In mortgage origination, how borrowers view your brand largely depends on your point-of-sale (POS) system. A non-intuitive, slow interface leads to lost business, whereas an effective, modern POS increases customer satisfaction.

Understanding the Role of Point of Sale (POS) Systems in Mortgage Origination

It doesn’t matter if you work with a large, multi-state team or a handful of loan officers — an effective POS system is critical technology. It’s like your storefront; it’s what borrowers see when interacting with your company and how you communicate value.

The right POS system presents a simple application and dashboard to borrowers while collecting data for the backend.

In this guide, we’ll explain what makes a good POS, break down how the software improves efficiency, and provide tips for POS optimization. Use this resource as a tool for maximizing your mortgage POS investment.

Understanding Mortgage Origination POS Systems

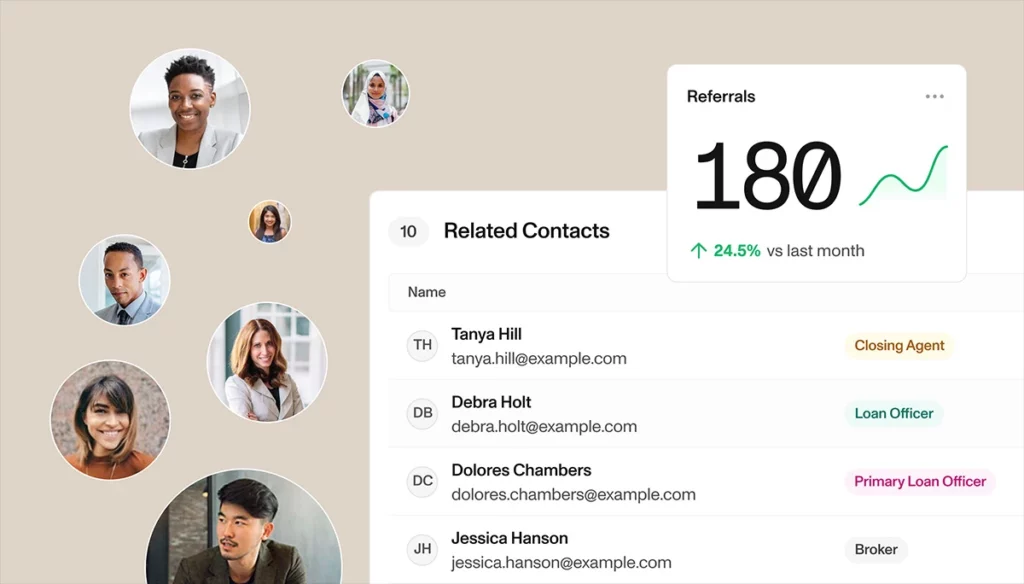

A mortgage POS system is software that provides an easy-to-use interface for borrowers to complete their applications and view their status online. It stores credit histories, income verifications, and other pertinent financial data in one spot.

You can find a POS that integrates with the rest of your tech stack or utilize a loan origination system with POS capabilities included, like Sonar.

Key Functionalities and Features of POS Platforms for Mortgage Origination

A POS should include several key functionalities that make mortgage origination easier:

Application Management

Borrowers may need multiple sessions to complete a mortgage application. However, when you use a high-quality LOS, you don’t have to worry about lost data or forgotten compliance checks. Application management within POS platforms should include features such as auto-save, form validation, and document uploads.

When the application is complete, borrowers can log into their dashboard to communicate with their loan officer and see the status of their loan.

Credit Decisioning

POS systems are also automation tools. It can pull credit reports and rapidly analyze the data, increasing the accuracy of your decisions. The speed also helps your reputation with borrowers.

Document Management

Mortgage applications are document-intensive. A POS system moves the process online and lets borrowers easily upload documents electronically. Document collection tools make collecting, verifying, and uploading digital documents straightforward.

Compliance Integration

Ideally, you run compliance checks at multiple points throughout the loan process. POS platforms can feed you the data and help you stay compliant when integrated with software.

Common Challenges with Mortgage Origination POS System

While a good POS simplifies origination, implementation may be challenging. A POS system is essential software, and its use might alter your typical workflow. Here are the most common problems that may arise

System Complexity and Navigation Issues

POS software can be complex. Loan officers who aren’t as tech-savvy may face a steep learning curve, which will slow down early adoption rates. Even mortgage professionals adept at software will likely need time to explore system navigation and complexities.

