AI-driven mortgage origination has radically transformed the industry. Lenders can expedite loans and increase business by leveraging advances in artificial intelligence, machine learning, and other technologies.

Many originators are wary. Some are concerned AI-driven origination could lead to unfair or discriminatory lending practices. These concerns grow when you understand the role of humans in AI-driven mortgage origination and how you can maintain control over this process.

The most important aspect of AI technology is its ability to automate mundane aspects of the loan workflow and free up originators’ time for more lucrative tasks.

The Rise of AI in Mortgage Services

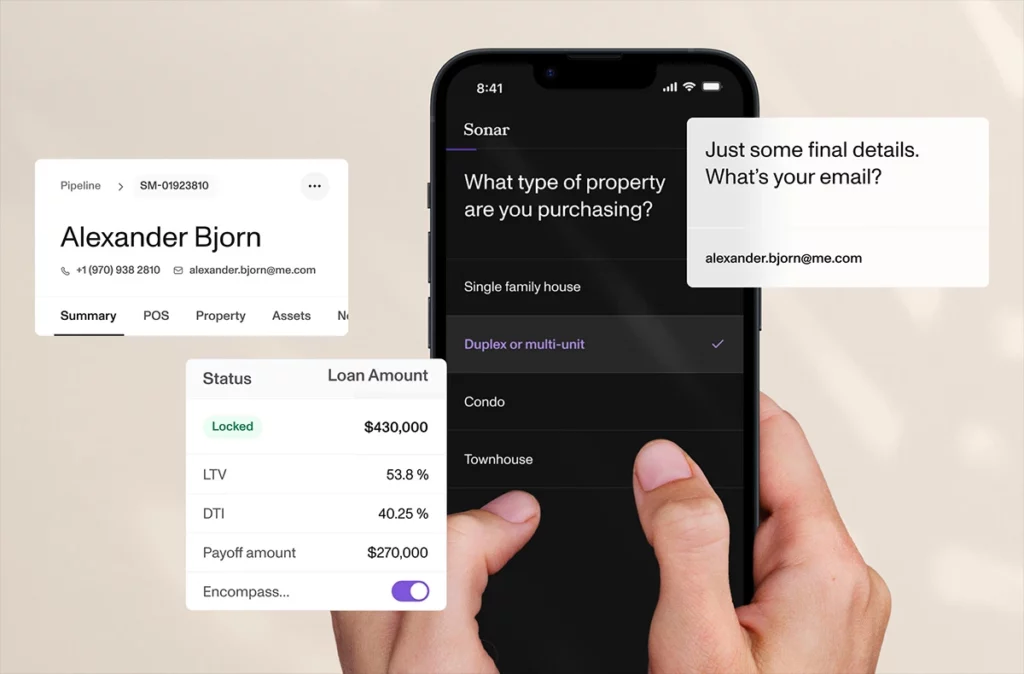

Artificial intelligence, or AI, is embraced by originators because it offers benefits that directly affect cash flow. You can use AI-powered mortgage tools to identify, verify, and sort documents, detect fraud, increase customer engagement, and more.

AI is also enabling originators to customize the process for each borrower. By aggregating data from various sources, AI mortgage services provide lenders better visibility into the potential borrower’s finances. This could lead to more accurate decisions and increased loans overall as you can pinpoint exactly how much risk each borrower represents.

Understanding the Human Touch in Mortgage Origination

AI-driven mortgage origination can speed up the time for a loan to move from application to closing. But it’s important to remember that AI is not designed to replace humans but instead supplement them by automating and improving tedious aspects of the job.

Underwriting is still a human process and requires a human touch to ensure fairness and accuracy. AI solutions prioritize tasks, increase efficiency, and reduce manual labor for originators.

Still, they do not replace the need for a trained mortgage professional who can communicate with customers effectively and provide guidance throughout the loan application process. Originators can navigate complex hurdles AIs are not prepared for.

See what mortgage process automation can do for you. Schedule a demo today!

The Dangers of Overreliance on AI

Although AI tools have the potential to provide greater efficiency and accuracy, they are not a panacea. It’s important to remember that no matter how sophisticated an AI system is, it can never fully replicate a human originator’s experience.

An overreliance on AI can lead to errors because AI is only as good as the data used to train it. If biases exist in the training data, they could be replicated in decisions made by the AI system. Other dangers include data breaches, privacy issues, and potential regulation or compliance violations.

Striking a Balance: AI as an Enhancing Tool

By striking the right balance between AI and human involvement, mortgage originators can take advantage of the many benefits that AI-driven technology offers without sacrificing quality or accuracy.

Originators need to understand how their role is evolving with the advent of AI-driven technologies and be prepared to adapt their approach accordingly. Employing a hybrid model which combines the speed and accuracy of AI with the nuance and understanding of a human is vital to taking advantage of automated processing.

A few ways you can leverage AI include:

- Detect falsified documents that are then sent for human review.

- Automate the mortgage preapproval process to assess a borrower’s eligibility quickly.

- Use chatbots to provide 24-hour, instant responses to customer inquiries.

- Draft customer emails about document uploads, offers, etc. An originator approves emails before being sent.

Chris de la Motte says, “We think of this as an AI assistant to allow each human to do more, faster.”

The Future of Mortgage: AI’s Evolving Role in Origination

The future of the mortgage industry looks rich with technology. AI mortgage underwriting software has altered what it means to be an originator. When only manual means are available, originating loans and ensuring compliance takes significant effort.

Now that technology has eliminated the worst part of the workflow, you can scale up your business without increasing your responsibilities or hiring more help. As AI mortgage tools multiply and grow, the borrower and the lender experience will be optimized.

Because AI advancements are constant, continuous learning is paramount for originators to stay ahead of trends and remain competitive. Following mortgage industry blogs like Sonar’s can help you stay current with any technology changes that could impact your business.

AI has changed the mortgage origination process and will continue to do so. While it has made underwriting faster and more efficient, the human touch remains essential. When combined with AI-driven technologies, originators can better serve their customers while streamlining their workflows.

As the mortgage industry shifts and advances, you must stay current with the latest trends. At Sonar, we provide regular updates on our blog about emerging mortgage technologies so originators can stay informed. Don’t miss out on new industry insights – explore the Sonar blog today and follow along for fresh ideas.

Ready to see what modern digital mortgage solutions can do for your business? Request a demo today!