Artificial Intelligence is here – and originators need to start thinking about how it will fit into their processes. The mortgage industry is rife with new AI-powered technology to streamline your workflow. Your business could suffer if you refuse to adapt.

AI’s power is unlimited, from improving the customer experience to increasing efficiencies and productivity. “We expect AI to be able to accelerate task management and help both processors and originators get more done each day,” says Chris de la Motte of Sonar. We already see AI technology for underwriting, automated document review, fraud detection, and more. Digital transformation continues to shape the future of the mortgage industry.

To keep up, consider leveraging AI in your mortgage business. These tools are not here to replace your job but to make it easier. By using AI-powered tech, you can take on more work without sacrificing quality or service.

Understanding Artificial Intelligence

Artificial Intelligence (AI) exploits the power of machines to execute tasks that usually require human intelligence. AI techniques rely on algorithms to achieve accurate results. It includes natural language processing (NLP), machine learning, deep learning, and image recognition, all with unique capabilities.

The goal of AI is to automate processes and help humans. It can be used in various applications, from robotics to healthcare and finance. AI has the potential to revolutionize society.

How Originators are Using AI in the Mortgage Industry

Originators are adopting AI technology to make the mortgage origination process better. Here’s what they’re doing:

Streamlining the Application Process: You can use AI to collect and store applicant data accurately, eliminating manual data entry.

Accelerating Underwriting and Decision-Making: AI speeds up the underwriting process by automatically assessing risk, reducing errors, and generating fast decisions. Borrower eligibility is evaluated within minutes.

Improving Customer Experience: With AI, responding to customers is easy. Chatbots and virtual assistants can handle routine customer service inquiries.

Managing Lead Pipelines: Technology can spot cold leads better than you can. AIs analyze data quickly and identify the leads most likely to close a loan.

Ensuring Data Accuracy: AI can improve accuracy by flagging discrepancies in documents, calculations, and more, acting as a second set of eyes. It can also flag potential falsified documents that humans might miss.

Using an AI mortgage lending tool lessens your workload but does not remove it. None of these uses are possible without an originator or lender working in tandem with the AI.

Ready to transform your mortgage operations? Request a demo with Sonar now!

The Pros of AI Adoption

You can use AI to improve your origination business in many ways.

Increased Efficiency

Efficiency soars when AI automates manual tasks. Instead of organizing massive data sets or bugging clients for missing documents, AI can act as a personal assistant, so you can focus on finding new business.

Enhanced Accuracy

AI eliminates human errors by running multiple checks and flagging discrepancies. It can detect patterns in data, like fraud or inconsistencies, that may have gone unnoticed.

More Informed Decisions

By using AI for decision-making, originators can assess risk parameters better and make more informed decisions. AI will also provide a deeper look into customers’ financial situations, so it’s possible to ensure they get the best product for their needs.

Cost Savings

Factors like improved efficiency, lack of processing delays, and decreased paperwork lead to large cost savings associated with using AI in the mortgage industry.

Improved Risk Management

AI enhances risk management by offering valuable insights into potentially risky loans. You can better determine if the risk is too high.

Increased Fraud Detection

AI can detect fraud and suspicious activities by analyzing large volumes of data in real time and spotting suspicious documents. You can determine what to do with the data.

Scalability

You can scale up the use of AI when more loan applications are received and scale it down during slow periods. Resources are used only when there’s a need for them.

The Cons of AI Implementation

Although AI can help mortgage lenders transform their processes, there are also some drawbacks.

Regulatory Compliance and Privacy Concerns

AI-driven decisions must be compliant with laws and regulations. Privacy protects both your borrowers and your business.

Ethical Considerations and Bias Mitigation

AI is susceptible to bias, which can be hard to detect. Originators need to ensure the data used in AI algorithms is not discriminatory against any group.

Importance of Human Expertise and Judgment

While AI is mighty, it cannot replace human expertise and judgment. You still need to understand the core elements of the loan application and how to look at each case individually.

Adoption Barriers and Integration Complexities

Depending on your operation, AI may not be a one-size-fits-all solution. You may need specialized IT staff to properly integrate the software into your systems, which may require additional investments.

