Underwriting a mortgage can take as little as a few days if your team is equipped with modern software.

However, relying on traditional mortgage lending methods might take a month or more to process the same loan. Mountains of paperwork and tedious data entry would hobble your team. Traditional processes also put more work on the borrower, forcing delays if they misplace paperwork or need help understanding specific requirements.

Digital mortgage solutions make underwriting faster, more efficient, and less reliant on manual work. This guide explores popular mortgage software and its benefits.

Current Challenges in Traditional Mortgage Lending

Mortgage loans involve heavy paperwork. If most of your documentation methods are manual, you’ll likely find competing with more agile lenders difficult. Much of your team’s time will be spent verifying records and moving data from one system to another.

Additionally, manual processes involve significantly more errors. Everyone makes mistakes, and in an industry as heavily regulated as mortgage lending, even a slight mishap can trigger penalties. These penalties may outsize your cash flow because traditional mortgage lending inevitably takes longer than digital alternatives. As a result, fewer loans are approved in the same timeframe, leading to lowered revenues.

Your use of technology also impacts the number of borrowers you reach. Traditional lenders may need help to serve remote areas, as the physical nature of documentation often requires borrowers to submit paperwork personally.

Underserved borrowers may be excluded from the traditional pool because metrics like rent payments have historically been excluded from credit calculations. However, modern software can incorporate alternative data and offer more inclusive underwriting methods.

Addressing Challenges with Digital Mortgage Solutions

Going paperless makes a big difference for mortgage professionals. You can use software to store every document so it’s easily retrievable at any moment. If the document contains errors or signs of fraud, the software can highlight problematic sections for review.

Additional challenges addressed by digital mortgage solutions include:

Faster approval times

Borrowers demand speed, and you can easily comply if you get help from technology. Borrowers can submit their applications and documents online, with automated reminders to keep them on track. On the lender’s side, technology can verify multiple factors simultaneously and speed up underwriting.

Increased accessibility through online platforms

Digital access expands your market reach because borrowers can complete applications from the comfort of their homes.

Here are a few examples of user-friendly mortgage software:

- Encompass by EllieMae offers a highly configurable legacy LOS system.

- SimpleNexus by Ncino offers a mortgage point-of-sale platform that connects borrowers, loan officers, and real estate agents in a single solution.

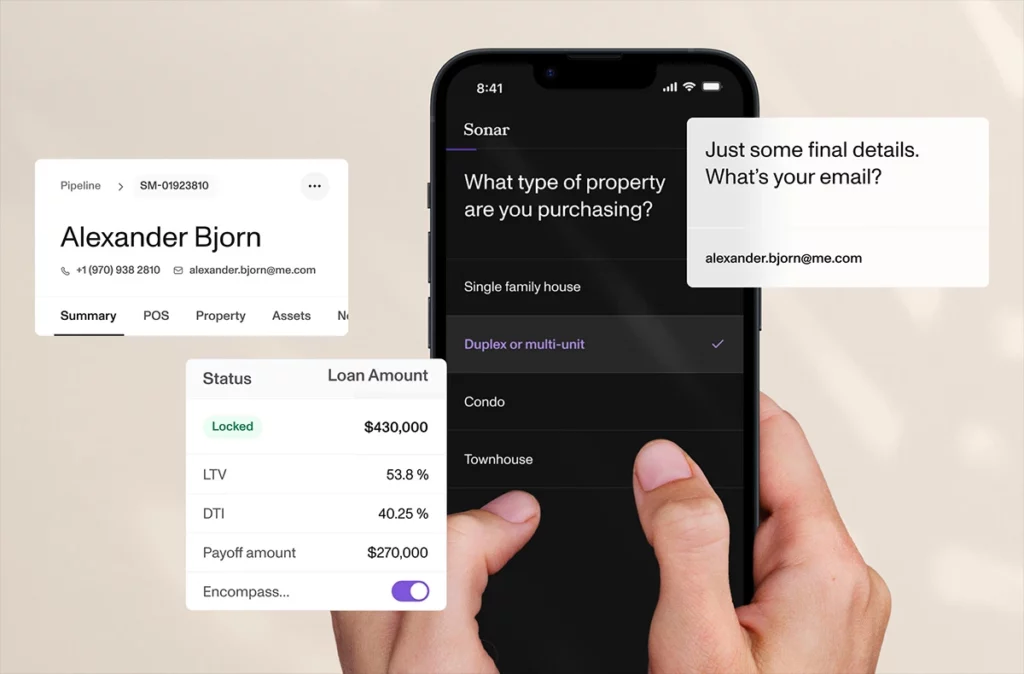

- Sonar’s platform offers a loan origination system that includes a state-of-the-art point-of-sale (POS) system to streamline the entire customer journey.

Driving Innovation in the Digital Mortgage Space

Let’s look at the principal influences driving innovation.

AI in the Mortgage Industry

New artificial intelligence tools are reshaping how lenders work, especially in underwriting. AI is far more precise and efficient than a human employee. Automating routine decisions helps the software analyze, validate, and store application data in seconds or minutes. Any inconsistencies are noted in a risk analysis, helping you detect fraud.

Blockchain Technology

Blockchain technology lets you create a secure ledger without intermediaries. You can use this for contracts and verification purposes. Blockchain technology also boosts trust because any changes to a record get recorded in real-time.

Encryption protocols

Robust encryption protocols are a requirement if you handle sensitive customer data online. Without encryption, your data is vulnerable to hackers.

Secure data storage

Technology enables secure data storage. The data becomes nearly tamper-proof, so you face fewer threats from criminals.

Benefits for Borrowers and Lenders

Both borrowers and lenders benefit from digital mortgage tools, although they may appreciate different aspects. Some of the main advantages include:

Efficiency

The value of efficiency is apparent to all parties, as borrowers spend less time worrying about their loans, and lenders have time for more clients.

Transparency

Borrowers can track their applications for real-time updates at any moment. They never have to wonder about their status or if their documents were received. They know what’s happening at every step, and their trust ultimately boosts the lender’s reputation.

Cost Savings

With less manual work, your team can handle more loans. You also save on potential penalties due to errors. The cost savings strengthen your business, making it easier to help potential homeowners achieve their goals.

Impact on Customer Experience

Of course, some advantages primarily benefit borrowers.

Seamless Online Application Processes

With a modern setup, borrowers can apply online, upload their documentation on mobile devices, and monitor their loan’s progress. The entire process is frictionless.

24/7 Access to Loan Information

If everything is online, borrowers can have 24/7 access to loan information. It doesn’t matter if your team is on the clock; they can look up their account independently.

Personalized Communication

Digital lending trends have led to more personalized communication. You don’t have to remember each borrower’s preferences; you can attach the data to their file so it’s always available. You can also automate milestone notices like birthday greetings.

Adopting a digital mortgage platform like Sonar can save time, increase accessibility, and enhance customer experience. You can reach a broader range of borrowers. That’s because software eliminates manual processes and the corresponding errors.

Ready to see how a digital mortgage platform can enhance your operations? Book a demo with Sonar today.