In a market where interest rates, loan products, and service offerings are often similar across the board, how will you stand out as the loan officer or originator that people choose to guide them through the mortgage process?

The answer lies in how well you know your customers. In addition to having the right loan products for their needs, creating an experience that makes each customer feel like more than just another file on your desk is important. Thoughtful professionals who go beyond the basics to provide personalized customer experiences have a distinct advantage that can often lead to referrals, repeat clients, and, ultimately, a stronger business.

What is a Personalized Customer Experience?

Customers aren’t just looking for the best interest rates—they’re looking for guidance, education, and support to secure their loans. It’s all about the customer experience.

A personalized customer experience in the loan industry centers on ensuring each customer feels understood and valued. You want to be providing solutions that align with a customer’s financial goals, communication preferences, and the timing of their decisions.

Personalization transforms what can feel like a transactional process into a relationship-driven one, ultimately enhancing customer satisfaction with loans. Getting a mortgage is one of the most significant financial decisions a person can make; when you create a personalized experience, you’re helping to ease the complexity and stress that often accompanies it. In turn, you’re building trust.

Benefits of Personalization

Personalization benefits both you and your customers, and its impact goes beyond surface-level satisfaction. The core advantages that make personalization a game-changer in the mortgage industry include:

Improved Customer Retention

Personalized experiences are one of the most effective ways to retain customers in a highly competitive market. Mortgage lending isn’t a one-and-done industry—customers often refinance, purchase additional properties, or recommend their loan officer to friends and family. By offering tailored solutions and support throughout the loan process, you make yourself the go-to resource going forward.

Increased Trust and Loyalty

Trust is the cornerstone of any successful relationship, and that includes the relationship between a loan officer and their customers. When you provide personalized solutions—whether it’s offering loan products that align with a customer’s financial situation or communicating in a way that resonates with them—you build trust. As a result, you’ll likely see stronger customer loyalty.

Higher Customer Satisfaction

Personalization allows you to solve problems before they become frustrations for your customers. For example, by proactively providing the right information or support based on their unique situation, you can eliminate common pain points that might cause delays or confusion during the loan process. A smoother, more satisfying experience leaves customers feeling grateful for your mortgage loan services and assistance.

Competitive Differentiation

While competitors may offer generally good service, few take the time to create tailored solutions for each customer. Personalizing your approach sets you apart by demonstrating a deeper level of care and expertise, which is something customers remember—and it’s what drives them to choose you over someone else.

Higher Referral Rates

Satisfied customers are not only more likely to return for future needs—they’re also more likely to refer others to you. When you deliver a personalized experience that exceeds expectations, you increase the likelihood of getting referrals, which can be one of the most cost-effective ways to grow your business. Personalized strategies for loan officers turn customers into advocates who actively promote your services to their friends, family, and colleagues.

Personalization Strategies for Loan Officers and Originators

Implementing personalized customer experiences doesn’t have to be complicated. With a thoughtful approach and the right tools, you can create tailored interactions that not only meet the immediate needs of your customers but also build long-term relationships. Here are several practical strategies to bring personalization into your day-to-day interactions:

Leverage Customer Data

Every customer interaction generates data—whether it’s a pre-qualification form, a phone conversation, or an email inquiry. You can use this data to better understand your customers’ financial goals, loan preferences, and communication styles. For example, if a customer is a first-time homebuyer, offering information about down payment assistance programs or FHA loans can demonstrate that you understand their unique position. By tracking customer interactions and using a customer relationship management (CRM) system, you can ensure every touchpoint is personalized and relevant.

Tailor Your Communication

Not all customers want the same type of communication. Some prefer emails, others may want phone calls, and some might respond better to text messages. Take note of how each customer prefers to communicate and adjust your approach accordingly. Personalizing communication also means sending the right information at the right time, whether that’s an interest rate update, an article on the home buying process, or a reminder about key loan deadlines.

Offer Custom Loan Solutions

Personalization isn’t just about how you communicate—it’s about what you offer in that communication. Tailor your loan product recommendations based on each customer’s financial situation and goals. For example, if a customer is interested in purchasing an investment property, presenting them with options for adjustable-rate mortgages or loans that favor long-term investment strategies can show you’re aligned with their needs.

