As a mortgage loan originator, you likely receive many questions from clients regarding the mortgage process. In order to provide the best experience for those borrowers, it’s vital you know the answers to those questions. Below you’ll find answers to some of the most commonly asked questions, so you can provide a smooth loan experience from start to closing for every borrower.

How long is an appraisal good for?

An appraisal is good for 120 days prior to the note date, so closing must happen within 120 days of the appraisal. When the effective date of the original appraisal report is more than four months, but less than 12 months, from the date of the note and mortgage, the appraiser must perform an appraisal update that includes inspecting the exterior of the property and reviewing current market data to determine whether the property has declined in value since the date of the original appraisal report.

How long is a credit report good for?

Agency guidelines state that credit reports are only valid for 120 days and an updated or re-pulled credit score after the initial preapproval is good for 90 days. If it has been more than three months since your preapproval, your report may need to be re-pulled.

What’s the difference between a HELOC & a mortgage?

Both mortgages and home equity lines of credit (HELOCs) are forms of debt that use property as collateral. The key difference is that HELOC takes its value from a property you already own and is a line of credit that can be used on demand with varying terms of repayment. Whereas a mortgage is a lien with a set term and dollar amount taken all at once. HELOCs may have higher interest rates and are sometimes considered a second mortgage, but repayment can consist of only interest on the balance owed for a predetermined time before you must pay on the principal.

Do closing costs have to be financed?

Closing costs do not have to be financed, but they can be in some cases. Typically, closing costs are between 2% and 5% of the loan amount. If a homebuyer has that cash in hand, they can pay these expenses at closing. Some buyers may want to finance their closing costs as part of their mortgage loan or refinance.

When can a POA be used?

A power of attorney (POA) allows one person to legally bind another, such as in loan agreements. A specific POA for the transaction can be used for a purchase or a limited cash-out refinance, so long as the agent is not an affiliate of the lender, loan originator, title insurance company, or the property seller.

When does repulling credit affect credit scores?

Hard inquiries stay on your credit report for two years, but when looking for a mortgage you’ll likely have multiple lenders pulling your credit report. There are two main models for credit scoring that allow for different rate shopping windows. When pulling credit for the same purpose from multiple lenders within certain time periods, the inquiries will count as a single inquiry and only hit your credit once. Newer versions of FICO score offer homebuyers a 45-day window for rate shopping. Whereas older versions of FICO and VantageScore 3.0 only allow 14 days.

Who can be considered a relative for FHA?

In cases where not all the borrowers will live in the home full-time, FHA non-occupying borrowers include those related by blood, marriage, or law. This means family members including spouses, parents, children, siblings, step-children or step-parents, aunts, uncles, nieces and nephews.

What’s considered a high cost mortgage?

For 2022, a loan is considered high-cost if the points and fees charged in connection with the transaction exceed:

5% of the loan amount for loans of $22,969 or greater

8% of the loan amount, or $1,148, for loans less than $22,969

When can a borrower drop mortgage insurance?

Borrowers can request their private mortgage insurance be removed once the principal balance of the loan falls to 80% of the original home value or current appraised value.

How can a borrower drop mortgage insurance?

In order to drop PMI, homeowners can wait for automatic termination when your mortgage balance reaches 78% of the original purchase price, request to remove PMI when you reach 20% home equity, or refinance either with a new appraisal that shows they have more than 20% home equity or when they have paid down their original loan-to-value ratio.

Can title be held in an LLC?

Yes, but while title can be held in an LLC, most lenders do not allow a mortgage to be granted in the name of an LLC.

What is an official loan estimate?

A loan estimate is a three-page document that tells you important details about the loan you have requested including terms and costs. This standardized document must be delivered by the lender within three days of applying for a mortgage and is meant to make comparing loans easy.

How do seller concessions work?

Seller concessions are buyers’ closing costs that the seller has agreed to pay. These may be set costs, such as title insurance or inspection fees, or a set percentage of total costs. Seller concessions are not a requirement and sellers are under no obligation to pay them.

Can I use a personal loan for downpayment?

Neither conforming conventional loans nor FHA loans allow buyers to use personal loans for downpayment.

Being a mortgage loan originator requires a thorough understanding of the various aspects involved in the home buying process. By staying up-to-date with the latest industry guidelines and regulations, loan originators can better serve their clients and help them navigate the complex world of home financing with confidence. Explore our blog for more insights into the latest mortgage trends and guidelines.

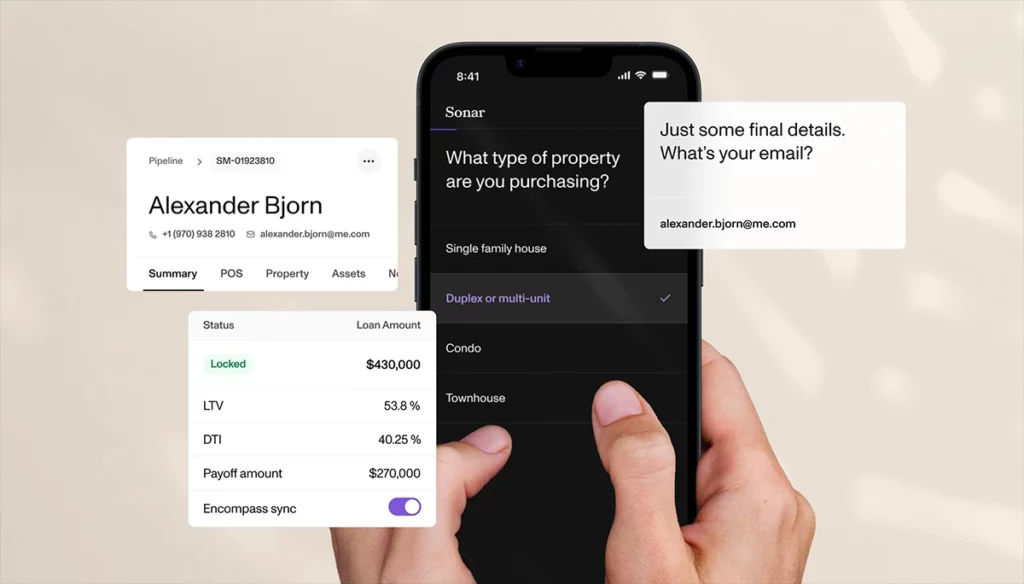

Want to go beyond FAQs? Schedule a demo today to see how Sonar can help you navigate the complexities of the mortgage landscape with confidence.