities that enable lenders to improve the customer experience while mitigating risk.

Customers are unaware of the evolution of LOS systems. However, they still expect the benefits of the new technology, such as fast decisions and constant communication. Lenders who want to grow their business need to switch to a top-of-line, modern LOS to maximize their earning potential.

See what Sonar’s LOS software can do for you business.

How to Choose a Loan Origination System

The loan origination space is full of mortgage loan origination system vendors, each with different features and capabilities. However, figuring out the best option for your business isn’t easy.

At first glance, modern LOS systems might seem identical. They all purport to streamline the mortgage workflow, most require limited hardware, and many offer mobile access.

But beneath the surface, significant differences between them can impact your business’s performance and bottom line. Is the interface reliable and easy to use? Are any integrations offered? These are just a few questions you should try to answer before investing in a new LOS.

We’ve distilled the essential criteria into five distinct points:

- Unified platform

- Omni-channel access (emphasis on mobile)

- Pricing integration

- Software reliability and security

- Customizable to your needs

Each of these criteria affects how useful the LOS will be. When you’re searching for your next LOS, make sure to question the potential vendor about each one. Your budget may demand a sacrifice in one or more areas, but the right vendor should be able to balance your needs and financial goals.

Position yourself for loan origination success with Sonar’s cutting-edge system. Schedule a demo today!

5 Criteria To Look for When Choosing a Loan Origination System

Here’s a closer look at the criteria to consider when comparing loan origination software.

Unified Technology

One of the biggest problems originators faced was the need to rely on multiple disparate systems. The data on each system was siloed, making it challenging to get needed information at once.

Now, lenders can select a unified platform LOS, meaning the loan origination system and point-of-sale (POS) technology integrate into one streamlined solution. The integration provides a clear view of each customer’s journey from application start to finish. Customers can take advantage of the visibility as well.

If you ignore the benefits of using unified technology and instead use separate LOS and POS systems, you risk data integrity issues and manual processing errors. You also have to waste time dealing with multiple interfaces.

Maintaining quality and control of your pipeline is easier when you have a single, unified system. When you have two systems, troubleshooting becomes more complex and unpredictable.

Omni-Channel Access

Gone are the days when originators had to be stuck behind a desk to close a loan. With mobile-friendly capabilities, lenders can interact with borrowers and process loans at the office, riding the subway, or anywhere else. The ability to do business on the go lets lenders work in environments that suit their productivity, with many going remote.

The most effective LOS software offers omnichannel access, allowing you to take advantage of digital document signing, automated customer notifications, and more.

Lenders may need this option to meet market demand and client expectations. Most borrowers expect near-immediate responses during the workday. In an industry where speed is critical to success, originators risk losing deals to more agile competitors if they can’t access their data from anywhere.

By having an omnichannel solution, originators can keep deals moving forward. When selecting a LOS, remember to inquire about its mobile capabilities so you can ensure it meets your needs and those of your borrowers.

