Despite record-breaking innovation in mortgage technology and a growing emphasis on customer experience, loan officers in 2025 are still falling into familiar traps. Whether it’s underestimating the power of automation or neglecting borrower education, these mistakes can cost time, money, and trust.

We’ve put together the top 10 mortgage mistakes loan officers are still making, and how to avoid them.

1. Failing to Embrace Automation

Manual processes are no longer just inefficient; they’re a competitive disadvantage. Many loan officers still rely on outdated methods for data entry, document review, and borrower follow-up. With AI tools like Sonar Apex now capable of handling routine tasks with speed and accuracy, failing to adopt automation means slower closings and more room for human error.

Fix it: Identify high-effort, low-skill tasks in your workflow and delegate them to AI-driven tools.

2. Inconsistent Borrower Communication

Today’s borrowers expect regular updates and instant responses. Yet too many loan officers leave clients in the dark for days, especially during underwriting. Lack of communication creates anxiety and erodes trust, even if everything behind the scenes is on track.

Fix it: Set expectations early and use automated messaging platforms to keep clients informed throughout the process.

3. Neglecting Compliance and Documentation

Even seasoned loan officers sometimes cut corners on disclosures or miss updated compliance rules, especially with ever-changing regulations at the state and federal level. This can trigger audits, delays, or worse.

Fix it: Use compliance monitoring software that flags risks in real-time and keeps you updated on policy changes.

4. Overlooking Credit Nuances

Relying solely on credit scores to qualify borrowers can lead to missed opportunities or approvals that fall apart later. In 2025, deeper data is available to help assess risk and tailor loans accordingly, but many loan officers aren’t using it.

Fix it: Integrate alternative credit data tools into your application process to get a fuller picture of borrower risk.

5. Not Educating the Borrower

Borrowers in 2025 are savvier, but they’re also overwhelmed with information. Loan officers often assume clients understand terminology or next steps, which leads to confusion, mistakes, and drop-off.

Fix it: Proactively explain key milestones, fees, and decisions. Use visual tools or pre-recorded walkthroughs to make the process clear.

6. Ignoring the Power of Pre-Approval

Skipping or rushing the pre-approval process can slow down deals and frustrate both real estate agents and borrowers. Yet many loan officers still treat it as optional or superficial.

Fix it: Offer fast, accurate pre-approvals supported by real-time data and pricing tools that build borrower confidence.

7. Underutilizing CRM Systems

A powerful CRM can help you nurture leads, automate follow-ups, and build stronger referral networks. Yet many loan officers either don’t use theirs or treat it like a contact list.

Fix it: Integrate your CRM with your loan origination system and commit to consistent data hygiene and follow-up workflows.

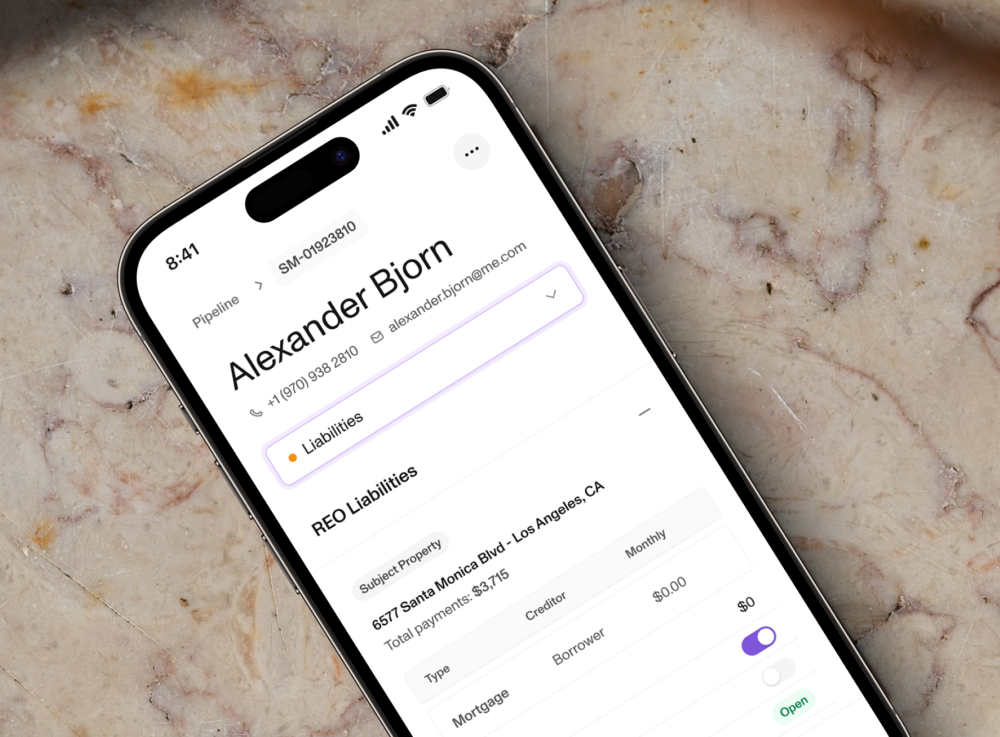

8. Forgetting About Mobile Borrowers

Many borrowers now apply, upload documents, and sign forms entirely on mobile. If your process isn’t optimized for that experience, you’re introducing friction that could cause drop-off.

Fix it: Audit your borrower journey from a mobile-first lens; forms, portals, and e-signatures should all be seamless on smartphones.

9. Delaying Rate Locks

With market volatility, timing matters more than ever. Loan officers who wait too long to lock rates can cost borrowers thousands and risk losing the deal entirely.

Fix it: Use integrated pricing engines and lock automation tools to seize the right moment based on borrower goals and market conditions.

10. Failing to Follow Up After Closing

Once a loan closes, many loan officers move on. But post-close communication is key to building long-term relationships and generating referrals.

Fix it: Set up automated check-ins post-close and offer value-add content to stay top-of-mind.

Loan officers in 2025 have more tools than ever to streamline their workflows, build trust, and deliver better borrower experiences, but only if they avoid these common pitfalls. With the right tech, mindset, and follow-through, today’s loan officers can close faster, convert more leads, and future-proof their careers.

Sonar’s AI-powered mortgage platform helps loan officers automate the tedious stuff, stay compliant, and deliver a seamless borrower experience, without the guesswork. Book a demo today and see how Sonar can help you close smarter, faster, and mistake-free.