Maintaining a solid customer retention rate strengthens your mortgage business and builds your bottom line. However, there are numerous challenges to confront.

Borrowers applying for mortgages typically plan to keep their homes for at least ten years, limiting their interactions with lenders. Refinancing is more common, representing nearly one-third of mortgage originations in 2023, but opportunities for repeat business are still limited.

More problems come from third parties like real estate agents, who often act as intermediaries between borrowers and lenders, making it even harder to foster customer loyalty.

Despite the hurdles, improving customer retention is worth the resource investment. The advantages compound over time, boosting revenue and reducing the cost of acquiring new customers.

In this article, we’ll explore the importance of customer retention in mortgage origination and provide practical tips for building long-term relationships with borrowers.

Understanding Customer Retention in Mortgage Origination

Within mortgage origination, customer retention reflects your ability to sustain borrower relationships beyond the initial loan. These borrowers will seek your services when refinancing or making a new purchase, and they’ll also recommend your business to friends, giving you free word-of-mouth advertising.

Given the time and marketing expertise necessary to acquire just one customer, retaining existing clients helps trim your budget while increasing profits.

Metrics for Success

Customer retention with relevant reporting metrics. Here are a few key performance indicators (KPIs) to consider:

- Referral rates from existing customers

- Customer satisfaction and net promoter score (NPS)

- Lifetime customer values

- Percentage of repeat business by loan type.

Challenges in Customer Retention for Mortgage Originators

No matter how efficient and well-trained your team is, mortgage originators face inherent customer retention challenges. Some, like high competition, are found in most industries, but many are specific to the field.

To combat eager competitors, you’ll have to devise a way for your brand to stand out. Stringent lending regulations mean mortgage products are often very similar, and borrowers won’t spend time searching for small nuances between companies. They’re usually motivated by price and convenience rather than loyalty to any particular originator.

Another problem arises when you consider the length of time likely to occur between transactions. Customers may not think of their originator or lender after the initial transaction. Even if your former borrower does keep you in mind for their next loan, a rate hike or a market crash can push them toward the cheapest option instead.

Customer Retention Strategies for Mortgage Originators

Now that you understand what you must overcome let’s look at customer retention strategies that can work for the mortgage industry.

Proactive Communication

One of the most effective ways to retain customers is to initiate engagement beyond the mere transaction. Keep communication lines open and make a phone call or send an email recognizing milestones and personal events like birthdays or anniversaries.

If remembering 10,000 (or more) birthdays sounds stressful, don’t worry. Automation can help. You can find tools to send updates and emails automatically, keeping you connected to customers without straining your time.

Exceptional Customer Service

Poor customer service will derail your retention goals. Customers expect fast help when they have concerns, and any delay could cause irreparable harm to the relationship. This may sound dramatic, but customer service may be your main differentiator.

You can extend your value by offering extra services like financial consultations or workshops. Providing these resources for homeowners helps you stay top of mind even when a mortgage deal isn’t in the cards.

Relationship Building

It’s hard to resist a genuine, friendly person, which holds true in mortgage origination. Teach your team to strive for a consultative relationship in which they provide more than just the mortgage product. Remembering personal details and maintaining contact between transactions makes customers feel like they have someone in their corner.

