As a mortgage originator, profitability soars when you have access to a well-defined sales funnel powered by steady leads. Originators with less reliable sales funnels will find it difficult to advance in the industry regardless of their ability.

Generating qualified mortgage leads on your own requires a deliberate strategy. Competition is strong, making it difficult for your business to grab attention. Traditional lead generation tactics, such as partnering with realtors or relying on former clients, may produce a lower volume than you desire.

This article will discuss key ways to overcome the challenges of obtaining qualified leads.

Understanding the Current Market

The mortgage market shifts. The average 30-year mortgage rate hovers around 6.5%. On May 4, 2023, rates were at 6.79%. The week prior, rates were at 6.87%.

High mortgage rates reduce borrower demand by making it harder to qualify. The reduced demand, in turn, slows construction, deepening a housing supply crisis that’s been developing for more than a decade. Data shows that “the gap between single-family home constructions and household formations grew to 6.5 million homes between 2012 and 2022.”

By understanding current market trends, mortgage originators can identify new opportunities before they disappear.

Traditional Lead Generation Isn’t Enough

Traditional lead generation tactics, such as word of mouth or professional partnerships, have long been the cornerstone of many mortgage originators’ business models. You can nurture relationships with satisfied customers to develop referrals or use realtors to tap into their existing client pools.

However, these tactics alone usually don’t produce enough to stay profitable. Digital lead generation is quickly becoming a necessity.

Evidence shows that traditional forms of lead generation are less effective. A 2022 Fannie Mae survey of mortgage executives found that 79% believed that digitization improved the borrower experience, while 70% reported increased productivity.

To remain competitive, you must adopt new lead-generation tactics and strategies that capitalize on modern technology and customer preferences.

Unleash the potential of seamless customer relationship management with Sonar’s integrated mortgage origination software. Schedule a demo now.

How to Generate Leads in a Modern World

Generating leads in the modern world takes a dedicated effort.

Employ Tools

If you want to know how to get mortgage leads, use available technology. Several tools, such as CRM and email marketing software, can make lead generation more efficient and effective.

CRM (customer relationship management) tools automate lead acquisition, follow-up, and customer segmentation. CRM platforms also collect multiple customer data points so you can target leads with personalized emails or direct mailers.

Email marketing lets you send messages quickly and efficiently to many individuals simultaneously.

Utilize Social Media

Utilizing social media grows your reach. 76% of internet users report going online for product research. By developing a robust and authoritative social media presence, you help customers find you.

To reach the right audience, tailor your social content to appeal to specific segments.

Create Valuable Content

Borrowers want to understand the mortgage process’s intricacies before they put pen to paper. You can connect with new and diverse customers by providing high-level content that satisfies that need.

For example, give in-depth coverage to mortgage programs specific to your state and recent policy changes. This thought leadership is information that’s often challenging for borrowers to access. You can position yourself as a knowledgeable authority and build trust.

Leverage Targeted Campaigns

Finding qualified leads means targeting the right individuals. Paid ads are a great way to reach them.

Create campaigns that attract prospective borrowers who fit your desired profile, whether a specific demographic or loan type. For example, targeted ads can be used to reach first-time homebuyers who are looking for FHA loans.

Optimize your Website

Your website is an integral part of your online presence. 38% of people refuse to interact with a sloppy website.

Optimizing your website is a simple way to generate new leads. Ensure it has an appealing design and is easy for visitors to navigate. Removing unnecessary content and minimizing page loading times make a big difference.

Creating a Sales Funnel

The lead-generating tactics mentioned become helpful at different points in the sales funnel.

At the top of the funnel, you want to capture leads through website forms and targeted ads. Lead nurturing follows, including personalized content marketing engineered to draw qualified leads.

Once you identify leads that fit your desired profile, start the conversion by providing an application or pre-qualification option. Follow up with phone calls, text messages, and emails to close the deal.

