You know why you’re installing mortgage origination software—it can optimize your operations. But how do you know if the implementation is successful?

You measure ROI against predetermined benchmarks.

Measuring ROI tells you what’s working and what needs tweaking. In this post, we’ll demonstrate how to gauge the effectiveness of your implementation and provide insights on maximizing ROI.

Understanding ROI in Mortgage Origination Software Implementation

ROI stands for return on investment. It directly measures financial gains relative to investment costs and signals whether your software implementation drives the business forward. You can use ROI to guide everything from resource allocation to risk management decisions.

Knowing your ROI can help improve:

Financial Evaluation

Talking about ROI points your focus toward your bottom line. So, it makes sense that one of the most important metrics is financial. Simply put, does your new origination software make sense financially? Owners rely on ROI-based judgments because they offer a clear picture of the software’s financial viability within the scope of your budget.

Resource Allocation

A mortgage platform should be able to optimize resource utilization. A thorough ROI analysis will let you see whether the software allows for better allocation of time and resources that would otherwise be spent on manual processes or workarounds.

Performance Monitoring

See how your team’s performance changes after implementation. If productivity rises, it’s a good sign. You can calculate how much the additional work boosted your bottom line and compare it to the software’s costs.

Risk Management

Investing in mortgage origination software may aid your compliance efforts and lower risk. ROI calculations help determine if the risk reduction justifies the cost of the software implementation.

Decision Making

Perhaps most importantly, ROI helps inform future decisions. Should you continue using the software? Is your strategy sound?

KPIs for Measuring Mortgage Origination Software Effectiveness

You can’t measure the effectiveness of mortgage origination software by changes in your bottom line alone; key performance indicators, or KPIs, offer a more nuanced understanding of software performance.

Loan Origination Time

On average, how long does it take your team to move a loan from application to close? A faster mortgage pipeline boosts customer satisfaction while making loan officers more effective.

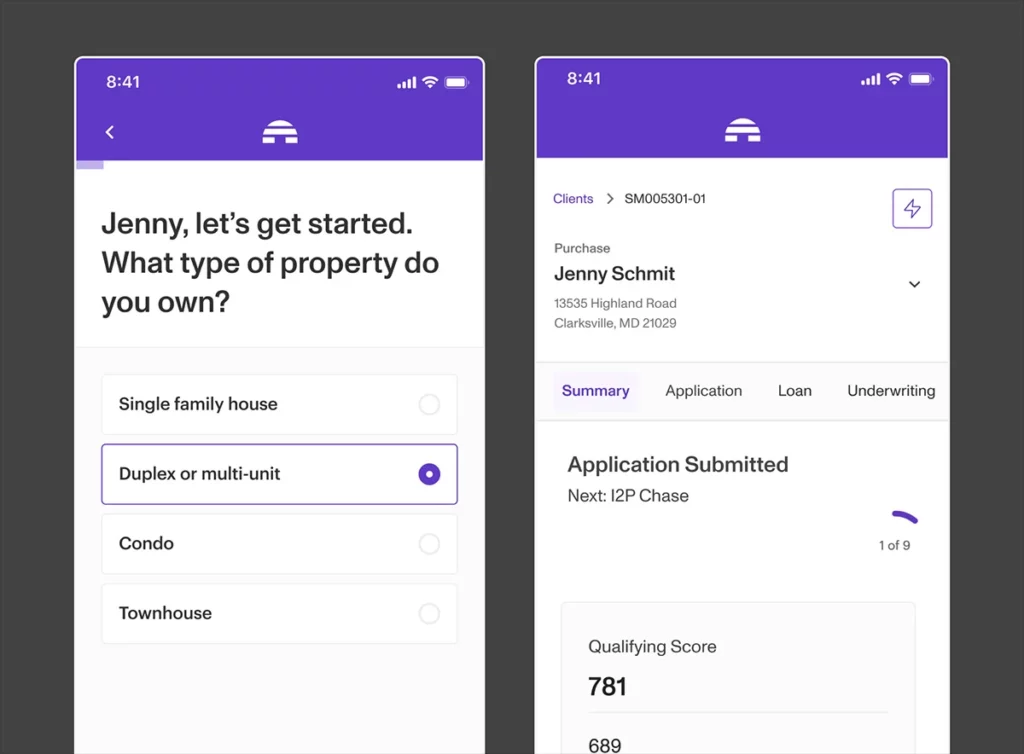

Application Completion Rate

Customers have no patience with clunky or cumbersome applications. An increase in the application completion rate indicates that your software has improved the process.

Loan Turnaround Time

The turnaround time between application and decision is a KPI that should be kept to a minimum if you want to grow your business.

Customer Satisfaction Score

Software needs to improve the customer experience, leading to higher satisfaction scores.

Average Loan Size

A rise in the average loan size indicates that your software may contribute to more upselling or a happier, broader customer base.

