The mortgage industry faces rising borrower expectations, tighter compliance regulations, and mounting pressure to reduce origination costs. Mortgage lenders and loan originators must adapt or risk falling behind. Understanding where mortgage tech trends are heading over the next three years is critical for strategic planning.

AI in Mortgage Lending Becoming Baseline by 2028

Over the next three years, AI will move from an optional feature to an essential component of any loan origination system. Predictive analytics will assist with borrower risk modeling, income verification, and automated pre-approvals. AI-driven underwriting engines will analyze borrower data in real-time, eliminating bottlenecks and reducing human error. Lenders not integrating AI into their workflows will be in an even more competitive landscape.

Rise of Digital Mortgage Tools Across the Loan Lifecycle

By 2028, we expect fully digital loan workflows to be standard. Digital mortgage tools such as e-closings, remote notarization, and borrower portals will not be differentiators; they will be baseline expectations. Borrowers will demand mobile-first, digital-forward, and self-service experiences throughout origination, from initial application to final closing. This shift will require lenders to invest in flexible, borrower-centric systems supporting end-to-end digital interactions.

Blockchain and Smart Contracts for Secure, Transparent Lending

Blockchain technology will move beyond the hype phase and into practical mortgage applications. Over the next three years, expect to see increased adoption of blockchain for managing e-notes, compliance tracking, and secure data storage. Smart contracts could automate parts of the loan agreement process, enhancing transparency and reducing administrative overhead. While widespread blockchain use is still emerging, early adopters will gain an edge in compliance efficiency and borrower trust.

Automated Underwriting and Decision Engines

The next generation of automated underwriting (AU) tools will integrate real-time data sources, including alternative credit scoring models and income validation systems. Decision engines will evolve to deliver faster, more accurate approvals while maintaining strict regulatory compliance. Bias monitoring and explainability will become essential, as regulators scrutinize AI-driven lending decisions more closely.

Sonar recently launched Sonar Apex, an agentic AI tool for loan origination, to help usher firms into the industry’s future. To see a demo, click here.

Modular, API-Driven LOS and Ecosystem Integration

Legacy, monolithic loan origination systems will continue to be phased out. Lenders will shift toward cloud-native, modular LOS platforms that integrate seamlessly with CRM, POS, servicing, and secondary marketing tools. API-driven architecture will enable faster system updates, better customization, and broader ecosystem connectivity. This flexibility will help lenders scale more efficiently and respond to changing borrower needs.

The Future of Mortgage Origination: What Lenders Should Expect

Looking ahead, the future of mortgage origination will be defined by platform consolidation, increased personalization, and a shift toward relationship-first strategies.

Consolidation will reduce the number of point solutions lenders rely on. Lenders will favor comprehensive platforms that cover multiple functions within a unified interface instead of combining separate tools for underwriting, compliance, and borrower communication.

Personalization will rely on borrower-level insights drawn from integrated data sources. Mortgage origination will evolve beyond generic product offerings toward tailored experiences that match borrower profiles, credit behaviors, and long-term financial goals.

Relationship-first strategies will replace purely transactional origination. Loan originators will focus on building long-term borrower relationships through consistent, personalized engagement supported by advanced technology platforms.

How Mortgage Leaders Can Prepare Today

Lenders looking to stay competitive should begin evaluating their current technology stacks against the trends outlined in this mortgage technology forecast. Here is a simple checklist for self-assessment:

- Does your LOS support AI-driven underwriting and decision-making?

- Are your digital mortgage tools mobile-friendly and entirely self-service?

- Is blockchain or innovative contract capability on your roadmap?

- Can your systems integrate new data sources and APIs without major redevelopment?

- Do your platforms support borrower personalization and long-term engagement?

To modernize effectively, prioritize:

- Replacing legacy LOS platforms with modular, cloud-native alternatives

- Integrating AI tools that improve underwriting speed and accuracy

- Deploying borrower-centric portals and self-service tools

- Exploring blockchain use cases for compliance and security

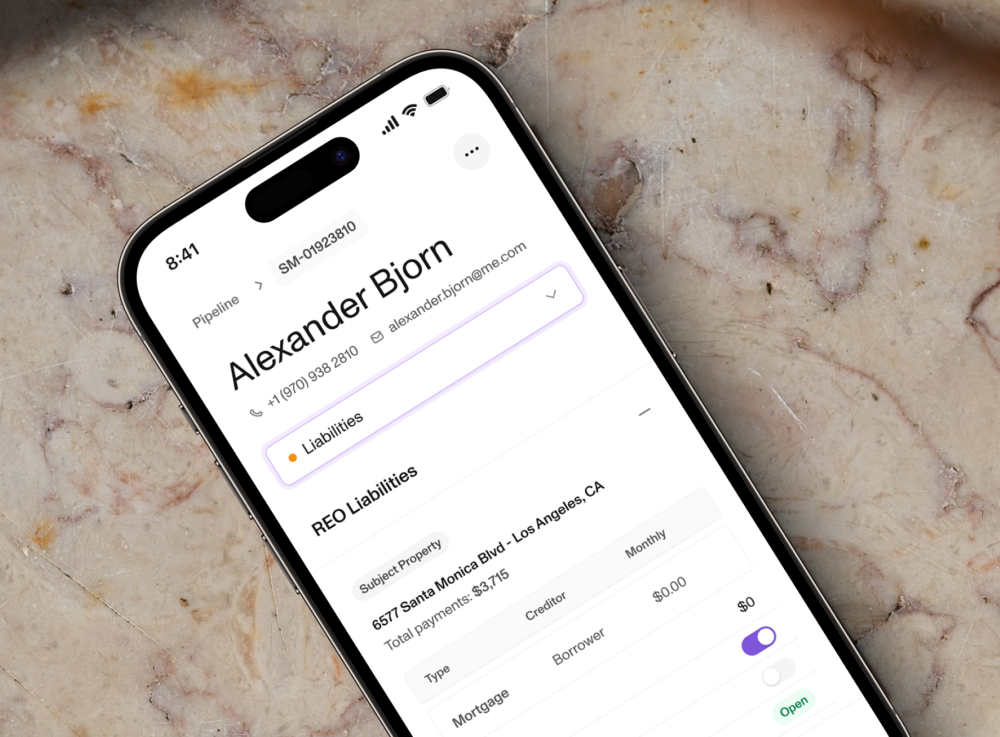

Sonar helps lenders future-proof their mortgage operations by offering an AI-powered, modular LOS designed for the future of mortgage origination. Sonar’s platform enables seamless integration, borrower-first experiences, and compliance-ready AI decision-making.

Mortgage Tech Trends as Strategic Advantage

Between now and 2028, mortgage tech trends will not be optional features; they will become the foundation of competitive lending. AI in mortgage lending, digital mortgage tools, blockchain, automated underwriting, and modular LOS platforms will shape the industry’s future.Lenders that invest early will position themselves to lead the market in borrower experience, cost control, and regulatory compliance. Explore how your team can lead in mortgage tech trends today. Get started with Sonar.