Traditionally slow to change, the mortgage industry is now rapidly evolving. New technologies are being introduced to the industry and proving to be game-changers. At the top of everyone’s mind right now is the integration of artificial intelligence (AI). Loan officers and originators can leverage AI to improve efficiency and streamline manual processes, but it should not be viewed as a replacement for human judgement.

Instead of spending hours corralling paperwork and chasing after signatures, loan officers can focus on what they do best: providing sound advice and managing relationships.

It’s important to strike the right balance between technology and human expertise. While AI can automate tedious, time-consuming tasks, human touch is essential for retaining customers. AI should be used as a complement to loan officers and originators rather than a replacement.

AI’s Role in the Mortgage Process

AI has found its place in various aspects throughout the mortgage process, from identifying prospective borrowers to closing a loan. By automating repetitive tasks, AI accelerates task management and dramatically alters the mortgage workflow, acting as an AI assistant a nd empowering originators to accomplish more each day.

For example, AI can draft suggested customer emails, leaving loan officers to fine-tune and personalize them. Simple emails like document re-upload requests may not need any alteration.

Additionally, on the lead management side, it’s possible to use AI mortgage tools to pair certain borrower profiles with specific originators by matching borrowers’ needs with loan officers’ experience. This can significantly increase loan success rates.

Once the loan enters the underwriting phase, AI acts like an eagle-eyed employee, flagging potential issues that might have been overlooked. The technology can even help detect fraud and minimize losses—a significant benefit since mortgage fraud has grown to epidemic proportions in recent years.

Finally, AI constantly learns from data sets that can enhance decision-making capabilities. By analyzing vast amounts of data and recognizing patterns, AI can provide valuable insights that allow originators to make well-informed decisions.

Where AI Falls Short

AI possess tremendous potential and is already revolutionizing the mortgage industry. That said, certain aspects of loan origination remain better suited for human expertise and judgment. There is simply no way to replicate the power of human empathy, discretion, and adaptability.

For example, AI cannot create trusted relationships that lead to referrals and great word-of-mouth. It can’t comprehend difficult financial situations or make nuanced decisions about unique borrower risks and needs. That’s something that requires a professional with years of experience.

The Value of Collaboration

The mortgage industry needs the speed and accuracy of AI combined with the professional judgment and discretion of human loan officers. By optimizing processes for both humans and AI, businesses can benefit from cost savings, revenue growth, improved customer service, and a 40% boost in productivity.

Strategies for effective AI and human collaboration include:

- Establish clear roles and define precisely what they involve.

- Maintain constant communication between team members.

- Continuously train on new technology.

- Develop feedback loops to identify problems.

An environment that utilizes human-AI collaboration will benefit from improved customer service through chatbots with 24/7 availability, increased employee engagement, and improved decision-making.

Overcoming Challenges and Ethical Considerations

While the integrating AI into the mortgage origination process can bring immense benefits, it also presents new risks. It’s crucial to navigate these hurdles to ensure responsible and fair use of AI technology. The most pressing risks involve the following:

Data Privacy & Security

With the implementation of AI may come an increased risk of data breaches due to accidental disclosure. Sensitive borrower data is shared throughout the mortgage process and protecting that information should be a top priority when integrating AI. Implementing robust data encryption, access controls, and following basic security measures can safeguard this information and also keep you compliant with regulations.

Bias Management

AI can suffer from algorithmic bias, resulting in disparate treatment of borrowers based on gender, race, income, or other characteristics. To mitigate bias, it’s essential to train AI modls on diverse and representative data sets. Collaborating with expert originators who can provide oversight and evaluate decisions can also contribute to reducing bias.

Fair Lending Practices

Fair lending practices require that each borrower’s information is treated equally. If lenders’ bias management plans fail, they will be held accountable. Mortgage originators should closely monitor AI systems to ensure compliance with fair lending laws and regulation. Regular audits and assessments can also help identify any disparities and correct them promptly.

These risks do not have to be overwhelming. The added human element provides oversight that mitigates AI blindspots. For example, initiating human review for complex applications helps ensure that borrowers aren’t unfairly excluded and compliance is maintained.