Integration Challenges with Existing Infrastructure

Integrating a new POS system with your firm’s existing technological ecosystem could be an uphill task. When choosing a POS and wanting to retain your current software, the only system that makes sense is one with ample integration capabilities.

Compliance Requirements and Regulatory Changes

Mortgage lenders need to keep compliance at the forefront at all times. However, you can’t set your measures once and forget about them. Compliance requires a flexible strategy that can accommodate evolving regulations. That’s why you need an agile POS that swiftly incorporates every new rule.

User Adoption and Training

Does your team understand how to use the POS? Do they see how the software optimizes workflow? If the answer to either of these questions is no, you’re not getting the maximum value out of your POS.

To get your team onboard, conduct regular training sessions and make sure you answer every question.

Strategies for Optimizing Mortgage Origination POS Systems

If an out-of-the-box POS system doesn’t work perfectly, tweak it to fit your needs. Optimization strategies can be highly effective. Here are techniques to try:

Workflow Optimization Techniques

A clear picture of your regular workflow will help you determine how to optimize your POS. For example, if you spend a lot of time handling borrower communications, let your POS make it easier.

The 24/7 customer dashboard means borrowers have fewer questions because they can check their status. Furthermore, since the POS keeps data in one spot, you don’t have to spend time searching for borrower information.

User Experience Enhancement Strategies

User experience is the most significant factor affecting a POS system’s adoption. Enhancements should be made based on actual user feedback and pain points, which you can glean by regularly talking to your team. Do they think the POS is too clunky to use? Take their opinion into account and consider mitigation efforts like customizing screens, or you won’t have a fully powered POS.

Automation and Integration Solutions

Automation is a significant driver of current AI technology. A well-optimized POS system can plug in data from various sources to auto-populate fields and assist in risk assessment. It can also send automatic updates when the borrower’s status changes or more documentation is required.

Compliance Management Best Practices

Staying compliant means adopting the latest regulations and implementing practices that ensure their enforcement. A robust POS system might have built-in features like audit trails and tailored checklists that make it easier to adhere to regulatory standards.

Customization and Configuration for POS Optimization

Your team’s daily company operations make sense. However, your POS may not fit your routine. Customization and configuration should be considered mandatory steps in implementation. Tailoring the system to meet internal needs achieves even greater efficiency.

Future Trends and Considerations in Mortgage Origination POS

The mortgage industry is subject to rapidly changing influences, such as new regulations, fluctuating borrower demand based on factors like interest rates and home prices, and evolving technology. To continue to thrive, mortgage firms need to stay nimble.

Here are some considerations for the future of mortgage origination POS systems:

- Increased automation: Just 7% of mortgage lenders say they deployed AI and machine learning (ML) tools in 2023. That number is expected to grow dramatically as AI/ML becomes more accessible.

- Mobile POS: Borrowers want to complete loan applications on their phones, making mobile-friendly POS systems increasingly necessary.

- Data-driven decision-making: With more data available, making decisions based on real-time analytics is easier. As AI tools spread, better predictions will also be possible.

These are just a few trends headed toward mortgage lenders and loan officers.

Future-Proofing Investments in Mortgage Origination POS Systems

A POS system for your mortgage platform is a big investment that cannot be constantly repeated. How do you pair the need for flexibility with the need to budget? The answer lies in future-proofing. Choose a POS vendor that’s built with modern tools and embraces adaptability. Scalability matters, too. Ask questions until you find the right fit.

Your mortgage origination POS system manages applications and makes it easy for borrowers to submit documentation. A great POS helps you develop a speedy mortgage pipeline and a pleased customer base.

By understanding the role of POS systems, their challenges, and their optimization strategies, you can invest in a system that will propel your growth. The key to total optimization is to combine superior technology with rock-solid internal processes.

Whether you’re considering an upgrade or are about to implement a new mortgage origination POS system, consider this guide another tool and use it to take the pain out of LOS shopping.

Sonar’s POS system is a robust and customizable solution with features like automated emails and mobile functionality. Plus, with our commitment to constant updates. You can trust that your investment in Sonar will continue to pay off.

Sign up for a demo to further explore Sonar POS system’s capabilities.