2024 was a year of economic volatility on multiple fronts, mortgage market trends mirror those of the economy.

Specifically, mortgage activity has decreased by 1.8% as of April 2024, and as of July 2024, a 30-year loan carried a mortgage interest rate of 7.04% – up from a 6.6% low at the end of 2022.

A common narrative when discussing the housing market is the perceived inaccessibility of the younger population, who find it difficult to afford a home and opt instead to rent at a lower rate.

As a loan originator,keeping an eye on these mortgage market trends is pivotal. Assessing how to climb out of this period of volatility will be important for the housing market.

Understanding the Mortgage Market Tends in 2024

As we said earlier, there isn’t one cause of the volatile economy we’re experiencing; there are many different factors impacting mortgage industry strategies.

- Interest rates: Higher interest rates require buyers to stomach more borrowing costs, reducing the affordability and demand for homes. To put it in perspective, if the national average mortgage rate is 6.79%, a $500,000 home will ultimately cost over 1.1 million on a 30-year loan.

- Inflation: When paired with high interest rates, inflation creates the perfect storm for making it difficult to buy a home. Since the start of 2021, inflation has grown by an average of 4.98% year-over-year, making a daunting loan much scarier with the declining purchasing power of people’s money.

- Housing Shortage: High construction costs, labor shortages, and zoning regulations have led to underbuilding. It’s simple economics: lower supply equals a higher price for homes.

Part of the problem is that the Fed has remained steadfast in keeping higher interest rates to combat inflation. Although inflation still feels very high, it’s shown a continual decline in the last 24 months. If this trend continues, and the Fed has faith in the economic trajectory, it may expedite the lowering of interest rates, causing them to drop dramatically—even by the end of this year.

As a loan originator, what are you to do? At Sonar, we recommend utilizing times like this to audit your processes and platforms. Now is the time to integrate your LOS, POS, and PPE platforms into one cohesive platform like Sonar. If there is one thing everyone can agree on, the housing market always finds a way to rebound. As a mortgage loan originator, preparing yourself for scale in a better market is the best course of action when the amount of loans getting executed has dipped.

Key Challenges Facing Loan Originators Today

The loan origination profession is competitive and saturated due to the attractiveness of the real estate industry. That increased competition means potential customers have many options when choosing a loan originator, and they will consider aspects such as customer service, communication timeliness, and how easy or difficult it is to use your platform(s).

While customers maintain these high expectations, constant changes in the legislative and regulatory landscape require loan originators to be on top of the latest trends and information. Your customer base also expects this, and they will look to you as the expert who can advise them on these changes.

With all of this volatility, it’s essential to maintain every constant. One easy way to do that is by simplifying and streamlining your team’s internal workflow. Maintaining relevant productivity vs. busy work is a great way to position your team for high customer expectations and a constantly evolving regulatory landscape.