Leveraging Other Technologies to Enhance Originators’ Work

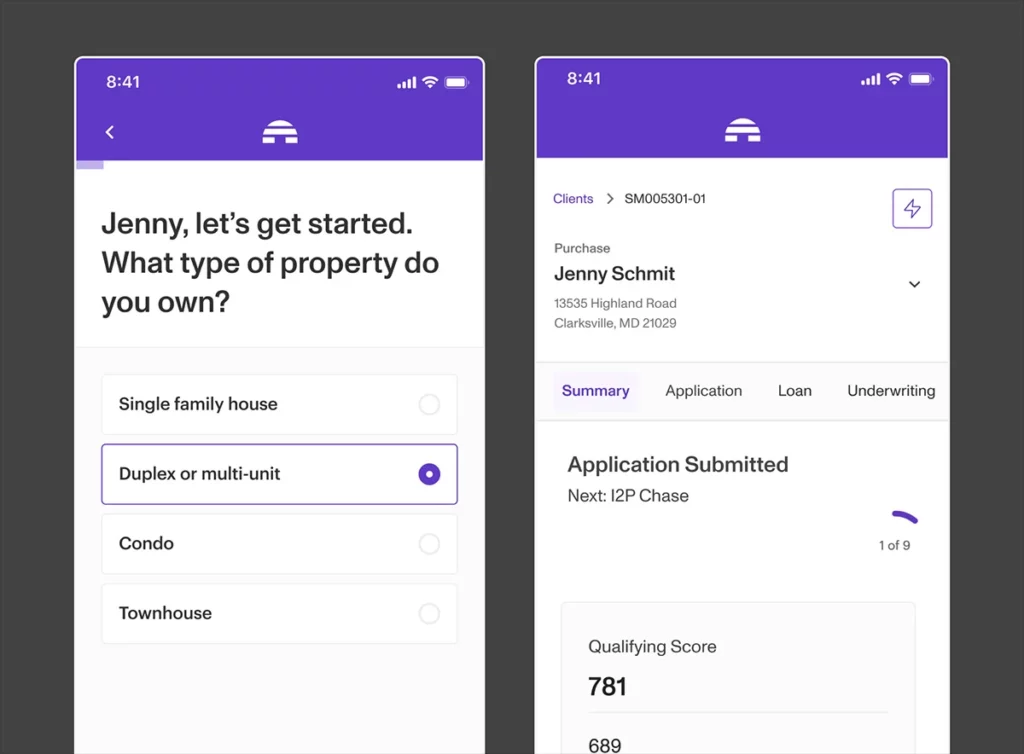

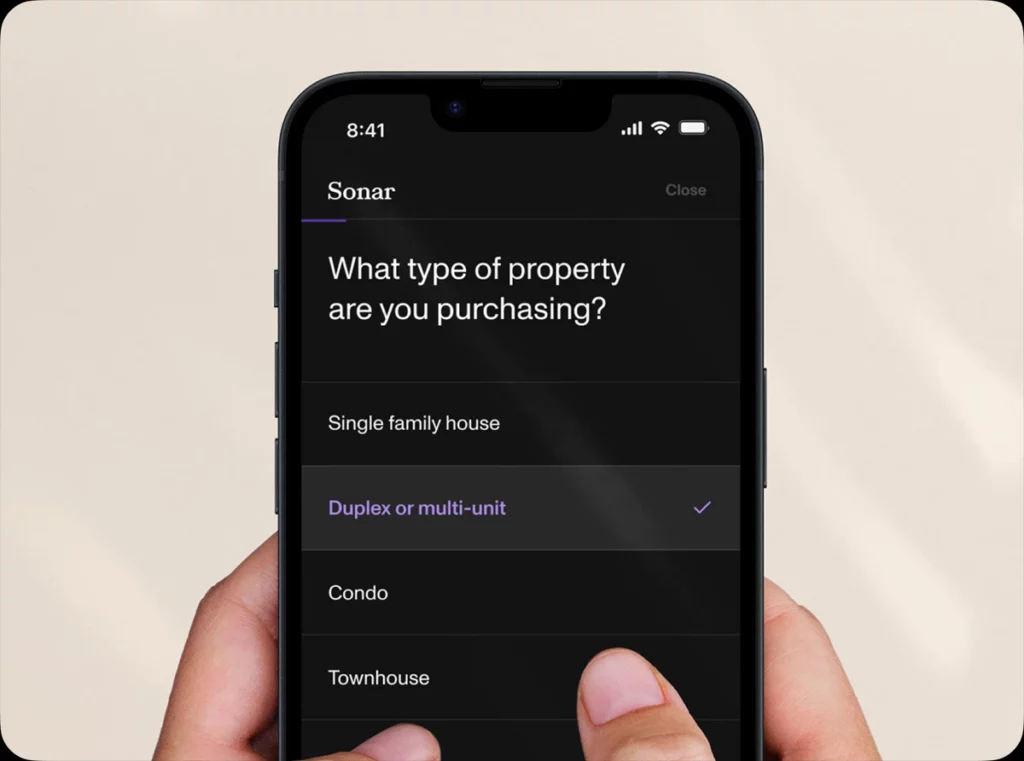

Sonar’s integrated point-of-sale (POS) and loan origination system (LOS) is a great way to make the mortgage origination process easier and more efficient for loan officers. The platform can automate steps throughout the loan process, from preapproval and the initial application to closing. Moreover, Sonar’s system allows loan officers to keep up with changing regulations and borrower needs.

Request a free demo and see how Sonar can help your team.

In addition to tools like Sonar, several other technologies, like machine learning and big data analytics, play an increasingly important role in loan origination and can complement the process. Machine learning helps lenders assess borrowers’ finances more accurately, while big data enables them to understand market trends better. Investing in the right tools can help take your origination operations to the next level.

Evolving with an Ever-Changing Collaborative Landscape

As the mortgage origination landscape becomes more complex, originators must remain agile and embrace a mindset of continuous improvement. Staying on top of the latest technologies and trends is the only way to be competitive, ensure you’re utilizing the technology to its full potential, and provide an optimal borrower experience.

To learn about new developments, originators should join industry groups, subscribe to relevant publications, and attend webinars or seminars. Taking a proactive approach to the industry, ensures you’re equipped with the knowledge, tools, and mindset needed to provide an optimal experience for borrowers in an increasingly evolving industry.

Coexistence is Key

AI can be a powerful tool for mortgage lenders, but it should never be used in place of loan officers and originators. Technology can help to speed up the workflow and automate tedious tasks, but ultimately, human judgment is required to close loans successfully.

The combination of AI and human expertise is essential in today’s complex mortgage origination climate. With the right tools, originators can provide a better borrower experience while ensuring compliance and improving efficiency.

Sonar’s integrated POS and LOS platform is the perfect way to start for originators ready to take advantage of the opportunities presented by effective human-AI collaboration. Ready to revolutionize your mortgage business? Schedule a demo now to unlock the full potential of Sonar’s all-in-one mortgage experience platform.