Loan originators operate in a competitive environment where minor delays can lead to fallout, missed opportunities, or compliance issues. In today’s ever-volatile market, managing your loan pipeline requires considering volume, precision, foresight, and control.

At Sonar, we equip loan officers with the tools and insights to reduce pipeline risk, improve borrower engagement, and accurately forecast performance. This guide covers common risks, mitigation strategies, and how Sonar helps originators succeed, even when working with rate-sensitive or diverse borrower segments.

Understanding Loan Pipeline Risks

Loan pipeline risks refer to the potential disruptions or losses that can occur between application and closing. These risks can be operational, financial, or market-driven. Left unaddressed, they lead to lost deals, compliance failures, and revenue leakage.

Here are some of the most common pitfalls:

- Pipeline Fallout: When borrowers withdraw before closing.

- Pricing Changes: Shifting rate sheets can affect borrower eligibility and intent.

- Rate Lock Expirations: Market swings may expose you if a rate lock isn’t extended in time.

These risks compound in a competitive market, especially when working with a diverse borrower base who may need additional clarity and communication to stay engaged.

Identifying Common Loan Pipeline Challenges

Pipeline Fallout

Borrower fallout can occur for many reasons, such as indecision, qualification issues, or sudden rate hikes. Diverse borrower groups may also face barriers to understanding the process or need more guidance, making proactive education critical.

Market Volatility

Rate fluctuations can stall applications, trigger renegotiations, or cause borrowers to pause entirely. Locked-in rates may expire before closing if underwriting or appraisal delays occur, primarily when pipelines are mismanaged.

Operational Inefficiencies

Gaps in internal communication, unclear borrower updates, and compliance bottlenecks can all derail loans midstream. These issues are particularly damaging in high-volume periods or when teams juggle multiple priorities.

For more on staying compliant, see The Key to Staying Compliant with Mortgage Regulations: How Sonar Helps.

Strategies for Effectively Managing Loan Pipeline Risks

1. Enhancing Forecasting and Analytics

Strong loan pipeline forecasting helps originators stay ahead of fallout. With predictive analytics, you can anticipate when and where drop-offs are most likely to occur, adjust rate lock strategies, and align staff capacity to market conditions.

2. Streamlining Communication Across Teams

Miscommunication between loan officers, processors, and underwriters is a common cause of delay. Centralizing updates and using a shared communication hub ensures every party, including the borrower, receives timely status changes.

See how CRM tools improve communication in our article: Everything You Need to Know About Mortgage CRM Software to Accelerate Lead Management.

