A potential borrower can navigate your website, hit the apply button, and enter a few details in seconds. Unfortunately, exiting the page is just as easy — and it often happens. Application abandonment can severely diminish your lead pool if you don’t take steps to mitigate it.

Digital experiences should move at lightning speed; even a slight hiccup in the application journey might push customers toward competitors. No one wants to fiddle with a complicated app or website when a quick search leads to more accessible options.

Keeping this in mind, application abandonment prevention as loan originators means optimizing until filling out your digital application verges on being effortless.

User Experience Optimization

Mortgages moved online because digitization added speed, accuracy, and convenience. If your application process violates these benefits, clients will bolt. You need an intuitive design that focuses on simplicity.

For example, are there 30 questions on your application? Split them into three pages with a progress bar. Seeing a long list of questions at once can make someone feel like they need more time to finish the application.

What about your website? Is the loading time slow? Are there links to nowhere? A Bain & Company digital financial consumers survey found that 48% experienced friction when opening an online account.

Optimize your user interface and navigation with these tips:

- Simplicity is vital: Avoid using jargon or complicated instructions.

- Use a responsive design: Your application should be accessible on all devices, including smartphones and tablets.

- Include progress indicators: People like to know where they are. Showing a progress bar or percentage provides control.

- Test for bugs: Make sure your application is bug-free and conduct regular tests. Your customers have little patience for glitches.

Transparent Communication

Let customers know what’s going on. Don’t promise a one-day closing if you know it will take a week. Instead, set realistic expectations and communicate your application timeline. If customers understand every step of the process, there’s less chance of them becoming confused and abandoning their applications.

Here are some loan application tips for transparent communication:

- Be honest: Don’t make false promises or misrepresent your services.

- Provide clear instructions: Ensure customers understand what information is required and how to input it.

- Communicate delays: If there are any delays, keep customers informed and provide an estimated timeline.

- Provide updates: Reach out throughout the process, even just to say everything is going smoothly.

Personalized Support

Getting a mortgage is a big decision; borrowers want to know their originator respects that. If your platform treats applicants like robots, they won’t develop a connection. They’ll quit your application and move on to a new one without ever considering your company again. That’s why personalization makes a difference.

Using automated communication tools increases efficiency without sacrificing personal touch. For example, a customer can get customized emails or text messages based on the stage of their application. This extra effort provides a personalized experience for the borrower and saves time for your team.

If an applicant forgets to complete their application, you can set your system to send automated friendly reminders. Automation enhances your team’s work but doesn’t replace it.

Security and Trust

Your platform’s simplicity shouldn’t extend to its data protection. Employing advanced security measures is critical, as is conveying the strength of your security posture to customers. They don’t need an in-depth technical breakdown, just a few solid indicators their information is safe.

You can build trust through measures like:

- Trust badges: Trust badges are a sign that your platform undergoes regular security checks. Customers are more likely to trust you if they see a McAfee or VeriSign badge on your site.

- Clear data handling explanations: How and sharing why you collect and store customer data builds trust and loyalty.

Progress Tracking and Documentation

A mortgage application can involve lengthy delays and various documents. To keep applicants invested, they need to know how close they are to the end. Even the most tedious application parts become less tiresome when you know you’re almost done.

Applicants should know if their application is 25% completed, if they’re in lender review, etc. They should have access to all the forms they need and be able to see which ones still need to be added.

Switching to mobile-friendly documents and document uploading is an excellent way to make your application more navigable. Let people work on their applications on their phones. Forcing them to switch to a computer might zap their interest and send them to a mortgage originator that allows mobile documents.

To make documentation easier, you can:

- Create a checklist: A clear list of documents required, documents received, and documents still pending helps borrowers visualize their progress.

- Offer multiple document upload options: Allow applicants to upload documents from their computer or phone or even take photos of physical documents.

- Create a mobile app: If possible, create a dedicated mobile app that allows customers to track progress and access relevant documents on the go.

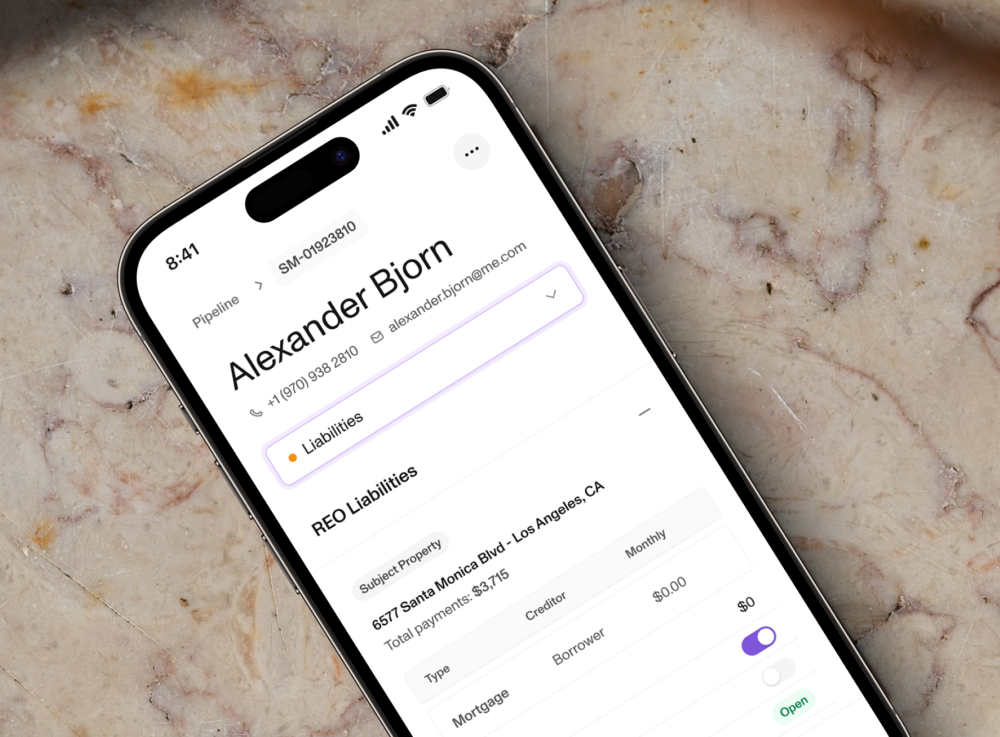

Introducing Sonar Mortgage Experience Platform

The Sonar Mortgage Experience Platform is a comprehensive tech stack designed for the mortgage industry. Utilizing Sonar within your operation amplifies your effectiveness by streamlining repetitive work and optimizing the frontend and backend systems.

Your borrowers will love the intuitive point-of-sale system (POS), while the platform’s AI tool can help boost personalization.

Additionally, Sonar offers features such as automated communication, customization options, industry-standard security protocols, and progress tracking.

With technology like Sonar, you can significantly reduce application abandonment rates. Implement the tips and strategies in the blog with Sonar to optimize the loan application process.