For loan officers, a consistent stream of qualified leads is critical but costly if reliant only on paid channels. A well-developed mortgage referral network drives sustainable lead generation and builds your reputation within the market. When referral partners trust you to serve their clients well, you gain more than just business: you gain influence.

Our guide outlines the best referral partners, how to build and maintain strong relationships, and how tools like Sonar can help you grow and manage your network more effectively.

Why a Strong Mortgage Referral Network Matters

A strategic mortgage referral network delivers two major benefits: consistency and credibility. Trusted connections send warm leads your way with clients who already believe in your value, thanks to the endorsement of someone they trust.

Benefits include:

- Lower cost per acquisition compared to digital leads.

- Improved conversion rates.

- Stronger local presence and long-term brand equity.

In a saturated market, the strength of your referral network can be your most significant competitive advantage.

Identifying Key Referral Partners

Real Estate Agents

Realtors remain the top source for loan referrals. They are often the first point of contact in the homebuying journey and play a central role in shaping the buyer’s next steps.

Position yourself as their go-to lender by being highly responsive, tactical in your communication and updates, and collaborative in offering pre-approval tools and quick turnarounds.

Financial Planners and CPAs

These professionals influence major financial decisions. Partnering with them allows you to tap into a client base that is financially informed and often investment-minded.

What works:

- Offer insight into how mortgages align with broader financial goals.

- Share educational content on lending products that they can pass along to clients.

- Be a resource, not just a vendor.

Local Businesses and Community Leaders

Community-based relationships are powerful. They offer credibility and access to tightly connected networks, from insurance agents to homebuilders and even church leaders.

How to leverage local connections:

- Attend community events and business networking groups.

- Sponsor or co-host workshops with complimentary service providers.

- Build relationships before asking for business.

All of these groups represent valuable referral partners for mortgage professionals. Targeting the right ones is the first step to consistent success.

Top Referral Partners at a Glance

- Real estate agents: Speed, communication, reliability

- Financial planners: Long-term strategy alignment

- CPAs: Documentation clarity, transaction transparency

- Insurance agents: Cross-service marketing opportunities

- Homebuilders: Fast pre-approvals, partnership branding

Strategies for Building a Strong Referral Network

Building Relationships Through Communication

Relationships grow through frequency and quality of contact. Check in with your contacts regularly, not just when you need referrals.

- Set recurring calls or coffee meetings.

- Send updates on mutual clients to keep partners in the loop.

- Invite them to co-host educational webinars or workshops.

Demonstrating Your Value

Help your referral partners grow by being a resource they can rely on.

- Create co-branded flyers or digital content they can share.

- Share market insights that help them position their services.

- Show up as a knowledgeable, professional extension of their team.

These are essential components of building mortgage partnerships that last.

Providing Exceptional Service

Your treatment of shared clients reflects directly on your partner. Delivering excellent service keeps their reputation strong and builds trust in your relationship.

- Keep clients updated and reduce confusion.

- Solve problems quickly and proactively.

- Ensure the handoff back to the partner (e.g., agent) is seamless.

Leveraging Technology for Collaboration

Manual tracking can become a bottleneck when many referral relationships are active simultaneously. Technology makes collaboration smoother.

- Use a CRM to log, segment, and follow up with referral partners.