Pricing Integration

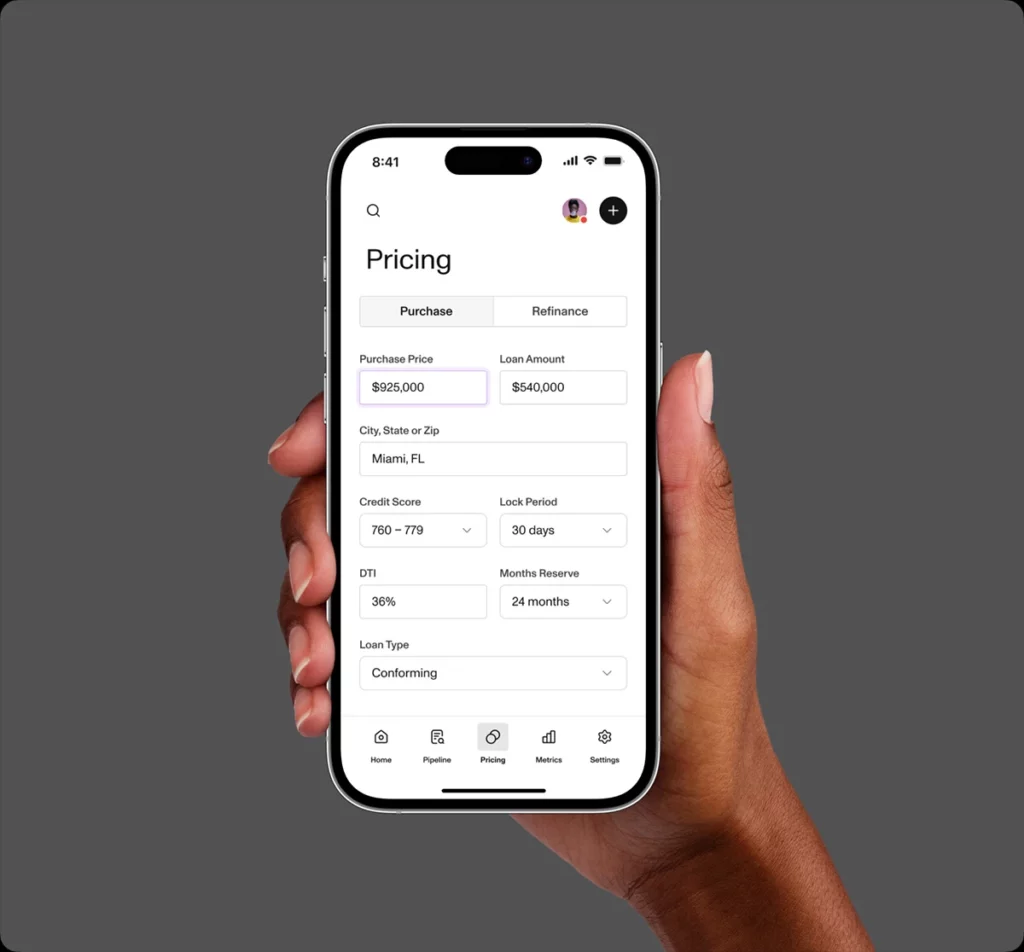

Lending becomes faster when you can access a LOS with pricing integration with a product pricing engine (PPE). The tool lets you automatically access the current market rates.

Integration also enables you to update the system with instant rate refreshes automatically. You don’t have to worry about sharing the data with your LOS or POS systems, as the integration takes care of that for you.

Having an integrated system keeps valuable information on one screen. Using a standalone PPE instead, you may spend time manually entering pricing data into multiple systems. This traditional way of pricing loans slows the loan process and leaves room for errors or delays.

Reliability & Security

Mortgage applications involve sensitive customer data, emphasizing reliability and security points. Your vendor should be able to provide thorough technical, organizational, and physical safeguards that protect both your system and customer data from unauthorized access or malicious cyber-attacks.

For example, look for a LOS solution that offers role-based access control functionality. This feature ensures only authorized users can access the system and view private customer data.

In addition, you want to select an originator with solid disaster recovery features. The plan typically includes a backup and recovery strategy that helps you quickly restore your system in an emergency. It also minimizes downtime and enables you to stay compliant with industry regulations.

These safeguards are necessary because a breach could have a devastating impact, especially if customer trust has eroded. As the lender in charge of handling customer data, you must be able to prove that you’re taking the appropriate steps to protect it. This responsibility includes picking a LOS backed by robust security protocols.

Customization

The most useful LOS systems are highly customizable and able to meet the specific needs of most lenders or originators. You need features that fit your business. White labeling, dark modes, pipelines, etc., should all be customizable to ensure the system aligns with your team’s needs.

White labeling, for example, lets you utilize the system with your branding. You can create a look and feel that reflects your brand identity so customers build trust. White labeling allows your business to shine instead of your LOS vendor’s.

Dark modes are growing more popular as they help reduce eye strain, improve visibility in low-light conditions, and save energy. Dark modes are valuable for originators who spend long hours in front of their screens.

If you forego customization entirely, it might lead to brand confusion. Customers may struggle to recognize your company without a customized look and feel.

To summarize, selecting the right loan origination system (LOS) is integral to creating a successful mortgage business. An effective solution must have reliable mobile capabilities, an integrated POS and PPE, and customization options. Dedicated security protocols should also be in place.

If you consider all of these factors, you’ll have the tools to make an informed decision that yields results.

Why Brokers & Lenders Choose Sonar for their Loan Origination Software

The mortgage industry is flooded with LOS platforms, but one option stands out. Sonar is a complete LOS system offering features that ease broker and lender workflows.

Sonar is fully integrated with POS and PPE software, keeping pertinent loan information on one page. Finding data is easy. And, because Sonar is 100% mobile-first, you can look up information no matter where you are. Sonar’s security measures keep the data safe.

If you need to tweak the platform to match your needs more directly, feel free. Sonar’s software is fully configurable and can be white-labeled to fit any brand identity. From your customer’s point of view, they never have to leave your site or interact with a third party.

Sonar has everything you need to succeed. It’s no wonder brokers and lenders keep returning to Sonar for their loan origination software. They want a solution they can depend on.

Position yourself for loan origination success with Sonar’s cutting-edge system. Schedule a demo today!