Experts believe the global mortgage industry will be worth almost $30 billion by 2030. Americans alone entered 2024 with more than $12 trillion in mortgage debt. The staggering sums and wealth of consumer data involved in mortgage origination attract scammers if sufficient protection isn’t provided, especially if data gets exchanged online.

Origination software is necessary for modern mortgage teams, yet its convenience also brings security risks. Lenders and originators must safeguard all data entrusted to them to keep customers happy and compliant with the government. These data handling measures must cover application, closing, and every step in between.

Understanding Data Security in Mortgage Origination

Mortgage data protection involves a multi-pronged approach. You must consider technical safeguards, physical security, and compliance with regulations.

- Technical safeguards: Most of your attention should be focused on technical safeguards, as digital attacks represent a significant threat. The safeguards you choose will also promote compliance.

- Physical Security: Does your office have any paperwork filed onsite? Is access to this paperwork controlled? Physical security measures such as security of physical documents, restricted access to sensitive information, and proper records shredding are no longer needed.

- Compliance requirements: The mortgage industry is highly regulated. Compliance requirements differ by location and are imposed by federal, state, or local governments. These can be data privacy laws, regulations from consumer protection agencies such as the Consumer Financial Protection Bureau (CFPB), or guidelines from industry organizations. For example, the Gramm-Leach-Bliley Act (GLBA) and the Fair Credit Reporting Act (FCRA) are two U.S. laws that set standards for managing customer data.

Origination software can expose you to vulnerabilities if you choose a substandard vendor or can’t use the software because it’s non-intuitive. Your origination team must follow regulations the CFPB sets, which can change often. You should have software that meets these requirements and is regularly updated to remain compliant.

You also need a user-friendly platform because good origination software alerts you to potential issues and automates specific processes to reduce the likelihood of human error. It’s critical to understand how to utilize these features.

Potential vulnerabilities and risks associated with origination software include:

- Data breaches

- Malware

- Phishing attacks

- Insider threats

Best Practices for Ensuring Data Protection

Origination software should come with multiple integrated protection measures. These measures ensure data such as social security and credit card numbers are not released to scammers.

There are many things that an IT department may want included for origination software security, but what you need to focus on is encryption, access controls, and authentication.

Encryption

Encryption converts electronic information into a code to make it unreadable. An algorithm scrambles data so it can only be decoded by someone with the correct key or password. Encryption is a standard security feature that most vendors provide.

However, the word “encryption” covers many protocols. The best vendors use advanced end-to-end encryption measures such as Advanced Encryption Standard (AES), a U.S. government standard used globally.

Access controls

Access controls limit sensitive information to those authorized to view it. These controls can be physical or logical.

Physical access controls include secure device storage and limiting entry into physical spaces where the data is stored. Logical access controls involve setting up protections like password authentication and controlling access to specific features within the origination software.

Authentication

Who’s trying to access your customer’s account information? Is it the customer or a hacker trying to glean information? Authentication is a way of verifying that someone is who they claim to be. Two-factor authentication, in which a user must provide two forms of identification, is a common way to authenticate someone.

Integration for Secure Transactions

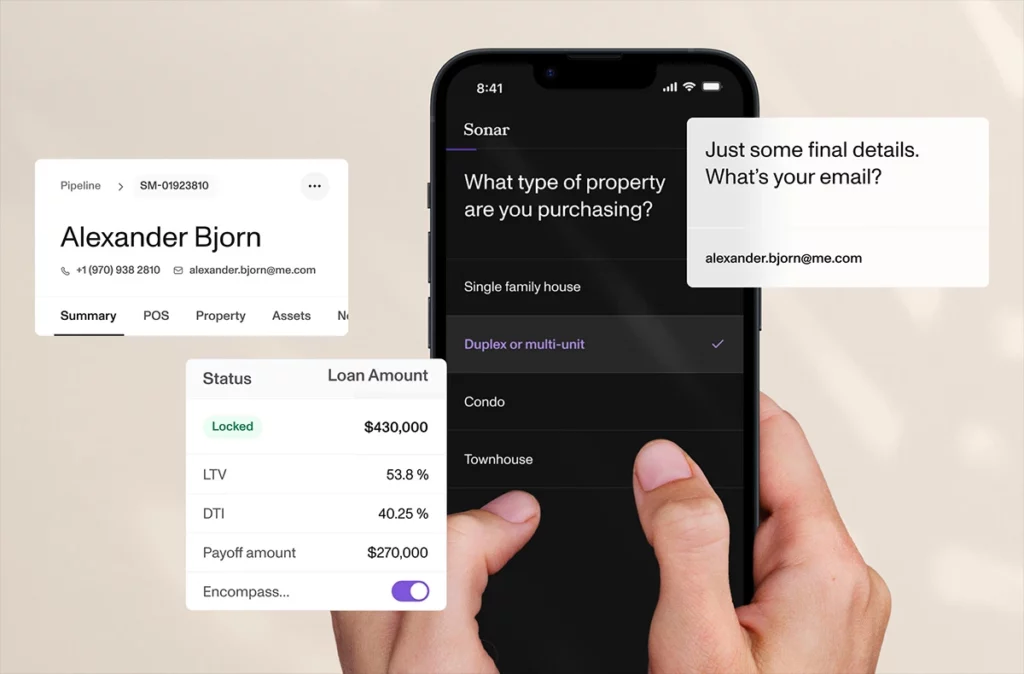

Choose a loan origination system (LOS) that integrates with customer relationship management (CRM) and point-of-sale (POS) software. This integration reduces the risk of data getting compromised because it creates a single source of truth; you don’t have to import data from divergent systems. The system ensures that data is only entered once, minimizing the possibility of discrepancies or typos.

The integration between LOS, CRM, and POS systems should be seamless. Ideally, it provides a smooth experience for both the lender and borrower, saving time and reducing the risk of human error.

Furthermore, integration streamlines communication between the borrower, lender, and originator. Borrowers can easily upload necessary documents online, keeping everyone in the loop and ensuring all data is securely transmitted through encrypted channels.

Compliance and Regulatory Adherence

Mortgage origination software, like Sonar, is designed to help mortgage professionals maintain compliance with rigid yet constantly evolving data security and privacy regulations. Offloading compliance checks and audit reports to technology enables you to keep up with shifting laws.

Work with a platform aligned with the top industry standards to ensure complete compliance and avoid fines. Compliance with measures such as Europe’s General Data Protection Regulation (GDPR) and California Consumer Privacy Act (CCPA) should be baked into the software.

Sonar, for example, meets compliance requirements and provides features such as data masking, secure document transmission, and audit logs. With its secure platform and integration capabilities, Sonar keeps sensitive customer information protected at all times.

Protecting customer data keeps your mortgage origination process in line with customer and government demands. Mortgage origination software should always include multiple layers of security and integration capabilities to streamline communication and data entry.

With new or updated compliance requirements being introduced regularly, choosing the right platform for secure data management is the only way to stay abreast of the changes. Sonar offers all the necessary features for secure mortgage origination while remaining compliant with industry regulations.

Schedule a demo to experience Sonars’ data security features firsthand.