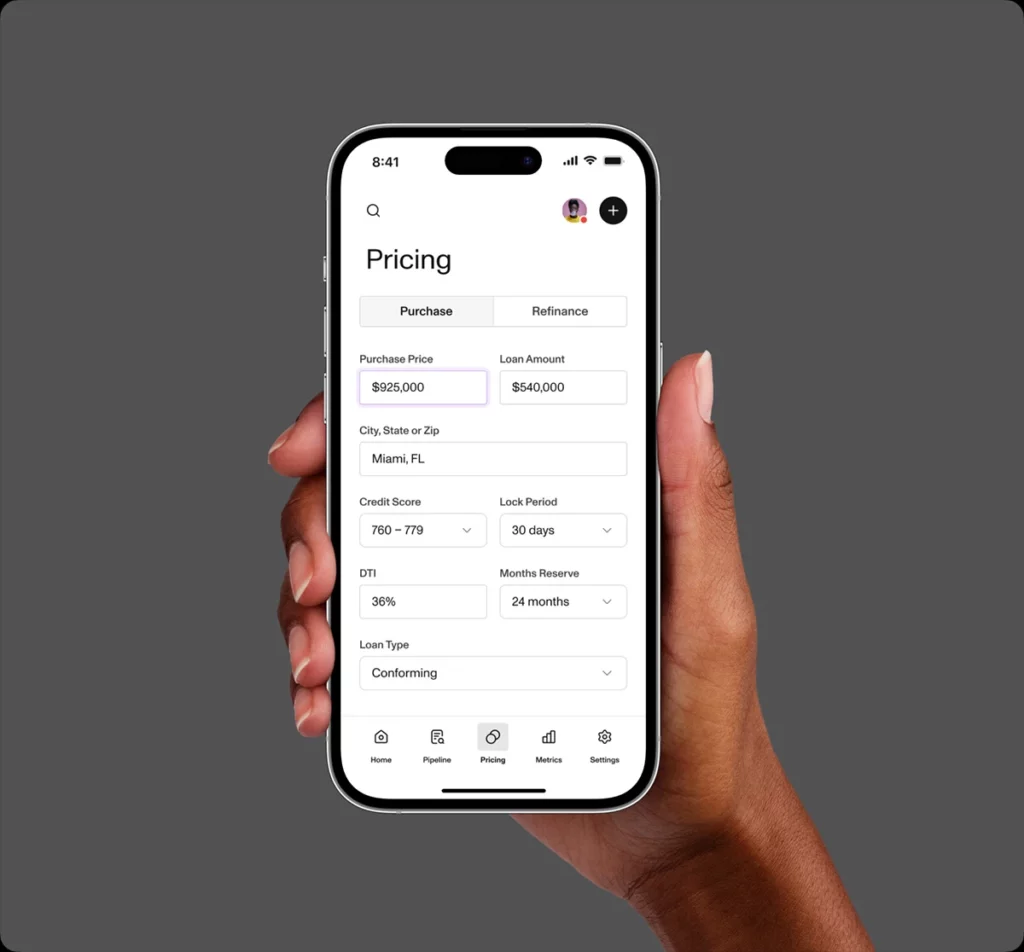

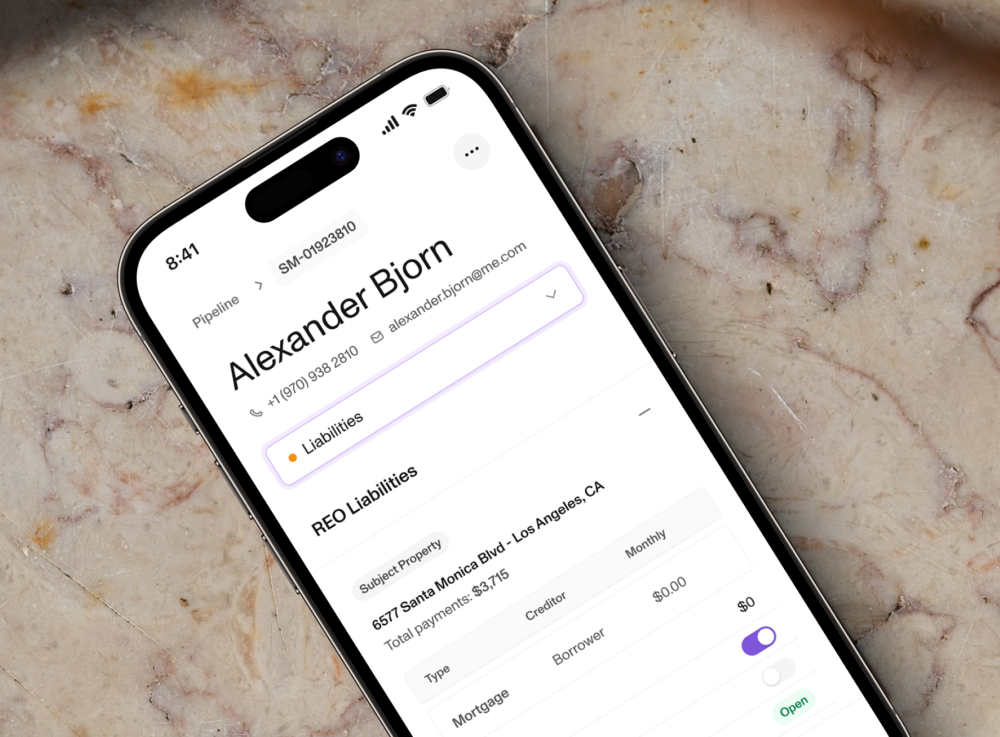

You can use technology to help improve relationships as well. A quality customer relationship management (CRM) system records customer preferences and service histories so you can tailor your approach to each borrower. CRM customer retention metrics are easy to view.

Post-Closing Engagement

If you want a borrower to remember you years later, keep in touch through post-closing engagement activities. You can send newsletters, educational materials, etc. The market changes constantly, and borrowers appreciate expert opinions.

You can also ask for feedback and see what your customers really want. Do they wish you offered a particular product? Were any parts of the process confusing? Take this information and use it to your advantage.

Technology and Tools for Customer Retention

As we discussed with automation and CRMs, technology can augment strategies for customer retention. Most successful origination teams rely on a growing stack of technology tools designed for mortgage professionals.

Technology can eliminate tedious manual labor, propel efficiency, and provide rich datasets for analysis. This analysis can reveal flaws in your retention plan and guide you toward better decisions.

The best software for mortgage origination includes:

- A CRM system enhanced with automation and analytics to improve the customer journey. Customer retention strategies in CRM involve tracking leads, referral sources, and customer interactions.

- A digital point-of-sale (POS) system for frictionless digital applications.

- Automated underwriting and mortgage marketing software.

- A loan origination system (LOS) to handle the entire loan cycle.

Depending on your needs and current setup, you can opt for disparate tools that communicate or find an LOS that combines every feature you want into a single software platform.

Customer retention in the mortgage industry is challenging but possible. Retaining enough customers to affect the course of your business requires you to understand the industry and implement the right strategies and tools.

Flexibility is also required. The housing market changes often, and customer behavior evolves in response. You need an agile strategy that can quickly adapt to altered conditions. Avoiding common pitfalls, such as neglecting regular contact with borrowers or blending into a crowd of competitors and failing to differentiate your business, is also essential.

Staying innovative and focusing on the long-term relationship with your customers can help you forge a sustainable business model backed by customer loyalty. Sonar’s mortgage CRM platform is built to help you implement these best practices.

Schedule a Sonar demo with a mortgage industry expert for a personalized experience.