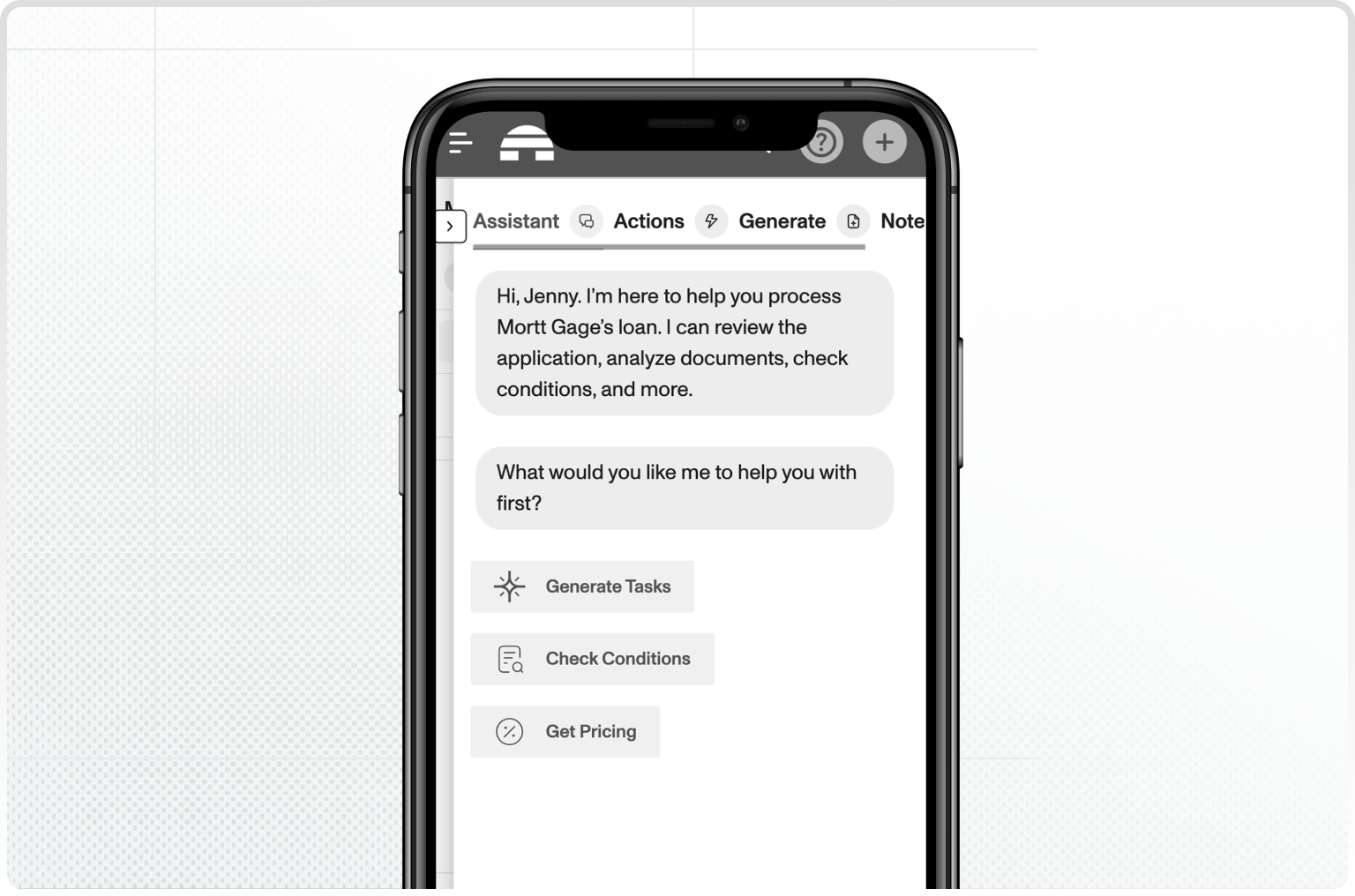

- Platforms like Sonar allow you to tag referral sources, track status updates, and automate partner communication.

- Sonar also lets you create co‑branded application links that embed your partner’s branding and automatically tag them as the referral source.

These are core loan officer referral strategies for scaling your efforts without losing the personal touch.

Engaging in Local Marketing and Networking

Face-to-face connections are still one of the greatest tools you have. Build a local presence that keeps you top of mind.

- Sponsor youth sports, local chambers, or charity events.

- Offer homebuying seminars in partnership with agents.

- Get active in online neighborhood groups.

This is an essential part of intentional networking for loan originators that builds goodwill and brand awareness.

Nurturing and Growing Your Referral Network

Once you’ve established your referral network, the next challenge is maintaining and expanding it. Consistency is key.

- Stay in touch with current partners through newsletters or quick check-ins.

- After a closed deal, ask your referral partner for additional introductions.

- Don’t overlook your past clients. Happy homeowners often become valuable connectors for new leads.

Your referral network should grow over time, not stagnate. Schedule time monthly to evaluate your outreach and add new contacts. Ensure every new referral relationship complies with applicable regulations and includes clear disclosures. Trust and transparency keep your network strong.

How Sonar Can Help Strengthen Your Referral Network

Sonar is more than just a pipeline tool; it’s a platform built to help originators manage every relationship in their business.

- Track referral sources and view performance metrics tied to each partner.

- Automate updates to keep referral partners informed.

- Centralized communication with built-in mortgage CRM features.

- Use insights to see which partners generate the most qualified leads.

When precise data and automated workflows support your mortgage referral network, you can spend less time managing and more time growing.

Build the Network That Builds Your Business

A strong mortgage referral network doesn’t just deliver leads; it multiplies your impact. You can create a self-sustaining source of trust, visibility, and growth with the right partners, strategy, and technology.

Stop leaving referrals to chance. Use Sonar to organize, grow, and maximize your mortgage referral network.

Explore how Sonar can help you build and manage your referral partnerships.