Potential homebuyers want fast approvals and stress-free communication with originators. A high-quality customer relationship management (CRM) tool is integral.

With a CRM, you can simplify processes, manage multiple leads simultaneously, and send automated emails, increasing your success in the competitive mortgage industry.

Why CRM Selection Matters for Mortgage Brokers

A mortgage broker juggles an ever-growing stream of customers, applications, and administrative tasks. The right CRM can make all the difference in efficiently managing these responsibilities.

For example, a well-suited CRM enhances lead management by organizing and prioritizing leads based on their likelihood of conversion. This optimization saves time and boosts profits because resources can flow to the best leads instead of being wasted on unlikely buyers.

Additionally, a good CRM allows for seamless communication between brokers and clients, ensuring that critical updates and documents are exchanged promptly. You can build a reliable reputation and increase customer satisfaction.

Key Criteria for Evaluating CRM Vendors

Any CRM system is an improvement over manual methods, but some are far more helpful than others. Before committing to a CRM vendor, consider these essential criteria:

– Scalability: As your business flourishes, you need a CRM system to keep up. Ensure that the software can handle the ebbs and flows of your business.

– Customization: Your mortgage brokerage has specific needs and processes. A customizable CRM allows you to tailor the software to fit your demands.

– Integration capabilities: A CRM should integrate smoothly with other tools and software used in your brokerage. The communication promotes better data transfers.

– Ease of use: The best CRM system is one that you and your team can easily navigate without extensive training. Look for user-friendly interfaces and intuitive workflows.

9 Questions to Ask Your CRM Vendor

When researching CRM vendors, it’s a good idea to delve into the specifics of the software. Here are nine questions to help with your CRM vendor comparison.

1. How Does Your CRM System Handle Lead Management?

Lead management is where a strong CRM system shines. Ask how the vendor CRM organizes leads. Is there a scoring system to prioritize the most valuable prospects? Is it easy to import new leads?

An effective system has lead-tracking capabilities to monitor where leads are in your pipeline. These capabilities should be paired with advanced lead nurturing tools that assist with conversion. For example, is there a feature for automated milestone emails?

2. What Integration Options Are Available?

During your CRM vendor evaluation, look into integration options. Your team likely already uses a software suite in their daily operations. Ensure the CRM can communicate with existing software, such as your loan origination system.

Top CRM vendors recognize the value of standard mortgage software and include pre-built integrations. If you’re using custom tools and the CRM isn’t compatible with your setup out of the box, see if there’s an available API for custom integrations.

3. How Secure Is Your CRM System?

Mortgage brokers handle significant customer data, making security a top concern. A data leak could cause your company to lose customers and money.

The first question you may want to ask involves data encryption. Data encryption is more than a perk – it’s a legal requirement. It’s important to know that your CRM adheres to robust data encryption practices that comply with industry standards.

Of course, encryption can’t be the only security measure. For example, the CRM should also have strict user authentication protocols and a plan for regular system backups.

4. What Reporting and Analytics Features Does Your CRM Offer?

Reporting and analytics features should not be overlooked if you compare CRM vendors. Analytics show if your efforts are working.

Find out if the CRM offers customizable reports that allow you to track key metrics such as lead conversion rates, ROI, and sales productivity. You should also inquire about real-time dashboards that enable you to monitor these metrics continuously.

5. How User-Friendly Is Your CRM Software?

A genius CRM system that’s difficult to use is worthless. You can only glean every benefit if your team is well-versed in how to use the tool.

A good bet is to find a CRM interface that’s simple and intuitive. This type of CRM can dramatically trim your implementation time. Some CRM vendors also offer training programs to get your team up to speed, whether it’s through instructional videos or phone calls.

How user-friendly your CRM is depends on how easy it is to make custom workflows. You shouldn’t have to twist your system to make the CRM fit.

6. What Customer Support Services Do You Provide?

Inevitably, questions will arise about how to use features of your CRM, or you may need help with technical issues. It’s best to choose a vendor with broad availability so you can get help immediately.

