For most people, purchasing a home hinges on getting a mortgage. Your role as a broker or lender involves helping potential borrowers understand their mortgage loan options by understanding current requirements and up-to-date regulations.

One option that may be suitable for your clients is a Freddie Mac Loan. Freddie Mac loans are backed by the Federal Home Loan Mortgage Corporation, also known as Freddie Mac. They offer fixed-rate mortgages at competitive interest rates and various loan terms to meet individual needs.

This blog provides an in-depth look into Freddie Mac home loans, including eligibility requirements, mortgage programs, and application processes.

Freddie Mac Loans 101

Congress created the Federal Home Loan Mortgage Corporation in 1970 to ensure a reliable and steady flow of funds to the mortgage market. Freddie Mac does not issue loans directly. Instead, it purchases loans from lenders that meet their eligibility requirements. Those lenders then provide mortgages to homebuyers who meet the necessary criteria.

By purchasing loans from lenders, Freddie Mac makes more money available for mortgages, which keeps interest rates low and makes buying a home more affordable. Freddie Mac mortgages appeal to borrowers because they offer flexible terms and low down payments, among other benefits.

Today, Freddie Mac is a publicly-traded company and government-sponsored enterprise (GSE).

Freddie Mac Loan Requirements

Freddie Mac loans have strict eligibility requirements. Generally, a borrower should have a minimum FICO score of 620. They should also be able to demonstrate steady employment or income for at least the past two years and reasonable evidence the income will continue for three years after closing.

A large down payment is optional. Borrowers can get approved with as little as 3% down. Some borrowers may even qualify for grants or assistance to help with their down payments or closing costs.

Freddie Mac loan products are ideal for borrowers with established credit who want a simplified mortgage process that offers lower rates at a lower cost.

Freddie Mac Loan Limits

Freddie Mac Loan Limits are the maximum loan amount that can be offered to a borrower under Freddie Mac’s mortgage programs. These limits vary by location and are based on median home prices in an area.

The baseline conforming loan limit for 2023 is $726,201 for a one-unit property within mainland America. If the property is located outside of the contiguous U.S., the single-unit baseline limit is

$1,089,300. That’s also the limit for high-balance loans, loans approved in areas with higher average home costs.

To determine the conforming limits where your borrower is located, visit the Federal Housing Finance Agency’s website. The FHFA publishes annual conforming loan limits for every area in the U.S. and high-balance limits where applicable.

Freddie Mac Loan Programs

Freddie Mac umbrellas several mortgage loan programs.

HomeOne®

The HomeOne mortgage from Freddie Mac helps first-time homebuyers purchase their dream homes. It allows for a 3% minimum down payment, and there’s no requirement that the buyer takes part in homeownership counseling programs unless they’re a first-time homebuyer. The down payment can consist of funds from non-income sources.

Home Possible®

The Home Possible mortgage is tailored explicitly for lower-income homebuyers, allowing them to purchase homes with just 3% down. It’s similar to a HomeOne mortgage with a few crucial differences.

First, Home Possible is explicitly intended for low and very low-income borrowers. Anyone purchasing their first home might be eligible for a HomeOne loan, while those who meet income requirements are eligible for Home Possible. Second, Home Possible applicants do not need to purchase their first home.

Relief Refinance Mortgages

The Relief Refinance Mortgage is designed to help borrowers refinance their mortgages and reduce the interest rate on their existing loans.

The Relief Refinance Mortgage program is a solution for homeowners who cannot apply for first-line refinancing options due to low home equity. Homeowners can qualify if they have an existing Freddie Mac mortgage and have made timely payments for the past 12 months.

Renovation Mortgages

Freddie Mac also offers renovation mortgages, allowing borrowers looking to buy or refinance a home that needs updates. They combine purchase or refinancing money with renovation funds in a single loan.

Renovation mortgages work for borrowers who have found the perfect house but need repairs or updates before moving in. These loans come with special requirements and require the borrower to use an approved contractor or home improvement professional to complete the renovations.

Conventional Mortgages

Conventional Mortgages are the most common type of mortgage product. They offer a variety of loan terms and down payment options ideal for borrowers with good credit and steady income, as well as a substantial down payment saved up.

