For every mortgage originator, seamlessly integrating a point-of-sale (POS) system and customer relationship management (CRM) platform is a strategic imperative. The synergy between these indispensable tools keeps your business competitive in a profoundly saturated market.

You'll miss opportunities to capitalize on customer relationships without an integrated POS and CRM. You need effective data-sharing to decide which customers to target and which loans and services to offer. Working with disparate systems makes monitoring customer engagement and tracking leads difficult.

Integration grants instant access to customers' financial data and credit scores when they submit an application via the POS system. This way, loan officers can quickly scan and review customer information before contact. The system should also provide a clear history of interactions with each customer so you always know where they are in your pipeline.

What is a Mortgage POS?

A mortgage point-of-sale (POS) system is a digital platform where borrowers initiate loan applications. It offers a user-friendly platform for borrowers to securely submit their information and documents, thus transforming the old paper-intensive process into a modern experience.

Explore the benefits of a mortgage POS system.

What is a Mortgage CRM System?

A mortgage customer relationship management (CRM) system is valuable for originators seeking to enhance customer engagement and retention. A CRM platform acts as a centralized database that tracks and manages all customer interactions, from initial contact to post-closing follow-ups.

Explore how you can manage relationships effortlessly with Sonar.

Why Should I Integrate These Systems?

A mortgage POS with CRM capabilities is more than just a technological upgrade. It's a revolution for your business. By merging the functionalities of these two tools, originators gain access to a plentitude of benefits that boost efficiency and drive business growth.

Streamline the Origination Process

Integrating POS and CRM systems unleashes a transformative effect on your origination process. The days of working around data silos and redundant manual data entry are gone. Why juggle different platforms when you can utilize a unified database ensures that all data is up-to-date and accurate? The centralized repository holds all loan-related documents, making accessing and managing critical information easy. This not only saves time but also improves compliance.

Automation has a significant effect on your business as well. With automated lead management, you can engage with potential clients and increase the chances of successful conversions. Automated borrower communication keeps clients informed throughout the loan process, increasing transparency and trust.

See what mortgage process automation can do for you. Schedule a demo today!

Enhance Efficiency and Productivity

CRM+POS platforms empower loan officers to work better. The integration optimizes productivity and eliminates many manual and repetitive tasks, leaving you more time to build relationships with borrowers.

Your system should offer a clear view of each loan's progress and the team's overall pipeline. The insight makes assigning tasks and collaborating with other team members easier. Loans aren't one-size-fits-all; some officers may be more equipped to work with certain borrowers.

The system provides valuable data analytics and reporting tools because you accumulate a wealth of data when utilizing mortgage CRM solutions.

Amplify Customer Experience

The customer experience jumps to new heights using a mortgage CRM and POS. You can craft tailored messages for each borrower, increasing the likelihood of successful conversions. You can also design unique follow-up campaigns based on specific customer interactions with your brand.

Every interaction gets tracked so you can spot trends over time and see what borrowers respond to. The integrated system's automation features facilitate proactive communication at critical touchpoints throughout the loan process. Automated updates and reminders keep borrowers informed even when you're busy.

Boost Closed Deals and Revenue

Utilizing a mortgage LOS with a CRM platform translates into tangible benefits like increased revenue. Deals close faster because automation trims loan processing and approval times. Faster turnarounds lead to satisfied borrowers and a competitive edge in the market.

Cross-selling and upselling opportunities abound as you'll have each borrower's financial situation and loan history. Offering tailored loan options lets you maximize revenue potential.

Automated data-sharing and document management minimize the risk of errors, boosting revenue even further. With a single source of truth and real-time data updates, originators can feel confident loan applications are accurate.

Streamline Operations with Sonar’s Integrated Loan Origination Software

The power of integrating a Mortgage POS with a CRM platform is undeniable, propelling mortgage originators towards better efficiency and more revenue. Sonar's integrated loan origination software stands out for those seeking a comprehensive solution to streamline their operations.

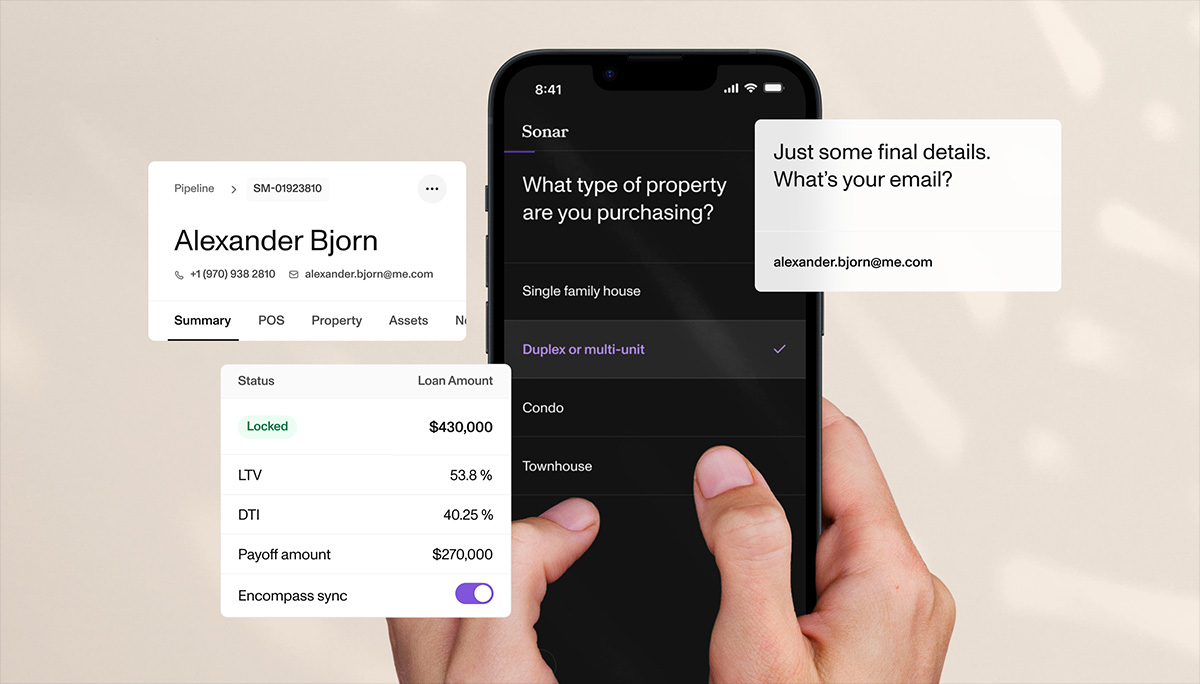

Sonar offers a modern, cloud-based loan origination platform with integrated POS and CRM capabilities. Originators get one unified system where they can manage the entire loan process - from lead capturing to post-closing follow-ups.

The intuitive interface makes it easy to route tasks, generate reports, monitor pipelines, track leads, access borrower data, and store documents. You can also view detailed analytics to refine your loan process further.

And to top it off, Sonar's integrated automated workflow engine helps you optimize operations with real-time updates.

Schedule your demo today and step towards increased efficiency, improved customer satisfaction, and business success.