The process of acquiring a mortgage involves high stakes for originators and borrowers. It is a complex process requiring multiple tools, extensive data sets, and precise tracking. A mistake or delay derailing the loan application could cause problems for both your business and the borrower, so avoiding those mistakes is vital. The solution to this: automation.

Mistakes are inevitable if you use manual tools like spreadsheets to manage your pipeline. There are four basic steps to origination: prequalification, application, credit review and underwriting, and funding.

Each step includes significant paperwork and many details to track. In the past, lenders had no choice but to devote hours to tedious tasks. Now there’s a new option – automation.

Automation eliminates most manual tasks and saves time. A quality point-of-sale (POS) provides a user interface with a complete workflow for borrowers to submit applications, upload documents easily, order appraisals, and more, while a loan origination system (LOS) ensures an organized workflow, offers detailed reports, and can help maintain compliance.

Mortgage automation tools can boost your team’s success.

See what mortgage process automation can do for you. Schedule a demo today!

Reduce Room For Human Error

Automation drastically reduces application and lending errors.

Manual lenders have to type or copy and paste information. A small typo could cause a big headache if you don’t catch it in time.

Lenders who switch to automated methods deal with far fewer mistakes. They can utilize features like automatic data fills that get rid of manual entry. Implementation of these features can happen immediately without the formal training required by employees.

Improve Regulatory Compliance

Filing the right paperwork is critical for lenders because the industry is highly regulated. For the loan to be valid, certain information is required.

An automated file manager ensures that all documents get filed properly, even if regulations change overnight. All changes to loan origination processes are applied instantly with automation software.

Automation also helps you guarantee compliance in borrower communications. For example, if you use point-of-sale (POS) software, borrowers can safely upload their documents to a secure server. The sensitive data doesn’t need to travel through email.

Close Loans Faster

The mortgage loan origination process often takes months. Automation can shave weeks or more off that time. Whenever a task becomes automated, you gain more time in your day.

A POS system gives borrowers the independence to submit applications without help from a lender. It will guide the borrower through the application to ensure an accurate 1003 is captured from the start. A LOS frees you from needing your own filing system. Every mortgage process automation feature saves time, allowing your team to focus on other tasks while loans close faster.

The smoother process lets buyers get into their homes as soon as possible, improving their experience and your reputation. Lightning-fast, real-time technology allows you to create seamless experiences for your team and customers.

Ready to transform your mortgage operations? Request a demo with Sonar now!

The Future of Loan Origination

The future of loan origination is linked directly to automation. Automation technologies can eradicate obstacles that have limited the mortgage industry for years.

Instead of endless confusing spreadsheets and masses of physical documents that you need to organize, you can work with an intuitive interface. You can access your files, create reports, and monitor threats with a few clicks.

Soon, automation won’t be a choice. Lenders that want to remain competitive will need to adopt the latest tools. Lenders with automated help have too big of an advantage to overcome.

Loan origination automation depends on mortgage platforms like Sonar to usher in the future. As Sonar grows more sophisticated, lenders will have an arsenal of tools at their disposal.

If progress continues, the industry is only beginning to scratch the surface with automation. Soon, mortgage lenders may eliminate manual work entirely.

Bring the Mortgage Process Into the 21st Century

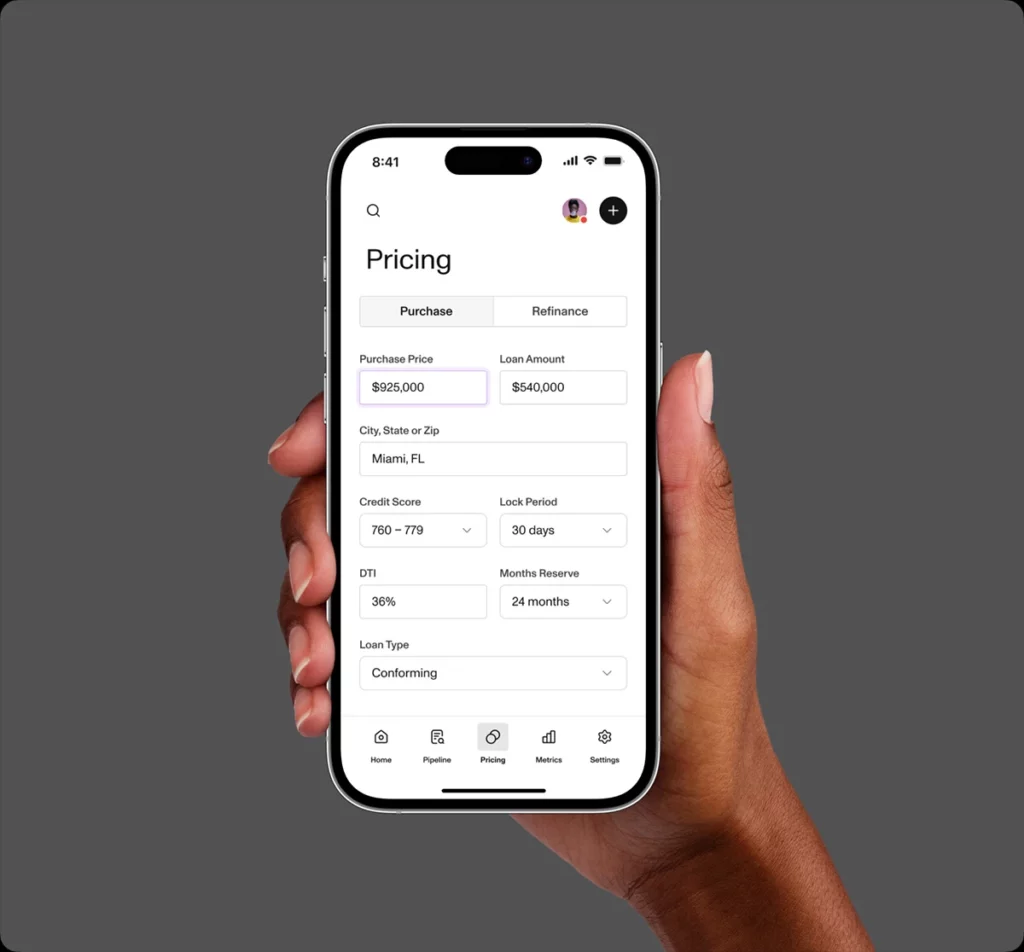

Sonar is a mortgage automation platform that simplifies the loan origination process.

Our software combines LOS and POS system capabilities so that you can usher borrowers through the loan pipeline with confidence. Sonar will be at your fingertips from application to funding.

With Sonar, organizing and managing your files is effortless, no matter how complex the loan is. Need to communicate with a borrower before closing? Sonar’s platform is designed for mobile use as well. Send critical communications and close loans from wherever you are.

Tired of drowning in data entry, repetitive tasks, and paperwork nightmares? Reclaim your time and efficiency – reach out to Sonar now to schedule a game-changing demo.