Pipeline Conversion Rate

How effectively do your loan officers convert leads into closed loans? A higher conversion rate speaks to a productive workflow; the right software should uplift that efficiency.

Challenges and Solutions in Measuring ROI

Measuring ROI comes with its own challenges.

Long-term Evaluation

Your business is subject to changing variables, from economic conditions to regulatory shifts. These make long-term ROI assessments complex.

Solution: Perform regular audits.

Intangible Benefits

Is your workplace more relaxed now that automation takes care of tedious tasks? Not all software benefits are easily quantifiable.

Solution: Implement additional metrics to capture the impact of intangible benefits, such as employee satisfaction surveys.

Resistance to Change

Employees at all levels may resist new software simply out of habit. Their desire to cling to old ways complicates ROI measurement efforts.

Solution: Provide ample resources and conduct training sessions.

Lack of Benchmarking

Measuring success requires a point of reference, and without established benchmarks, it can be challenging to gauge whether your software is performing optimally.

Solution: Establish KPIs relevant to your goals.

Inadequate Data Quality

A common issue is the data feed that software relies on. If the input data is unreliable or inconsistent, it can lead to skewed results, undermining your ROI analysis.

Solution: Invest in proper data management processes and regularly audit data integrity.

Strategies to Maximize ROI from Mortgage Software Investments

Unsurprisingly, implementing the right software doesn’t guarantee a high ROI. It takes a combination of software, strategic planning, and ongoing support.

Comprehensive Training

Training helps your team become experts in your new software. It’s necessary to ensure suitable adoption rates.

Continuous Monitoring and Optimization

Origination software requires an investment in constant improvement, with regular updates and optimization becoming standard.

Customization and Integration

One-size-fits-all software rarely fits any business perfectly. Customization keeps the software aligned with your needs, while integration with existing systems maintains operational continuity.

Data-driven Decision Making

You can generate insights from the data collected by your mortgage software. Making decisions based on this data can improve day-to-day operations.

Proactive Support and Maintenance

Software failures are often costly. Proactive support and regular maintenance will minimize downtime.

Mortgage origination software is a transformative tool. Measuring the software’s success indicates that you’re on the right track. Start by establishing nuanced KPIs and adopting a flexible, growth-centric mindset to set you down the right path to success.

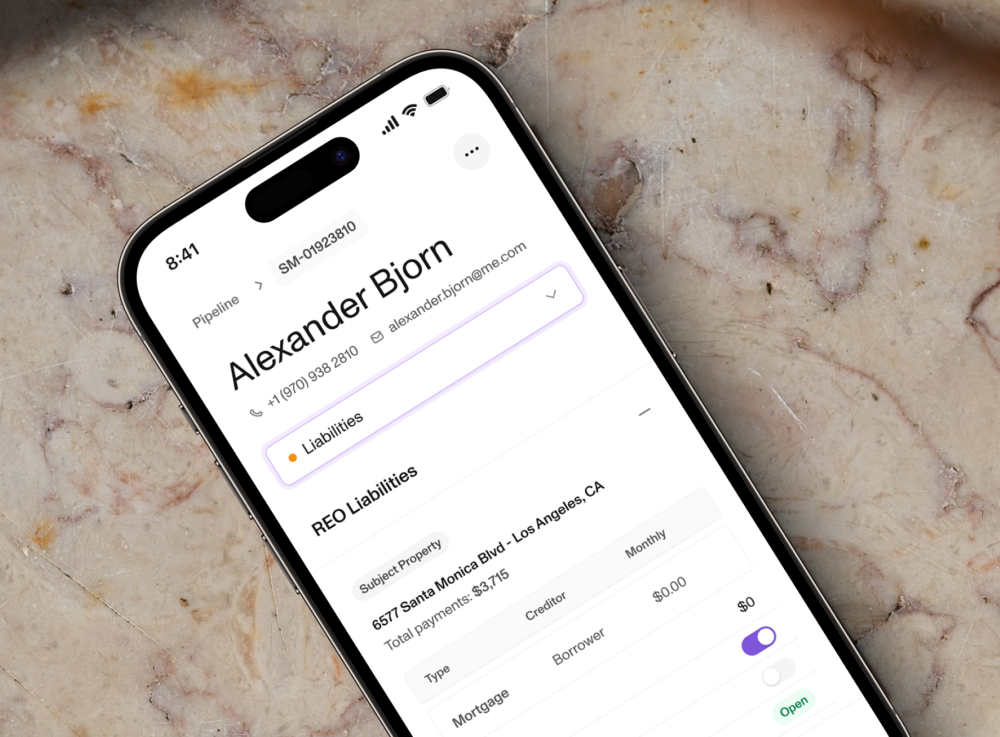

Sonar’s powerful origination software streamlines mortgage processes. With Sonar, implementation ensures continuous improvement and a long-lasting, maximum ROI.

Check out Sonar and learn how to maximize your ROI.