Embracing Change in the Mortgage Industry

Finding success in the mortgage industry requires an agile, forward-thinking approach. The strategies you relied on in 2023 may already need tweaking. Mortgage volume correlates with interest rates, and with the Federal Reserve declining to raise its benchmark Federal Funds rate in December 2023, many analysts predict a more robust housing market in the coming months.

Mortgage technology shifts constantly, too. Keeping the pulse of mortgage industry trends ensures competitors never eclipse you. In the post, we’ll predict evolutions in the 2024 mortgage industry and explain how these impact your team.

Here’s what we see.

Predictions for 2024 – Illuminating the Future

Increased mortgage activity may be on the horizon for 2024, although troubles like low inventory persist.

Analysts point to factors such as decreasing inflation and the Federal Reserve’s indication that recent restrictive policies may be easing to show that mortgage rates will likely fall this year. That decrease should lead to a modest surge in demand for mortgage refinancing and new home purchases.

We say modest because the possible lower rates are paired with a likely slowdown in hiring. Some expect unemployment to rise. Those forces may counteract.

Goldman Sachs expects new home sales to grow steadily until 2026 at least. The same analysis predicts that existing home sales will fall in 2024, only to rebound immediately in 2025.

Buyers who purchase in 2024 will experience digital lending trends like increased personalization and automation. Digital transformation is critical for competitive advantage.

This year, lenders adopting digital processes will meet customers’ rising expectations.

Anticipated Challenges Ahead

Even with the potential for more mortgages, we can still anticipate challenges ahead for industry professionals.

These challenges include:

- Low Inventory: Despite increased demand for new home purchases, low inventory remains a significant challenge in many markets.

- Low Wages: Wages may cool down in 2024, dwindling the potential buyer pool.

- Heavy demands: Borrowers want a personalized, mobile-friendly loan application process and quick turnaround times. This personalization and the predicted increase in mortgage activity could mean heavy workloads for loan officers.

- Increased Competition: As digital transformation becomes necessary for competitive advantage, traditional lenders may struggle to keep up with fintech companies.

Opportunities on the Horizon

The housing market is recovering, but it hasn’t completely bounced back. Ensuring your pipeline of qualified leads takes creativity and a willingness to explore new opportunities. Here are a few potential growth areas and emerging opportunities within the mortgage sector for 2024:

- Gen Z Homebuyers: This generation is still young, but they’re finally starting to move out of their parent’s homes and into properties in their name. The oldest Gen Z buyer is only 26, so capitalizing on this demographic shift can lead to long-term success.

- Diversifying Products and Services: With rising competition, lenders must diversify their offerings beyond traditional mortgage loans. This expansion could include moving into areas like home renovation loans or offering services such as credit counseling or financial planning.

- Enhanced Customer Experiences: In a competitive market, customer experience is vital. Lenders must focus on providing personalized, efficient experiences such as utilizing chatbots.

Strategies for Navigating the Forecast

Staying ahead of industry changes in the mortgage sector requires a willingness to embrace change. Practical strategies can help your team navigate forecasted changes.

- Stay Informed: Follow industry news and market intelligence and analysis reports.

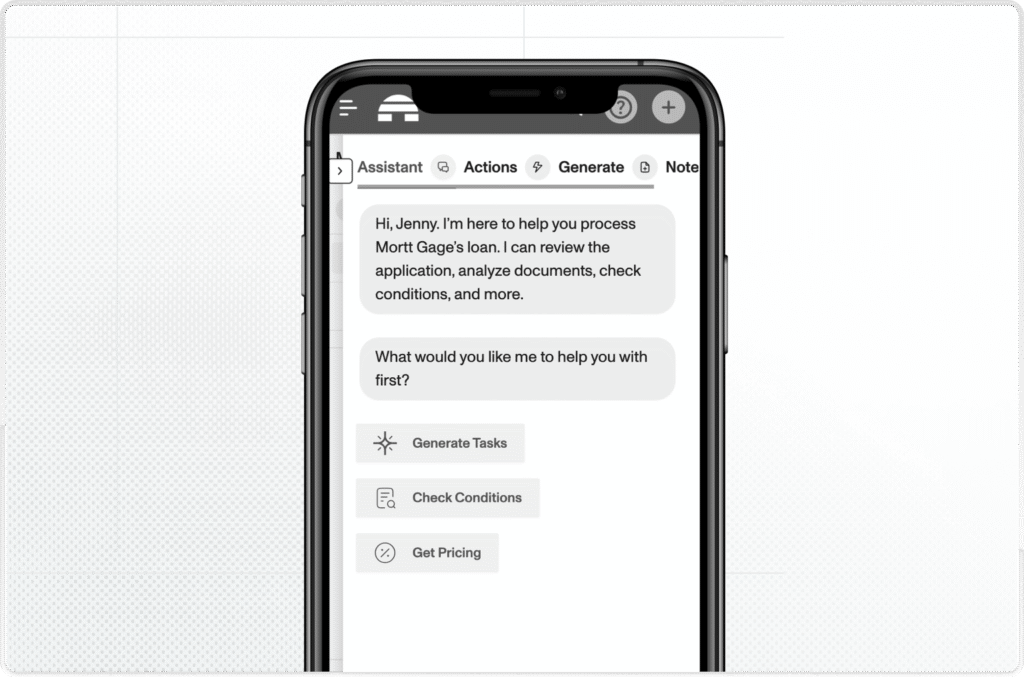

- Adopt Digital Solutions: Invest in technology that streamlines processes. Tools like Sonar, a digital loan origination system (LOS), are transformative.

- Discuss Changes: Regularly communicate with your team about potential changes and how they can be addressed. Try to collaborate on solutions so everyone’s on the same page.

- Diversify Offerings: As mentioned earlier, diversifying your offerings beyond traditional mortgages can help mitigate risk and open new growth opportunities.

Leveraging Technology in 2024

Technology is crucial to your mortgage business. Everything from how borrowers submit applications to how risk is analyzed has been affected by technology. This trend will continue in 2024 as mortgage software like Sonar improves and incorporates new tools.

Technology-driven processes can improve efficiency, reduce costs, and enhance customer experiences. For example, better regulatory compliance technology is rising, as are alternative data sources for creditworthiness.

AI improvements will also affect the mortgage industry.

Embracing Innovation

You can adapt to changes in the mortgage industry if you embrace an innovative attitude. If the market slides into a recession, your strategies to attract borrowers will look different than when the economy thrives.

For the upcoming year, consider insights from this 2024 Mortgage Industry Forecast. Mortgage rates may dip, but home prices and unemployment may as well. 2024 looks like the start of a housing recovery, albeit a slow one.

Sonar is here to help you handle these changes. The digital lending trends, like increased personalization and automation, will only grow in importance. You can stay ahead of the curve by adopting tools like Sonar now.