The real customer support test lies in reviews. Any CRM vendor that enables customer satisfaction should be able to gain its own customers’ loyalty. Read vendor reviews written by other mortgage brokers and see what problems they mention, if any.

7. What Are The Mobile Capabilities?

Customers want fast responses, meaning brokers must stay connected even when on the go. Mobile capabilities in your CRM are non-negotiable.

Some CRMs offer dedicated mobile apps you can access 24/7. The apps include features like contact management. If an app isn’t available, find out if the CRM has a responsive mobile website that provides a similar experience.

8. How Does Your CRM Assist in Compliance and Regulatory Requirements?

If you want to make your job easier, search for a CRM that assists in managing documents and disclosures. Dealing with compliance regulations can be very tiresome for brokers who don’t use the right tools.

That’s because compliance is an ongoing process that requires constant vigilance. A CRM system makes it easier for your brokerage by tracking compliance measures and generating audit trails and reports in addition to document management.

9. What’s the Pricing Structure for Your CRM Service?

Last but not least, try to understand the pricing structure before you commit to a CRM service. The features you want may not be available in the tier that fits your budget. Extra costs can also spring up, such as onboarding fees.

You may need a scalable pricing structure, meaning you can upgrade or downgrade your service as your company changes. Knowing every fee associated with scaling is essential before finalizing a contract.

Conclusion

Choosing a CRM system requires thoughtful consideration. Asking questions helps you discover the best match. Your business deserves a solution that aligns with your goals and refines your lead generation and retention strategies.

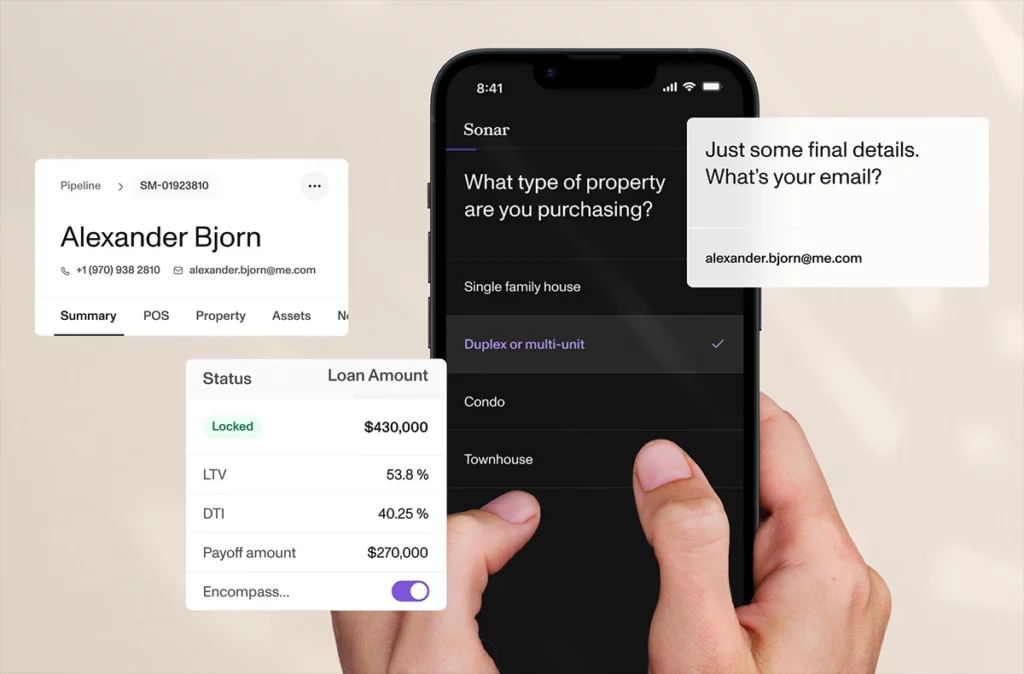

At Sonar, you can confidently schedule a demo and see how our CRM system can help you grow your mortgage brokerage. Our team is dedicated to creating a user-friendly platform with sophisticated security measures in place. We also offer extensive integration options, customizable reporting and analytics features, and reliable customer support services.

Ready to Revolutionize Your Mortgage Origination Process? Schedule a Sonar Demo Today!