The average mortgage application includes more than 200 data points to analyze. Originators who fail to use current technology may find it impossible to screen borrowers adequately.

Assessing creditworthiness is especially difficult with outdated processes. You may have to make your judgment based on an incomplete profile. This damages underserved applicants who do not meet traditional credit standards, and it also harms your business. Even if you collect enough data, it’ll likely get stored in multiple databases that communicate poorly.

Using the right digital mortgage technology keeps your data consistent and radically reduces errors. By harnessing algorithms and machine learning, you can accurately analyze large amounts of information in a fraction of the time it would take manually. This efficiency allows for a more thorough assessment of each borrower’s financial situation and limits the chances of lending inappropriately.

Relying on manual processes is no longer a viable option for mortgage origination.

The Role of Technology in Data-Driven Lending

For successful originators, technology is intertwined with critical operations. Instead of making credit decisions based on an unreliable combination of experience and gut feelings, mortgage data analytics allow for data-driven decision-making that is both efficient and accurate.

Incorporating modern technology into your lending process can bring several benefits.

- Fast data collection: Advanced data integration tools allow more rapid data collection. Create a fleshed-out borrower profile in seconds.

- Automated application review: Automating the application review process minimizes manual errors and helps decision-making.

- Machine learning for better insights: Utilizing machine learning in your operations gives you a more precise understanding of borrower profiles. Machines can analyze patterns invisible to humans and offer valuable insights into creditworthiness.

These benefits lead to improved risk assessments and an enhanced borrower experience. The ample data you collect lets you build loan offers that appeal to borrowers’ specific circumstances. One-size-fits-all is a poor strategy for mortgages.

Experience Accurate Mortgage Origination with Sonar

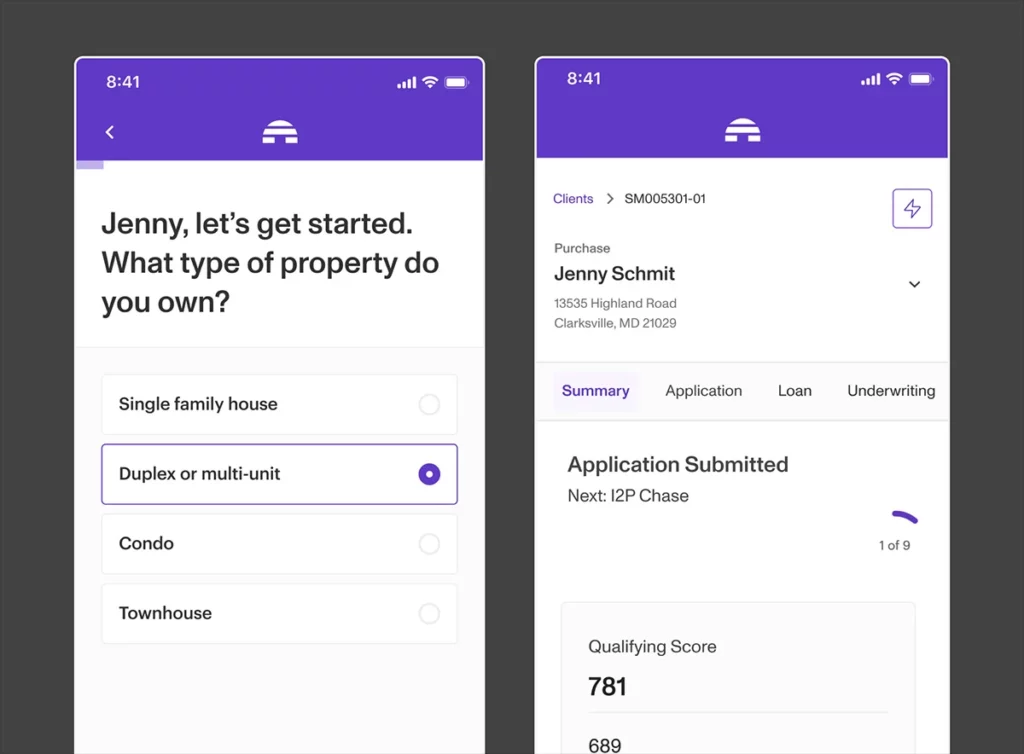

Sonar is a mortgage origination platform for busy lenders. Our user-friendly platform simplifies every step of the process so you’re never bogged down with tedious tasks. You can expect prompt data insights and secure document transfer throughout the loan origination journey.

Comprehensive Borrower Data

Sonar collects borrower information upfront, eliminating the need to request it from various sources and creating a comprehensive borrower profile.

The robust profile includes financial documents, credit scores, employment history, and more. This level of detail allows for a holistic understanding of the borrower’s financial situation and is crucial for making accurate credit decisions. One study estimates that 1 in 134 mortgage applications contain fraudulent documents or assertions.

Enhanced Credit Analysis

Sonar utilizes algorithms to analyze credit history in-depth. Within seconds, our platform can identify potential risks such as high debt-to-income ratios or a history of delinquent payments.

Studying a borrower’s credit history more closely helps you make better lending decisions. It may even increase your loan approval rates by highlighting applicants that traditional credit analysis may overlook. A practical algorithm can include factors like rent and utility payments.

Predictive Analytics

Sonar employs predictive analytics to forecast borrower behavior.

By using historical data, machine learning algorithms can identify patterns and flag borrower profiles with a higher chance of defaulting on their loans.

An example of this in action is the ability to analyze credit usage. If a borrower frequently maxes out their credit cards and then applies for a mortgage, it raises concerns about their ability to manage debt effectively.

Automated Risk Mitigation

Sonar’s platform implements automated risk mitigation, minimizing your burden as an originator.

The tool streamlines decision-making by highlighting risks and presenting them in an easy-to-understand format. This feature is helpful for loan officers who handle multiple applications simultaneously, leading to faster loan decisions.

A Better Experience For Borrowers and Lenders

The benefits of using Sonar’s platform for data-driven decision-making touch all parties involved.

By utilizing Sonar, originators gain a competitive advantage over those using slower and less reliable systems. The platform adeptly handles tasks that used to take hours or days with automated loan decisions.

Lenders experience improved profitability and increased customer satisfaction with Sonar. Prompt decision-making allows for speedier approvals and a frictionless application process. Lenders can offer personalized loan options that better suit individual financial situations, leading to higher approval rates and happier customers.

For borrowers, Sonar offers a faster and easier path to homeownership. The quick approvals and customized offers take away much of the stress embedded into older processes without machine-learning mortgage tools.

Conclusion

Mortgage origination software is undergoing a technological revolution, and Sonar leads the way. With our platform, the problems of yesterday’s originators disappear. No more dealing with tiresome manual labor or trying to reconcile data silos across.

Sonar’s technology lightens every step, providing comprehensive borrower data, advanced credit analysis, predictive analytics, and automated risk mitigation. Refrain from settling for outdated manual processes when you can have the power of Sonar.

Ready to Revolutionize Your Mortgage Pricing Process? Schedule a Sonar Demo Today!