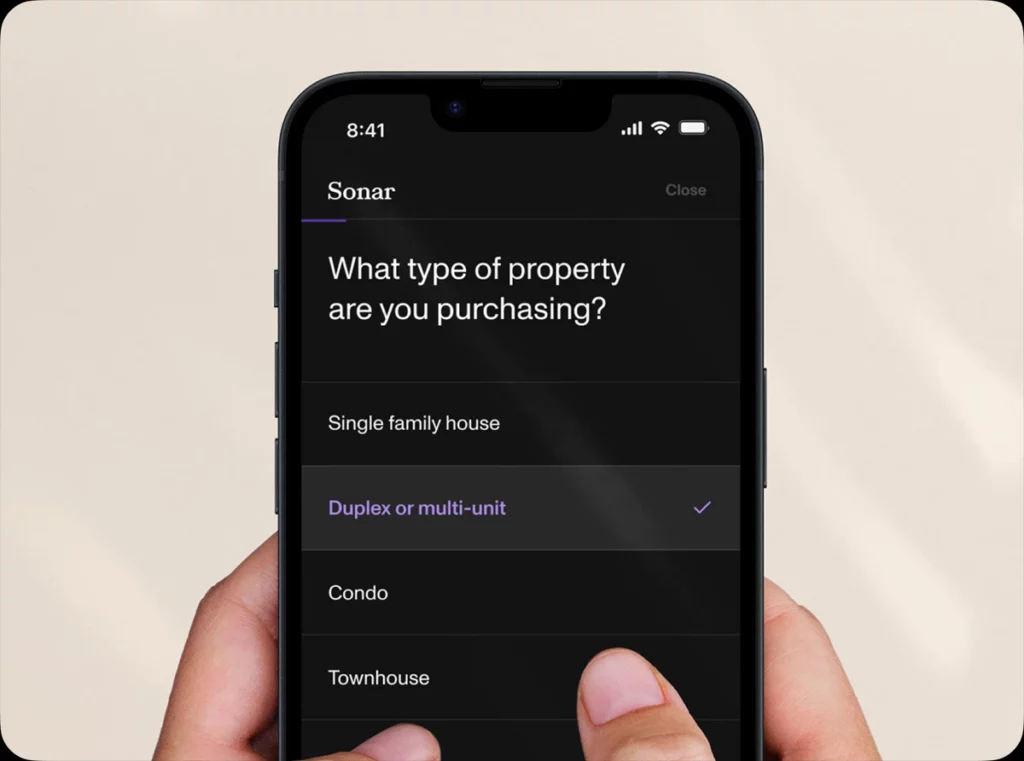

3. Implementing Technology Solutions

Modern loan origination tools like Sonar improve transparency, automate routine updates, and surface red flags in real time. Teams can track the full loan lifecycle, manage documents, and review borrower progress without chasing down manual updates.

Explore Sonar’s features for Loan Origination Software and Point of Sale Software.

4. Providing Flexible Rate Lock Options

Offer borrowers competitive and customized rate lock strategies that adjust with market conditions. When borrowers—especially first-time or diverse borrower groups—see flexibility, they’re more likely to stay committed.

5. Educating Borrowers

Transparency reduces fear and confusion. Sharing timely updates, explaining rate impacts, and providing checklists or how-to guides ensures borrowers can make decisions faster and confidently.

Improving Conversion Through Borrower Personalization

One overlooked method of managing pipeline fallout is personalization. Originators who tailor communication and loan options to the borrower’s needs—especially for first-time or diverse borrower segments—see higher engagement and faster conversions. Personalized messaging, segmented campaigns, and tailored loan products create a more responsive borrower experience.

Ways to personalize effectively:

- Customize follow-ups based on borrower behavior and loan stage.

- CRM data can be used to segment and tailor communication frequency.

- Offer education and resources in multiple formats or languages where applicable.

With Sonar’s borrower insights, originators can identify which groups need additional support and when, reducing fallout caused by confusion or delays.

Aligning Sales and Operations for Stronger Pipeline Execution

Sales and operations teams often work in parallel, but not always in sync. When these groups are aligned, loan applications move faster, errors drop, and borrowers have a better experience. Conversely, misalignment leads to bottlenecks, unclear expectations, and a higher risk of fallout.

Tactics to close the gap:

- Set shared KPIs across sales and operations (e.g., time to close, fallout rate).

- Hold regular pipeline review meetings to resolve stuck files.

- Use shared tools to track status updates, borrower milestones, and next steps.

Sonar supports cross-functional collaboration by giving sales and ops teams access to real-time pipeline views, borrower notes, and key alerts so nothing slips through the cracks.

Building a Risk-Resilient Loan Pipeline

The most successful originators treat pipeline risk management as a daily discipline, not a reactive fix. Here’s how to build a more resilient process:

- Conduct regular process reviews and post-mortems on fallout cases.

- Train teams to recognize early signs of disengagement or risk.

- Set benchmarks and monitor fallouts by stage, borrower type, and source.

- Prioritize tools that offer visibility across every part of the pipeline.

- Stay proactive when guiding diverse borrower groups through the process.

How Sonar Can Help

Sonar is purpose-built for originators who want more control over their pipeline. With real-time pipeline health dashboards, fallout predictors, and borrower engagement insights, Sonar helps you reduce risk and stay ahead of the market.

Whether you’re working with first-time buyers, refinancers, or a diverse borrower base, Sonar surfaces the metrics and signals that matter. Use it to:

- Predict and mitigate loan fallout.

- Monitor bottlenecks and inefficiencies.

- Enhance compliance tracking.

- Guide diverse borrowers through to close with confidence.

Explore our tools for Loan Origination and Point of Sale Automation

Get Ahead of Loan Pipeline Risks with Sonar

Managing loan pipeline risks is about more than volume. It’s about clarity, coordination, and foresight. From rate-sensitive customers to complex borrower scenarios, Sonar gives you the visibility to act early, communicate clearly, and close with confidence.

Stop losing loans to inefficiencies and fallout. See how Sonar helps originators close faster and smarter.

Schedule a demo with Sonar today and build a more resilient pipeline that works for you and your borrowers.