In an era where time is of the essence and customers expect seamless experiences, lenders must streamline their processes to stay ahead. As the mortgage industry strives for greater efficiency, lenders and originators turn to technology that provides automation and better scalability.

This software can speed up the process, but the information must be entered multiple times as it's passed from one platform to another. Trying to juggle the data can lead to errors and complications, ultimately resulting in an unhappy customer experience. To overcome this, there is a better digital solution available: Sonar.

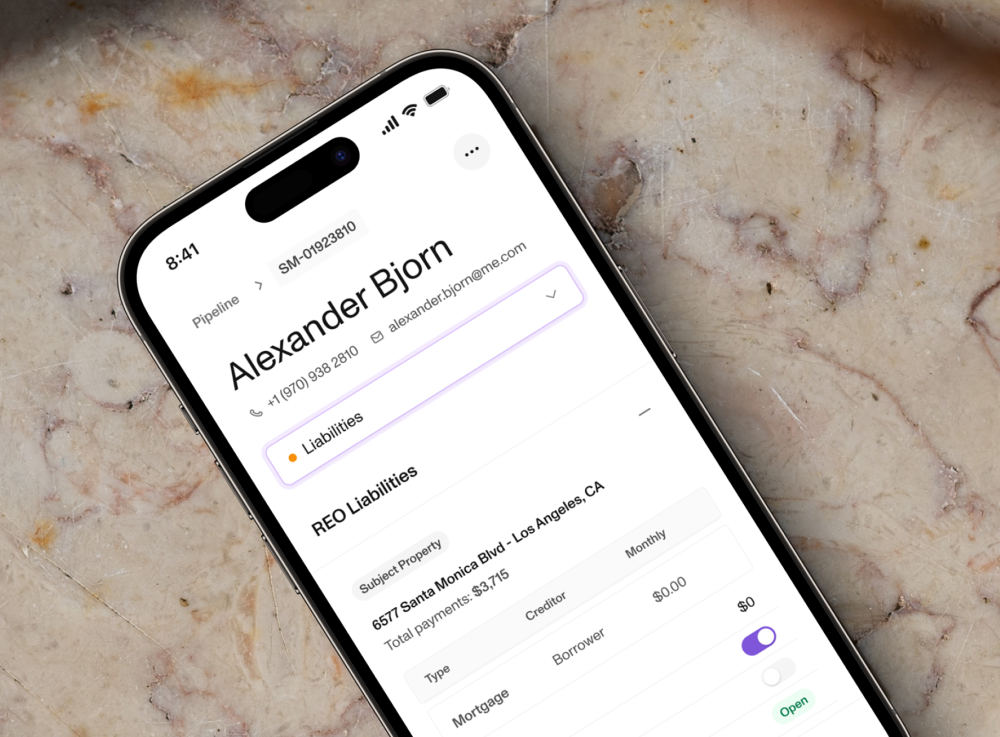

Sonar is an integrated origination software that allows lenders to have all of their industry tools in one place. With its simple interface and combined point-of-sale (POS), product pricing engine (PPE), and loan origination systems (LOS), Sonar gives you the flexibility you need to transform your workflow and reduce the manual steps involved in loan origination.

Ready to see what modern digital mortgage solutions can do for your business? Request a demo today!

Challenges Faced by Lenders

Legacy solutions have long plagued originators with inefficiencies and limitations. Traditionally, managing the mortgage pipeline requires significant manual data entry and the use of multiple systems. This is a time-consuming process, and mistakes can often occur due to human error. Real-time collaboration is tricky when coordinating information between disparate systems.

To address these challenges, digital mortgage solutions aim to streamline and simplify the loan origination process. Unfortunately, while these tools eliminate data entry and document management problems, many still lack integration. That’s where Sonar stands apart.

Sonar integrates LOS, POS, and PPE into one unified solution.

Game-Changing Integrated Software for Originators

Sonar provides an all-in-one platform designed to help you manage the entire origination process. It comprises three essential components: LOS, POS, and PPE.

