The mortgage industry is heavily regulated, with a swath of rules that loan officers (LOs) must follow. Mortgage compliance protects borrowers and keeps LOs out of legal trouble. However, staying compliant is not a one-time effort. Mortgage regulations are continuously evolving and can vary from state to state, making it essential for industry professionals to stay up-to-date and adapt when necessary.

Understanding why mortgage compliance exists is crucial for industry professionals. Failing to stay compliant can lead to severe consequences, including legal penalties, business suspension, and loss of customer trust. By understanding the regulations in your area and staying updated with any changes, LOs can limit these risks.

Understanding Mortgage Regulations

Lenders and loan officers must comply with numerous regulations when originating a loan.

TILA-RESPA Integrated Disclosures (TRID)

The Truth in Lending Act – Real Estate Settlement Procedures Act (TILA-RESPA), or TRID, is a regulation issued by the CFPB to simplify mortgage disclosures and help borrowers understand their loan terms. It consists of two parts: the Loan Estimate and Closing Disclosure. The Loan Estimate must be provided to the borrower within three business days of application, and the Closing Disclosure must be provided at least three days before the loan is closed.

The purpose of TRID is to ensure that borrowers understand their mortgage terms and are aware of any changes or additional costs incurred throughout the loan process.

Home Ownership and Equity Protection Act (HOEPA)

The Home Ownership and Equity Protection Act (HOEPA) was enacted in 1994 to curb predatory lending practices, such as high-interest rates, exorbitant fees, and prepayment penalties. It applies to higher-priced mortgage loans (HPMLs) or those with an APR greater than 6.5 percentage points above the average prime offer rate for first-lien transactions and 8.5 percentage points above the prime rate for first junior-lien transactions.

Lenders must provide additional disclosures and protections to borrowers before closing the loan, including a list of homeownership counseling organizations.

Home Mortgage Disclosure Act (HMDA)

The Home Mortgage Disclosure Act (HMDA) creates transparency. Lenders must collect and report data such as applicant demographics to the CFPB or other designated regulatory agencies.

The data lets the government monitor lending practices and identify potentially discriminatory activities.

Non-compliance with these measures leads to legal penalties or even the suspension or dissolution of your business. Customers may also abandon your business if they feel that they were misled.

Why Mortgage Compliance Exists

Mortgage regulations exist to protect customers and lenders. The regulations help borrowers get clear answers about their loan terms and establish punishments for predatory lending practices. Compliance maintains integrity and fairness in the mortgage industry.

Lenders don’t have a choice – compliance is a necessary tactic if you want to operate a legitimate business. However, doing the right thing and being compliant isn’t just a legal requirement – it’s also good business. Not only does mortgage lending compliance help protect consumers from unscrupulous practices, but it also increases customer confidence.

Best Practices for Staying Compliant

Unfortunately, compliance isn’t a simple matter for lenders. Staying compliant requires due diligence and a thorough understanding of the regulations.

Key practices to help you stay compliant include:

Maintaining Accurate and Up-to-Date Documentation

Accurate and timely documentation is essential for compliance. As a mortgage originator, you should always ensure your documents are complete and updated. Incorrect or incomplete information can lead to potential legal action. HMDA regulations, in particular, stress the importance of keeping accurate records.

Conducting Regular Internal Audits

Regular processes and procedures audits help you monitor your compliance efforts. If you identify any potential areas of non-compliance, they can be addressed before a real issue arises. For instance, take note of when you send your TRID Loan Disclosures. Are you sending the information within three days of receiving the application every single time?

Maintaining Transparency with Customers

Transparency is a hallmark of mortgage regulatory compliance. Being honest and open with your customers ensures they understand their loan terms. Obfuscation leads to compliance failures.

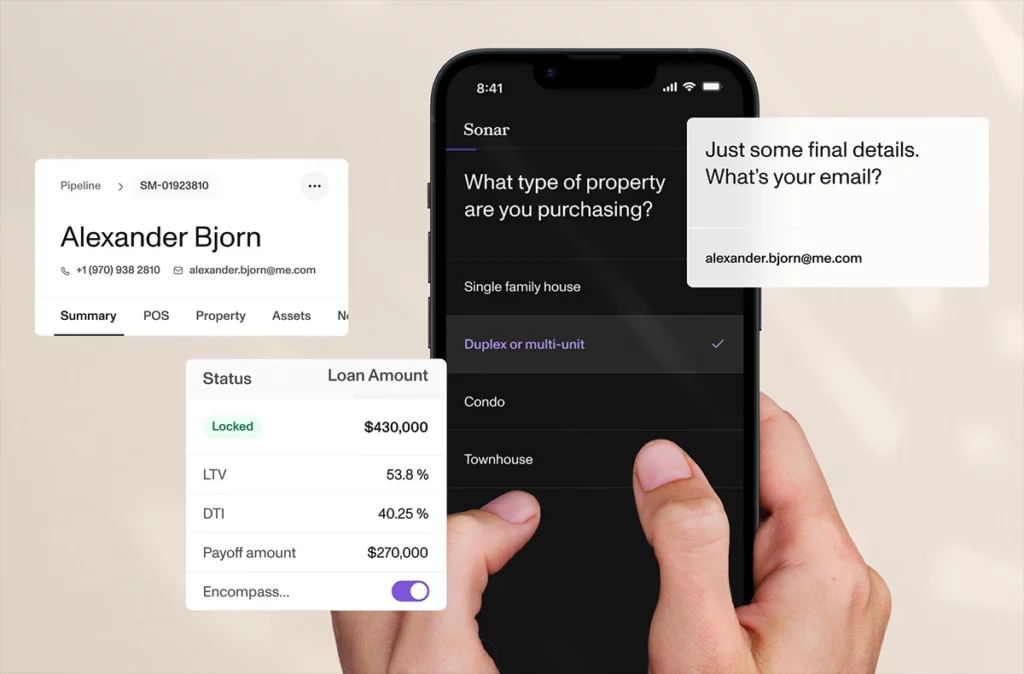

Utilizing Technology Solutions like Sonar

Technology solutions like Sonar help streamline the process of meeting compliance requirements. Sonar meticulously documents all relevant data while providing instant alerts to lapses and mistakes. With Sonar, mortgage originators can quickly verify compliance and keep up with rapidly changing regulations.

Improving Compliance with Sonar

Sonar is built with a variety of features to help lenders improve compliance. The platform offers data validation and verification, document management, and storage solutions for data tracking and analysis.

Data Validation & Verification

The Sonar system constantly verifies the accuracy of customer information in real-time. This AI-powered validation provides instant discrepancy alerts and ensures that all information is accurate when submitted to regulatory agencies.

Document Management & Storage

Sonar provides an automated document management system for storing and retrieving documents. All loan documents are securely stored in a single location, making them easily accessible anywhere. Finding the proper documentation in response to audits or other compliance checks is simple.

Understanding compliance is an integral part of operating a mortgage business. However, with numerous and changing regulations, meeting due diligence requirements is complex.

Sonar makes compliance more manageable. Sonar’s data validation and verification tools help maintain data accuracy while reliable document management and storage make locating the right documentation for review much less tedious.

Lenders who use technology to stay compliant also reap the rewards of increased customer confidence and improved customer relations.

Empower your compliance efforts while elevating your origination game. Request a demo now!