When it comes to lending, having the correct information is vital. Knowing which loan programs are available and understanding their requirements impacts how quickly you can qualify clients for mortgages.

One of the most important numbers to know about mortgage underwriting is the Loan-to-Value (LTV) ratio. Maximum LTVs vary by loan and property type, so staying up-to-date is critical.

Below, we’ll examine maximum LTVs for different property types and discuss how staying current on industry changes can help improve your time to close.

What is Loan-to-Value Ratio?

Loan-to-Value (LTV) is a ratio that shows the amount of money borrowed relative to the property’s value. It gets calculated by dividing the principal loan amount by the appraised home value or purchase price, whichever is lower. For example, if a borrower takes out a $150,000 loan to purchase a $200,000 home, the LTV ratio would be 75% ($150,000 divided by $200,000).

The lender or loan program sets the maximum loan-to-value ratio and often changes depending on the purchased property type. Generally speaking, lenders are more likely to approve loans with lower LTVs.

How Loan Officers Use LTVs

Loan officers must know maximum LTVs to qualify clients for the best mortgage program quickly. Knowing each loan program’s requirements helps you identify which programs will likely be approved and provide accurate quotes faster.

Today’s borrowers want an answer now; they don’t want to wait while you dig up facts online. If you give a pre-approval letter within minutes, you will likely beat your competition and close the deal.

Maximum Loan-to-Value Ratios by Property & Transaction Type

Below, we’ll review the maximum LTVs for different property types and loan programs. It’s important to note that these are general guidelines; lenders can set their limits, so double-check with your clients’ lenders before relying on this information.

Maximum LTV for Conventional Loans

Conventional loans, backed by Fannie Mae and Freddie Mac, typically have maximum LTVs of 95% for a single-family home. This parameter means you can finance up to 95% of the purchase price or appraised value (whichever is lower). For example, if your client buys a $200,000 home with a 5% down payment, the maximum loan amount will be $190,000.

Maximum LTV for Investment Properties

Investment properties generally has lower maximum LTVs than owner-occupied homes. The exact limit depends on the property type and other factors such as credit score and debt-to-income ratio, but it can range between 85% for one unit and 75% for 2 – 4 units.

Maximum LTV for Second Home (90%)

Second homes often require a higher down payment than primary residences, but they still have relatively high maximum LTVs of 90%. This means you can finance up to 90% of the purchase price or appraised value (whichever is lower).

Maximum LTV for Cash-Out Refinance

Cash-out refinances generally have lower maximum LTVs than regular home purchases, with up to 80% limits for a one-unit primary residence. The ratio drops to 70% for 2 – 4 unit investment properties.

Maximum LTV for HELOC

The maximum LTV for a home equity line of credit (HELOC) depends on the lender but is often between 85%, which means that your client needs to have at least 15% equity in their home.

Maximum LTV for Jumbo Loan

Jumbo loans, known as non-conforming loans, usually have lower maximum LTVs than traditional loan programs. However, the limit depends on the lender and borrower characteristics, like a credit score. Generally speaking, the maximum LTV for a jumbo loan hovers around 80%.

These foremost LTVs get based on clients with solid credit scores. Clients with poor credit scores will likely need higher deposits.

Qualify and Close Faster with Sonar

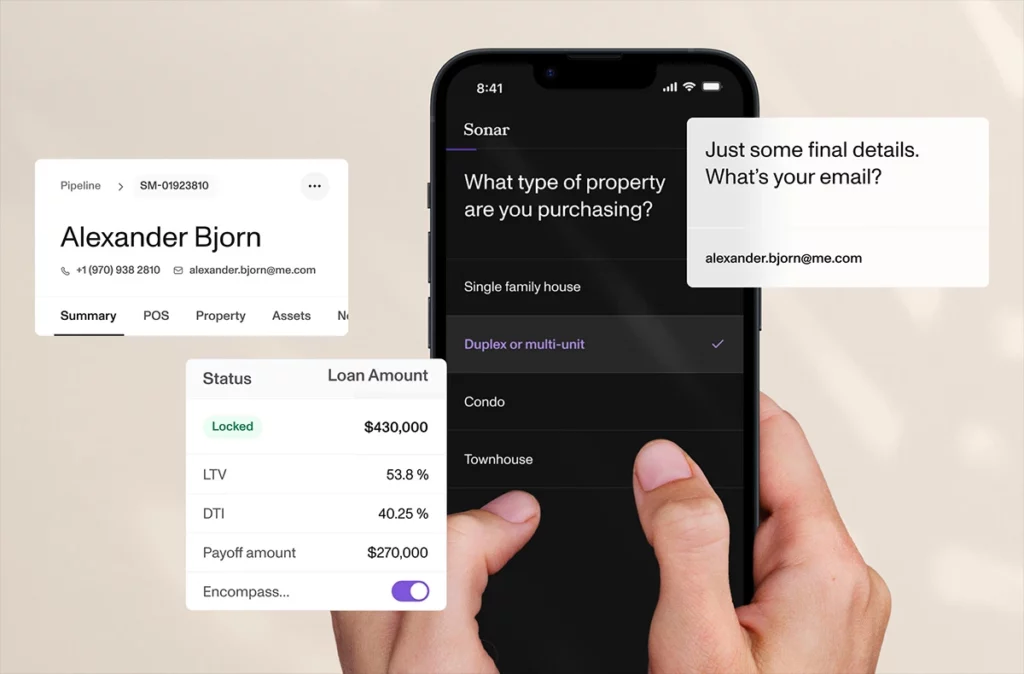

Loan officers who want to process clients faster should consider using Sonar. This powerful platform helps loan officers automate customer screening, eliminate manual data entry, and approve borrowers within minutes, all from a single platform.

Using Sonar, loan officers can quickly identify which mortgage programs best fit each client in minutes. Sonar’s automated mortgage origination software ensures that all mortgage applications are accurate and compliant with applicable regulations.

Experience the power of cutting-edge mortgage tech firsthand. Request a demo today.