- An LOS is a software platform that automates the pre-qualification, loan origination, and processing stages of mortgage lending. It also assesses risk and accurately calculates loan rates and terms.

- The POS is the customer-facing portion of the software. It improves the application process for customers by providing easy access to all origination information.

- Equally important is Sonar's PPE, the sophisticated tool that enables originators to compare available pricing options in a single click.

These three components - LOS, POS, and PPE - work together to create faster originations. Sonar grants complete visibility into every loan by integrating all of your systems into one platform.

The benefits of using a single system like Sonar include:

Enhanced Efficiency

Sonar removes duplicate entries and other manual steps through automation. The removal reduces processing times and allows originators to work faster and more efficiently.

The software also enables instant collaboration among stakeholders so that decisions can be made quickly.

Improved Customer Experience

The customer experience is paramount for any loan originator. Utilizing Sonar's robust PPE and POS system leads to faster loan approval times, expediting the lending journey and directly impacting customer satisfaction.

Customers can access their information and see their loan status 24/7. Transparent communication channels keep borrowers informed at every step of the process, promoting trust and satisfaction.

Our mortgage origination software can also produce personalized product and pricing options to satisfy diverse lending needs, further helping customers.

Enhanced Compliance and Risk Management

Mortgage professionals must adhere to stringent regulations, and Sonar makes it more accessible. The software is automatically updated with accurate and current regulatory guidelines, so compliance is never a problem. Our centralized data and document management system lets you access the information you need if you are audited.

Enhanced Scalability and Growth

Sonar simplifies the onboarding and training processes for new team members, reducing the learning curve and ensuring training doesn’t interfere with expanding your business. The platform offers flexibility, allowing lenders to adapt to changing market demands swiftly. Seamless integration with third-party systems and services ensures a connected ecosystem for lenders, further enhancing scalability.

Seamless Integration with Third-Party Systems and Services

Sonar's integration capabilities extend beyond our POS, PPE, and LOS. The platform connects to various third-party providers, giving you access to multiple services with no additional coding needed.

Secure a brighter future for both your borrowers and your bottom line. Schedule a demo today to discover how Sonar is revolutionizing the origination process.

Making the Transition: Considerations and Best Practices

Switching to a modern integrated system like Sonar transforms your originator business. However, successfully transitioning from legacy solutions to a new platform requires careful planning and execution. Here are some best practices to help you get started:

Evaluation Criteria

Before selecting a comprehensive origination system, list criteria to evaluate features and functionality. Consider scalability, integration capabilities, customer service, and compliance support.

Data Migration Strategy

Remember that migrating data from legacy systems to a new platform can be complex. Engage your technology partner for help with this process.

Training

Your team needs to know how to use the mortgage tools you adopt. Investing in sufficient training lets them become comfortable with the new software quickly.

Change Management

Transitioning to a new origination system is not just about the software. It's also about people and systems. When you upgrade your system, establish clear goals, timelines, and roles for staff to ensure everyone understands their part in making the switch.

Selecting a Reliable Technology Partner

The loan automation platform you choose determines how well your changes work. Look for a provider who will support you throughout implementation and maintenance.

Ready to Improve Your Lending Efficiency with Sonar?

Using loan origination automation software like Sonar is the best way to optimize your lending. With its integrated platform, intelligent automation, and document management, Sonar alters what it takes to originate a mortgage.

Loan officers used to spend a portion of their day organizing loan documents and entering data. Now, automation has shaved hours off the traditional workload. The extra free time makes delivering a superior customer experience more effortless than ever.

You don't have to worry about regulatory requirements either. Sonar's platform is continuously updated with the latest laws and regulations. Embracing the innovation of Sonar helps loan originators achieve greater success. Embark on a journey towards unparalleled success with Sonar's innovative solutions.

If you're prepared to elevate your lending efficiency to new heights, don't hesitate – request a demo now and experience the transformative power firsthand.