Freddie Mac conventional mortgages can get used to purchase a single-family home, townhome, condominium, or 2-4 unit property. They are available with terms ranging from 10 to 30 years. Borrowers may also choose the adjustable rate and balloon payment options depending on their circumstances.

Freddie Mac vs. Fannie Mae

Freddie Mac and Fannie Mae are publicly-traded GSEs that move money through the mortgage funnel by focusing on the secondary mortgage market. Both companies offer similar but not identical loan programs.

For example, Freddie Mac’s low-income option, Home Possible, limits applicants to those who make the same or less than their area’s average income, while Fannie Mae’s HomeReady loan is open to applicants who make less than 80% of their area’s median income.

Freddie Mac and Freddie Mae share loan limits, and many underwriting requirements, but the two companies have distinct mortgage sourcing goals. Freddie Mac buys mortgages from small regional banks, opposite Fannie Mae’s plan. Fannie Mae focuses on large commercial banks.

Freddie Mac Loan Application Process

The process of applying for a Freddie Mac loan must start with an approved lender. Borrowers cannot go directly to Freddie Mac, and instead must work with their lender to complete the process. The process for obtaining a loan from Freddie Mac follows these steps:

Pre-Approval

The first step is for the borrower to get pre-approved for a loan by submitting a loan application along with their financial information and documentation, such as tax returns and pay stubs. If the borrower is applying for a refinance, the first step would be to submit a loan application directly with their lender.

Documentation Required

The lender will review what’s submitted and determine what additional documentation may be needed.

Processing and Underwriting

Next, the lender will process and underwrite the loan. This step includes reviewing credit reports, income verification, appraisals, etc.

Closing

Finally, the borrower will need to close on their loan by providing the down payment (if applicable) and paying closing costs prior to receiving mortgage funds.

Freddie Mac Loan Servicing Guidelines

A lender may service the loan themself based on Freddie Mac guidelines or they may choose to sell your loan to a Freddie Mac servicer. However, once the loan has been closed, encourage your borrowers to stay in contact and inform you of any changes in their financial situation. Freddie Mac’s guidelines include provisions to give borrowers flexibility and time while they work out a solution to their financial difficulty. These may consist of extensions or forbearance periods, repayment plans, or other forms of assistance, such as loan modifications.

Regular communication and documentation help you stay in compliance.

Sonar: Your All-in-One Loan Experience Platform:

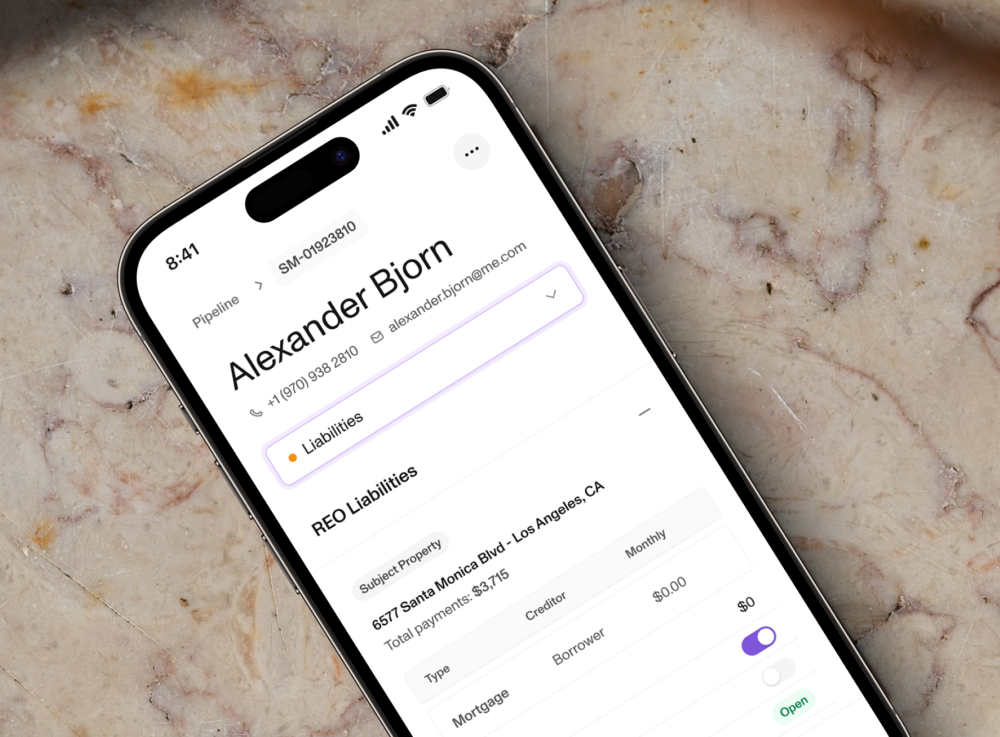

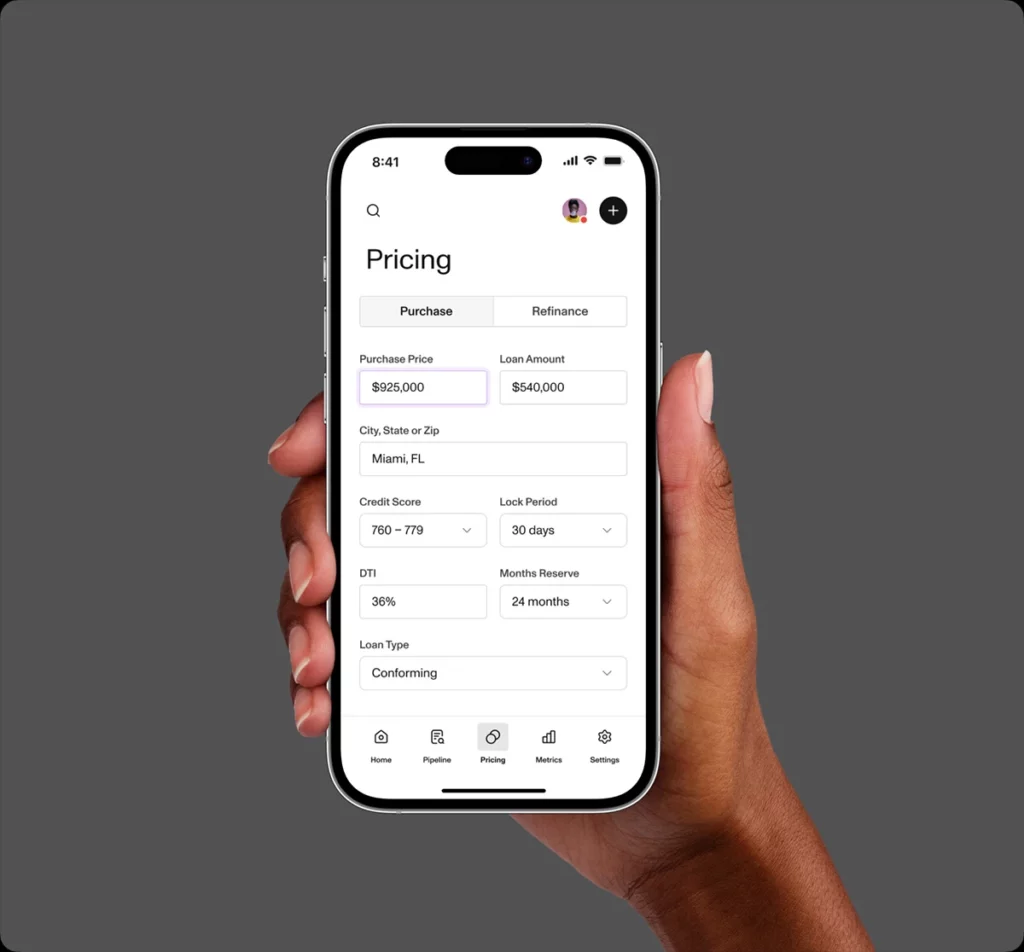

Sonar is your all-in-one loan origination platform. It allows lenders and brokers to originate Freddie Mac and other mortgage loans. With Sonar, there’s no need to flip between screens as you chase down client information. Our platform combines your LOS and POS systems so data is presented in one view, making the loan process more efficient.

Sonar also provides powerful tools to help you better connect with borrowers and potential leads. With our integrated customer relationship & pipeline management software, you can communicate with borrowers in real time, quickly respond to inquiries, and monitor their progress throughout the loan process.

Secure a brighter future for both your borrowers and your bottom line. Schedule a demo today to discover how Sonar is revolutionizing the origination process.