Analyzing and Measuring Success

Is your social media campaign gaining traction? Are users filling out the lead generation form on your website?

Analyzing your lead generation strategy lets you determine its effectiveness. Efforts that do not produce significant qualified leads may not be cost-effective. A qualified lead is a borrower that meets your predetermined criteria, such as age, location, or loan type.

When measuring a campaign’s success, common metrics include the number of leads generated, conversion rates, and return on investment (ROI). The conversion rate is the percentage of leads that convert into customers.

You can use the data from your analysis to refine your lead-generation techniques.

Ready to see what modern digital mortgage solutions can do for your business? Request a demo today!

Using Technology for Lead Generation

Mortgage lead generation becomes faster and more accurate when you utilize technology. Instead of juggling follow-up emails and other lead-nurturing tasks, automate the work with customer relationship management (CRM) software.

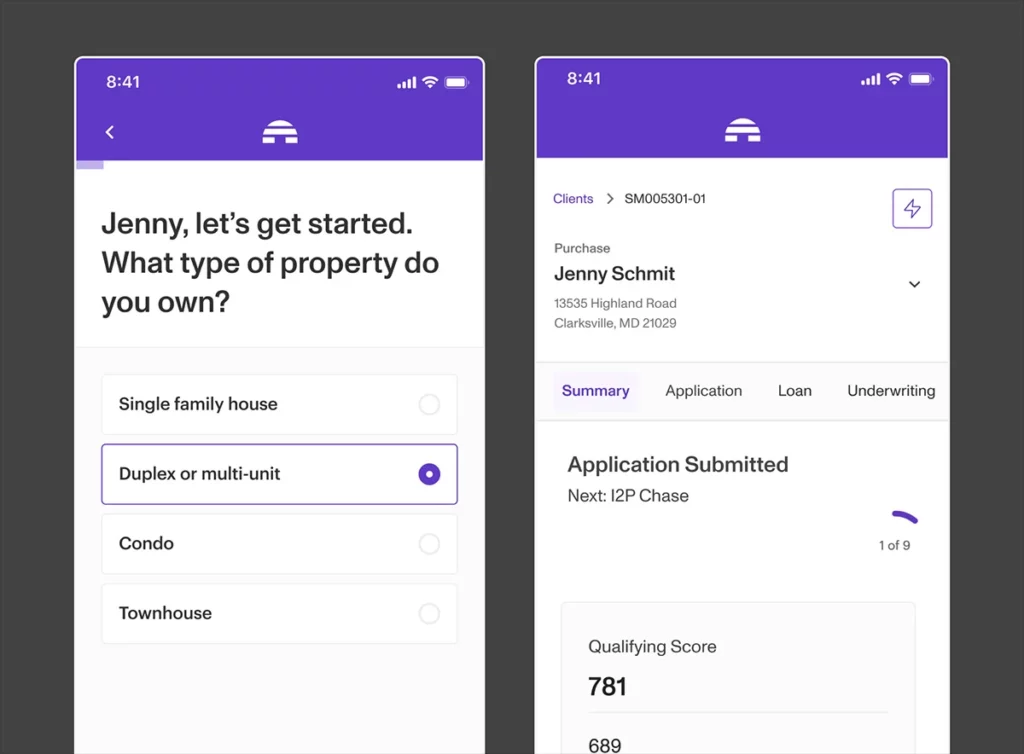

Sonar is a mortgage POS (point of sale) and LOS (loan origination system) with CRM capabilities. With Sonar, you can control the entire loan pipeline from lead generation to closing.

Turning Your Leads into Borrowers

Carefully guiding prospects through the sales funnel helps you convert leads into borrowers. Aim for engaging content, targeted campaigns, and powerful technology.

Sonar can be a valuable asset in this process. Its CRM capabilities make it easy to manage leads. Sonar’s other POS and LOS features ensure a smooth, hassle-free experience when the leads become borrowers.

Elevate your borrower experience and boost profitability with Sonar. Request a demo today.