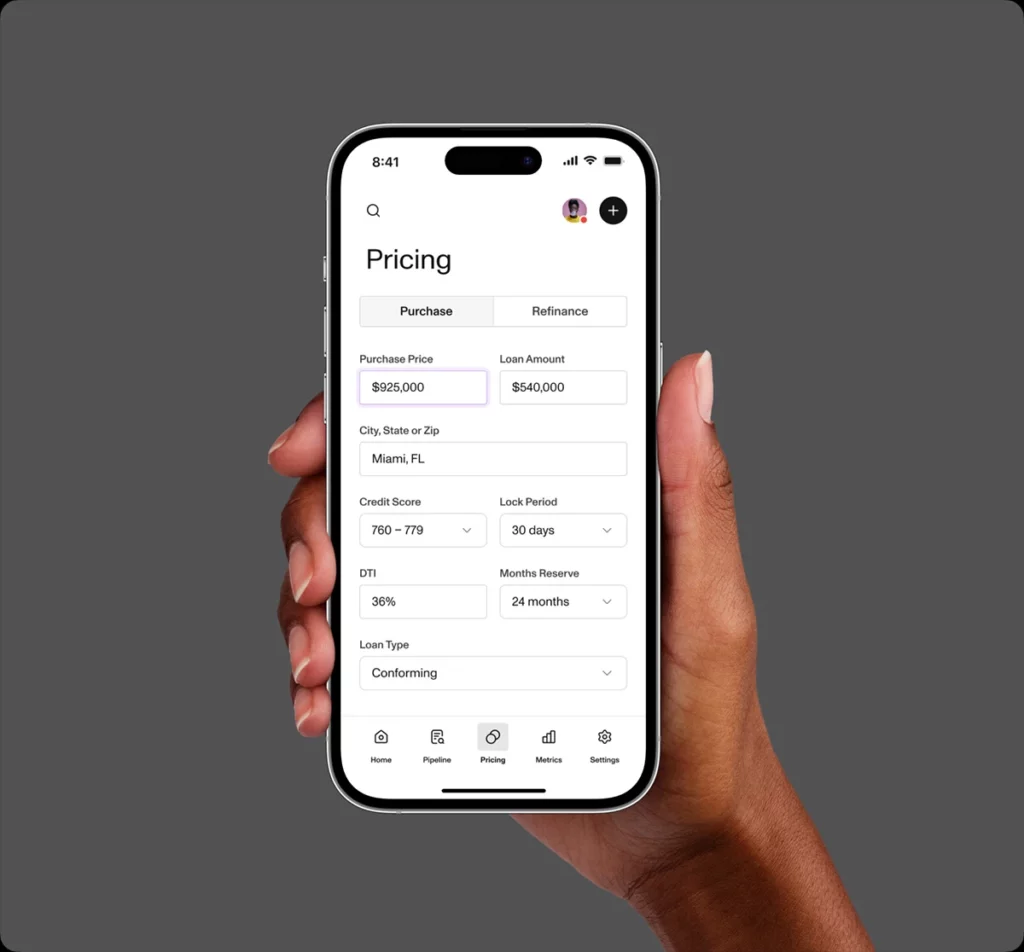

A great way to do that is to adopt platforms like Sonar that make sound internal workflow strategies and customer-facing experiences equally accessible. Combining PPE, LOS, and POS systems – historically clunky, bifurcated platforms, is a great start.

Leveraging Technology for Success

In this article, we’ve discussed LOSs, POSs, and PPEs. Sonar’s technological adaptations of these tools are great examples of thinking through the role of technology in successful loan origination companies.

However, that’s just the tip of the iceberg. Like many other industries, the loan origination industry opts for modern methods of workflow management and customer experiences rather than the traditional methods of old.

In addition to Sonar’s integrated CRM, an automated underwriting system (AUS) is another tool to equip your team to increase efficiency and productivity. An AUS leverages AI to increase borrower approval times, offer predictive analytics about a borrower’s qualifications, and detect fraud and compliance concerns faster and more accurately.

Enhancing Sales and Marketing Techniques

Choosing the right tech stack is half the battle. The other half is using it to boost customer retention and new customer acquisition.

By harnessing the power of technology, your sales and marketing team can offer customers a faster, more accurate, and seamless experience than your competitors, who opt instead for traditional methods.

Showing proof that your process avoids clerical errors and digitizes the process can be the deciding factor for a customer considering two or more companies.

Furthermore, when you land that great new customer, taking care of them by delivering on a fast, accurate process can do wonders for your business. Although we’re in the golden age of inbound digital marketing, word of mouth remains the most potent form of customer acquisition. There is nothing like a referral from a trusted source that points you in the right direction.

If new and referral clients represent two massively important audience bases for your business, customer retention is the third. By promising and delivering a superior experience, these customers will return to fulfill their loan origination needs.

Best Practices for Continuous Learning and Adaptation

To thrive as a loan origination officer, you must have knowledge, curiosity, and solution-oriented thinking to provide the best customer experience. Sonar recommends seeking ongoing training and education opportunities, especially as our industry becomes more integrated with tech.

Consider exploring industry podcasts, mailing lists, webinars, and blogs to get that information delivered in the preferred format. If reading blogs is your thing, then Sonar’s is a great resource.

Furthermore, consider attending industry conferences and roundtables. Those opportunities are often geared towards equipping you with knowledge of the latest and greatest in the industry and can provide actionable ways to boost your expertise.

We know how passionate and committed real estate and loan origination professionals are, so these mortgage market trends and tips will hopefully give you plenty of tips to consider, from technology to marketing practices.

If you’re ready to explore a tech stack that makes your life easier, try Sonar’s demo. Remember, given the current state of the real estate industry as of this article; this is the ideal time to audit and overhaul your workflow processes for a customer-friendly, workflow-focused platform that will make your customers refer to you and use you repeatedly.