Mortgage origination is a multifaceted process that requires strict risk management and adherence to regulatory nuances. The combined pressure can make it challenging to identify suitable borrowers, a problem compounded by outdated methods.

Traditionally, lenders and originators have relied on manual methods to assess creditworthiness, a tedious and error-prone process. With the rise of digital mortgage technology, it has become imperative for businesses to embrace new tools for mortgage origination. Ignoring these advantages exposes your business to various risks, ranging from offering mortgages to unqualified borrowers to inadvertently contravening regulatory requirements.

The Role of Technology in Data-Driven Lending

Technology plays a pivotal role in revolutionizing the lending landscape. Here are a few ways in which technology improves decision-making:

- Integrating Tools for Efficient Data Collection: Modern mortgage origination platforms, like Sonar, integrate powerful tools for efficient data collection. Borrower information is collected seamlessly, reducing the administrative burden on lenders and ensuring data accuracy.

- Automated Application Review: Automation redefines how mortgage applications get reviewed. Processing speed increases, errors become less frequent, and tedious manual work gets eliminated.

- Machine Learning for Better Insights: Machine learning algorithms analyze vast data troves to give lenders actionable insights. These algorithms can predict borrower behavior, helping lenders make informed decisions.

- Enhanced Risk Assessment: Advanced algorithms can assess risk factors with precision, reducing the chances of lending to high-risk borrowers.

- Personalized Experience: Technology allows lenders to personalize the borrower experience, tailoring offers to individual needs and preferences.

Experience Accurate Mortgage Origination with Sonar

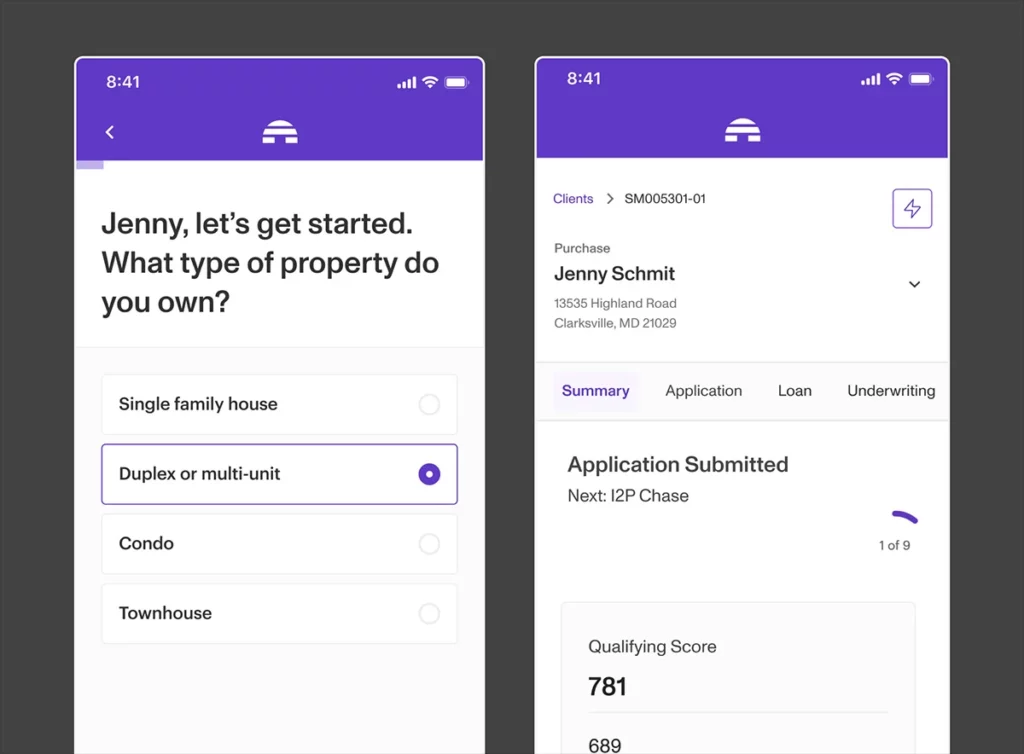

Sonar, an all-in-one mortgage origination platform, is at the forefront of this technological revolution.

Sonar benefits all parties involved. It simplifies the application process for borrowers, speeds up decision-making for lenders, and feeds real-time data to loan officers.

Comprehensive Borrower Data

Sonar collects borrower data upfront, automating the collection process and minimizing errors. This data includes credit scores and income verification.

The value of a comprehensive borrower profile cannot be overstated. Lenders can assess risk accurately and make better decisions by capturing mortgage data analytics. The fully automated approach removes the need for manual data collection.

Using Sonar may even help widen the applicant pool. Automated loan decisions and machine learning (ML) allow lending professionals to consider alternative financial data such as rent payment history. A recent study determined that “compared to a traditional scoring model, use of the ML-based model with alternative data results in significantly reduced probability of being rejected and lower interest rates for those approved.”

Enhanced Credit Analysis

Credit analysis is a cornerstone of responsible lending. Sonar’s credit analysis tools dive deep into a borrower’s credit history, identifying potential risks that might go unnoticed. The meticulous examination enhances the accuracy of lending decisions.

For example, Sonar helps lenders identify red flags, such as late payments or high utilization ratios, that may indicate financial instability. Advanced credit analysis lets lenders pick up on positive attributes such as consistent payment history and low debt-to-income ratios.

There’s a strong correlation between loan approval rates and credit analysis. With Sonar, you can be confident you’re making informed decisions based on reliable data.

Predictive Analytics

Another powerful tool Sonar offers is predictive analytics. By analyzing historical data and borrower behavior, Sonar can forecast how borrowers will likely behave in the future.

Does this borrower have a short credit history but consistently pay bills? That could be an indicator of sound financial management and responsible borrowing habits. On the other hand, is this borrower frequently behind on payments or straddled with a history of taking on more debt than they can handle? These are potential red flags that Sonar can spot.

Predictive analytics allows lenders to protect their interests by identifying patterns and trends that may not be apparent on the surface.

Automated Risk Mitigation

Sonar’s automation features improve risk management. Automating routine steps in the loan process minimizes human error, expediting application reviews and approvals.

Thanks to Sonar’s automation, lenders can identify and address potential risks before they escalate. This risk management system is superior to manual methods that rely solely on human judgment. With automated risk mitigation, lenders can expedite the loan process without sacrificing quality.

A Better Experience For Borrowers and Lenders

Sonar’s data-driven approach leads to a better experience.

Sonar offers a simplified application portal for borrowers that reduces stress and provides personalized offers based on their financial profile. The data-driven approach also speeds up approvals.

Lenders benefit from increased profitability and customer satisfaction. Their days are no longer filled with mundane data entry and error-checking; they have time to nurture more client-focused aspects of their businesses.

Originators who use Sonar can gain a competitive advantage. They work more efficiently and have the data needed to make informed decisions.

Sonar’s platform has transformed mortgage origination for the better. It enables lenders to leverage technology and big data to make sound lending decisions while making the loan process simpler and faster for borrowers. With Sonar, everyone wins.

We’ve only touched on a few of the many benefits Sonar offers. With its advanced machine learning algorithms, predictive analytics, and automated risk management tools, Sonar provides advantages that other origination platforms can’t match.

Ready to revolutionize your mortgage origination process? Schedule a Sonar demo today!