Be Proactive with Follow-Ups

After a loan closes, many loan officers consider the job done, but this is a missed opportunity to build lasting relationships. Reach out to customers at key milestones, such as their mortgage anniversary, when interest rates drop, or when market conditions suggest refinancing might be beneficial.

Automate to an Extent

Automation tools can help you scale your personalization. For instance, CRM systems can automate reminders, birthday greetings, or important loan milestones. However, the key to making automation work is to ensure that it doesn’t feel robotic. While automating some tasks is efficient, always make sure there’s a human element to your communications, such as a personalized message or a follow-up call when needed.

Tools and Technologies for Enhancing Personalization

Personalized strategies for loan officers rely on utilizing the right technology to tailor interactions at scale. Look to the following tools and technologies to elevate your offerings.

CRM Systems for Relationship Management

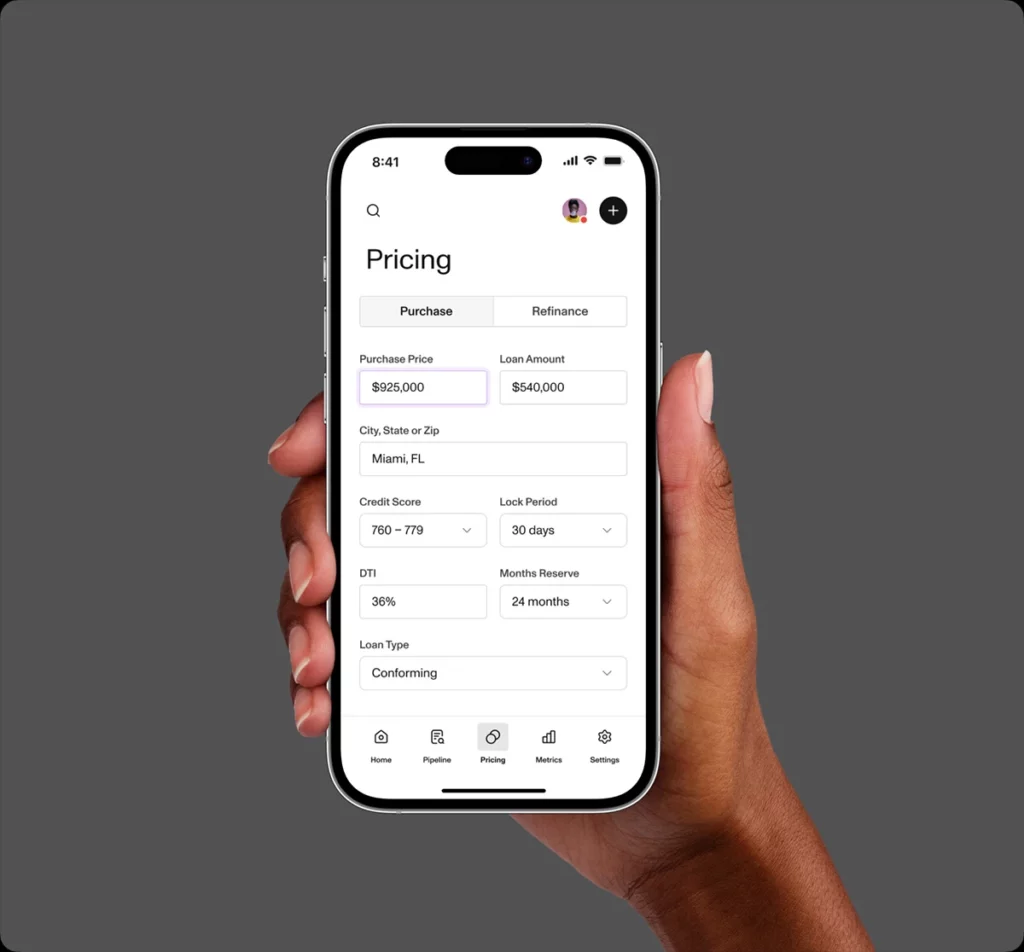

A CRM system is one of the most powerful tools loan officers can use to manage customer interactions. Sonar’s mortgage CRM software enables you to keep track of customer preferences, communication history, and key milestones in the loan process. You can access and update data in real time so every interaction is relevant and timely. Our CRM also allows you to automate routine tasks like sending reminders about important deadlines, rate updates, or post-closing follow-ups.

