In today’s digital age, the mortgage industry is undergoing rapid transformation. As technology progresses, it introduces new tools that greatly enhance the efficiency and productivity of mortgage professionals. One of these game-changing tools is a Mortgage Point of Sale (POS) system.

A mortgage POS system is a software platform specifically designed to streamline the entire mortgage loan process, from application to closing. This all-in-one solution brings together various key processes, such as data gathering, document collection, and credit report analysis, within a single, user-friendly interface. More than just a tool, a mortgage POS system is a robust platform that transforms the way mortgage professionals conduct their daily operations.

Boosting Operational Efficiency

One of the most significant advantages of implementing a POS system is its ability to enhance operational efficiency. By leveraging automation, the system takes over routine tasks and processes, enabling loan officers to focus on more important activities that require their expertise.

For instance, with a POS system that is integrated with loan origination software (LOS), loan officers can manage leads, process applications, and track loans with a few clicks. Manual data entry is minimized, thereby reducing the chance of errors that could potentially derail a loan application process. Furthermore, by centralizing all loan-related data in one place, the system eliminates the need for disparate systems, leading to a more streamlined and efficient origination workflow.

Integration is another key aspect of a Mortgage POS system that contributes to operational efficiency. A robust POS system can seamlessly integrate with other critical software systems, such as Customer Relationship Management (CRM) systems and Loan Origination Systems (LOS). This integration creates a comprehensive, end-to-end solution for loan origination, ensuring all necessary tools and data are readily accessible in one place.

Elevate your mortgage game with our all-in-one mortgage experience platform. Request a demo today!

Facilitating Improved Communication and Transparency

Effective and timely communication is a cornerstone of success in the mortgage industry. With a Mortgage POS, loan officers have a central communication platform that facilitates smooth and efficient interaction with borrowers and other stakeholders.

Integrated email and messaging features allow loan officers to communicate with borrowers on a personalized basis, addressing their queries and concerns in real-time. This level of communication helps maintain transparency throughout the loan origination process, ensuring that borrowers are kept informed every step of the way.

In addition, a POS system provides real-time updates on loan applications, allowing all parties to track the progress of a loan application from start to finish. This feature not only improves communication but also enhances borrower satisfaction, leading to higher conversion rates and better customer retention.

Accelerating Loan Origination Times

In a world where consumers are used to instant gratification, time is of the essence. The quicker a loan can be originated, the higher the chances of closing a deal. From the initial capturing of leads to the processing of applications, underwriting, and closing, every step of the loan origination process is optimized in a Mortgage POS system.

A POS plays a critical role in reducing loan origination times by simplifying and automating key stages of the loan process.Through automation, time-consuming manual tasks are eliminated, allowing loan officers to focus their attention on their clients rather than paperwork. This ultimately leads to quicker loan approvals, happier clients, and a more productive business.

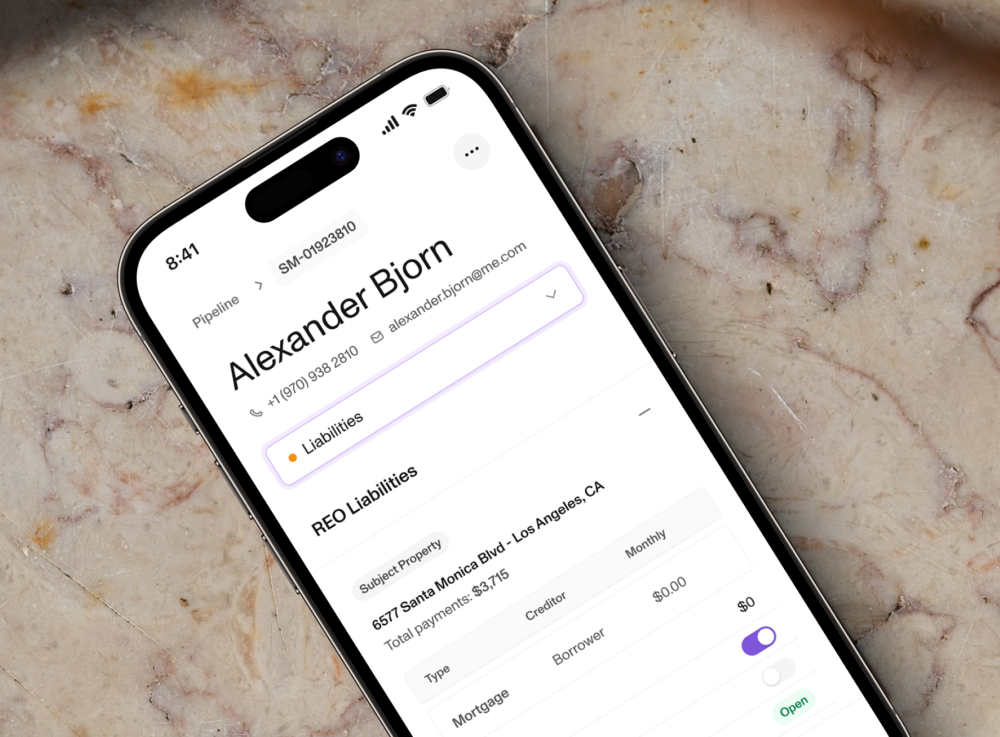

Embrace the Future of Origination with Sonar

In today’s fast-paced mortgage industry, efficiency and communication are key. The right Mortgage POS system can revolutionize your business, and Sonar stands ready to support this transformation. As a unified mortgage platform, Sonar streamlines operations, fosters clear communication, and reduces loan origination times, all while maintaining your focus on what truly matters – the borrower.

Seize the opportunity to transform your mortgage business into a thriving powerhouse of efficiency. Schedule a demo today.