Harnessing the Power of AI in the Mortgage Industry

If you’ve implemented an AI into your workday and want to maximize its potential, It’s a good idea to understand the collaboration between AI technology providers and mortgage originators.

Transparency is essential. It builds trust with customers and helps you stay compliant. iI’s equally important to remember that there needs to be a balance between automation and human touch.

As more and more companies adopt AI, the industry will continue to evolve. Following these guidelines can help you get the most out of your AI investment.

AI: The Future of the Mortgage Industry

The future of the mortgage industry is tied to the use of AI as originators are slowly becoming aware of how it can be used to their advantage. Further optimization is expected as the technology matures.

It’s important to remember that some potential drawbacks are associated with AI adoption, like compliance issues, ethical considerations, the need for human expertise, and integration complexities. That being said, done right, AI provides tremendous value.

To stay competitive, be agile and adopt new technology quickly.

Artificial intelligence mortgage software is changing the industry. Originators must take steps to understand and implement these changes. AI helps identify potential fraud and risky mortgages while also streamlining processes. Companies must balance AI with human expertise to ensure customers get the best service possible.

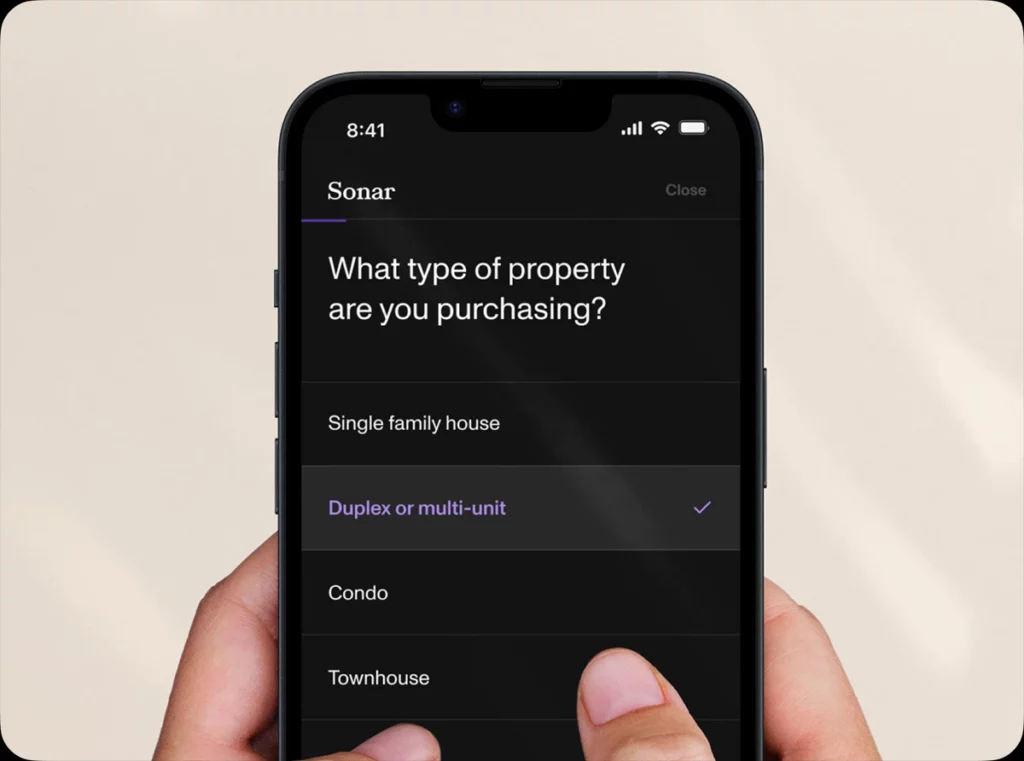

Now is the time for mortgage originators to embrace AI technology and get on board with the latest industry trends, like Sonar. Sonar is an integrated loan origination and point-of-sale system that is constantly evolving to keep up with innovations in AI. You can use Sonar to build better customer relationships and drive more successful outcomes.

Elevate your mortgage game with our all-in-one mortgage experience platform. Request a demo today!