Data Analytics for Personalization Insights

Data is the cornerstone of personalization, and advanced data analytics tools allow loan officers to dig deeper into customer behaviors, preferences, and financial goals. By analyzing data from multiple sources—such as application forms, credit histories, and even past interactions—you can create more accurate profiles of your customers and deliver better service.

For example, if analytics show that a customer is consistently looking for information on low down payment options, you can proactively offer FHA loans or other relevant products. By staying ahead of the customer’s needs, you’re providing a smoother, more engaging experience. Additionally, tools that analyze customer feedback can offer insights into how to improve the personalization strategy over time, making it an evolving process rather than a static one.

Automation for Efficiency

While personalization is about creating meaningful, individualized experiences, automation plays an important role in streamlining certain aspects of the loan process. With automation tools integrated into a CRM system, you can schedule personalized follow-up emails, send birthday messages, or trigger alerts when new loan options become available—all without the risk of human error or oversight.

The key to effective automation, once again, is balance. Automated messages and reminders should feel personal, not generic, and they should serve to enhance the relationship, not replace human touchpoints. For instance, while an automated email reminder is helpful, a quick, personalized follow-up call to check in on the customer’s progress can take the interaction to the next level.

Integration of Platforms for a Seamless Experience

The ability to integrate different platforms—such as CRM, data analytics, and loan origination systems (LOS)—is essential for delivering a truly personalized customer experience. When these systems are interconnected, data flows seamlessly between them, allowing you to work more efficiently and ensuring that your customers receive accurate, up-to-date information at every stage of the process.

For example, by linking a CRM system with a loan origination system, you can track a customer’s loan status in real time and provide personalized updates or next-step suggestions. Sonar’s platform integrates these functionalities to provide a unified experience that boosts both efficiency and customer satisfaction.

Measuring the Impact of Personalization

To see the benefits of creating personalized customer experiences, you’ll want to look at a few key performance indicators, such as:

Customer Retention Rate

Retention is one of the clearest indicators of successful personalization. A high retention rate means customers are returning for future business, which indicates that they’ve had positive, personalized interactions with you. Tracking how many customers come back for refinancing, additional property purchases, or other loan services gives you a sense of how well you’re building lasting relationships.

Referral Rate

Satisfied customers are more likely to refer others to you. Monitoring your referral rate is an effective way to gauge how much customers value your personalized approach. A steady stream of referrals suggests that your personalized experiences are exceeding expectations and encouraging customers to recommend your services to friends, family, and colleagues.

Customer Satisfaction Scores

Surveys and feedback forms are direct ways to measure satisfaction. Ask customers about their experience during the loan process—did they feel supported? Were their unique needs met? High satisfaction scores are a clear indicator that your personalization efforts are making a positive impact.

Engagement Metrics

Tracking engagement with your personalized communications—such as email open rates, response times, and follow-up interactions—helps determine whether customers are finding your outreach relevant and timely. Low engagement might suggest that your messaging isn’t hitting the mark, while high engagement indicates that you’re successfully connecting with your customers.

Time to Close

Personalization can streamline the loan process by providing customers with the exact information they need at the right time. Tracking the average time it takes to close a loan after implementing personalized strategies can help measure whether your approach is improving efficiency.

Feedback

While metrics provide quantifiable data, customer feedback offers qualitative insights that can drive meaningful improvements. Analyzing customer feedback helps you identify areas where personalization is excelling and where it may need to be refined. Whether it’s through formal surveys, informal conversations, or post-loan follow-ups, consistently gathering feedback will ensure you remain aligned with your customers’ evolving needs.

Ready to Personalize Your Mortgage Loan Services?

At the end of the day, what sets you apart as a loan officer or originator is more than just the products you offer—it’s how you make each customer feel. Personalization strategies for loan officers are your way of showing that you’re not just there to complete a transaction; you’re there to build a relationship. See how Sonar’s mortgage CRM software can help you deliver personalized experiences at scale, with measurable results. Request a demo today.