For lenders and originators, integrating a loan origination system (LOS) and a customer relationship management (CRM) platform is no longer just an option but a strategic necessity. Seamless collaboration between these tools optimizes mortgage operations, bringing many benefits that contribute to an improved customer experience.

You can amalgamate data and view real-time loan information. It's also possible to track loan progress on an individual or portfolio level and create customized workflows that help with accuracy.

Teams that work with siloed systems instead may find themselves dealing with redundant data, inability to access customer information quickly, and difficulty monitoring loan progress.

What is a Mortgage LOS?

A mortgage LOS is a software designed to manage the origination process. Originators and lenders typically use it, offering tools like automated compliance checks, document generation, and comprehensive reporting options. When a mortgage LOS is in place, your team won't feel burdened with excess manual work. It fosters effective collaboration.

Explore what the Sonar's LOS software can do for your business.

What is a Mortgage CRM System?

CRM mortgage software guides the customer journey from initial contact to post-closing. You can build workflows that consider specific lending requirements and create comprehensive, up-to-date profiles of every customer in the system. The knowledge bank empowers your originators to anticipate needs and build client trust through timely communication.

Explore how you can manage relationships effortlessly with Sonar.

Why Should I Integrate These Systems?

An integrated LOS and CRM system creates a unified workflow with accurate real-time data across platforms. Teams can access data-rich customer profiles and the latest loan information, resulting in happier customers and faster decision-making. By removing the need for manual data entry and minimizing errors, your focus can shift to developing relationships.

Here are some of the most significant benefits to consider.

Streamline Data Flow

When your CRM and LOS work together, there's no need to waste time juggling multiple systems to access customer information—the data is in one place. Real-time updates mean everyone will work with identical, up-to-date, and accurate records. And, because you don't have to worry about duplicate data entry, there's less chance of confusion.

Improve Operational Efficiency

An integrated LOS and CRM for loan officers can significantly enhance operational efficiency. Combining these disparate systems' strengths can eliminate repetitive manual tasks and reduce your team's workload.

Tasks such as document collection, follow-up reminders, and compliance verifications become automated, expediting the application process and further limiting your responsibilities. You can even tailor marketing materials to specific segments, increasing the chances of converting leads into clients.

Operational efficiency gets bolstered by data synchronization across systems and easy collaboration. Originators, underwriters, and support staff can access shared data and work together.

Enhance Customer Relationships

The power of an integrated LOS and CRM goes beyond improving operations; it recharges your customer relationship strategy and enables you to collect and analyze data about every interaction.

With this data, crafting personalized communication and targeted marketing messages that resonate becomes easy. An integrated system can identify clients eligible for refinancing based on their financial profiles and market conditions.

The identification lets you proactively reach eligible clients with tailored refinancing offers. Borrowers can monitor their status by viewing their dashboard or following automated updates and emails.

Convert Leads Faster

Lead management changes when your LOS and CRM work together. You can capture more leads, and by monitoring customer activity, you can identify buyers ready to purchase.

With streamlined workflows and automated follow-ups, leads are nurtured throughout origination. The care decreases the risk of leads going cold and keeps them in your pipeline.

When a new lead enters the system, it's assigned automatically to the most appropriate originator, ensuring prompt follow-up and engagement.

Streamline Operations with Sonar’s Integrated Loan Origination Software

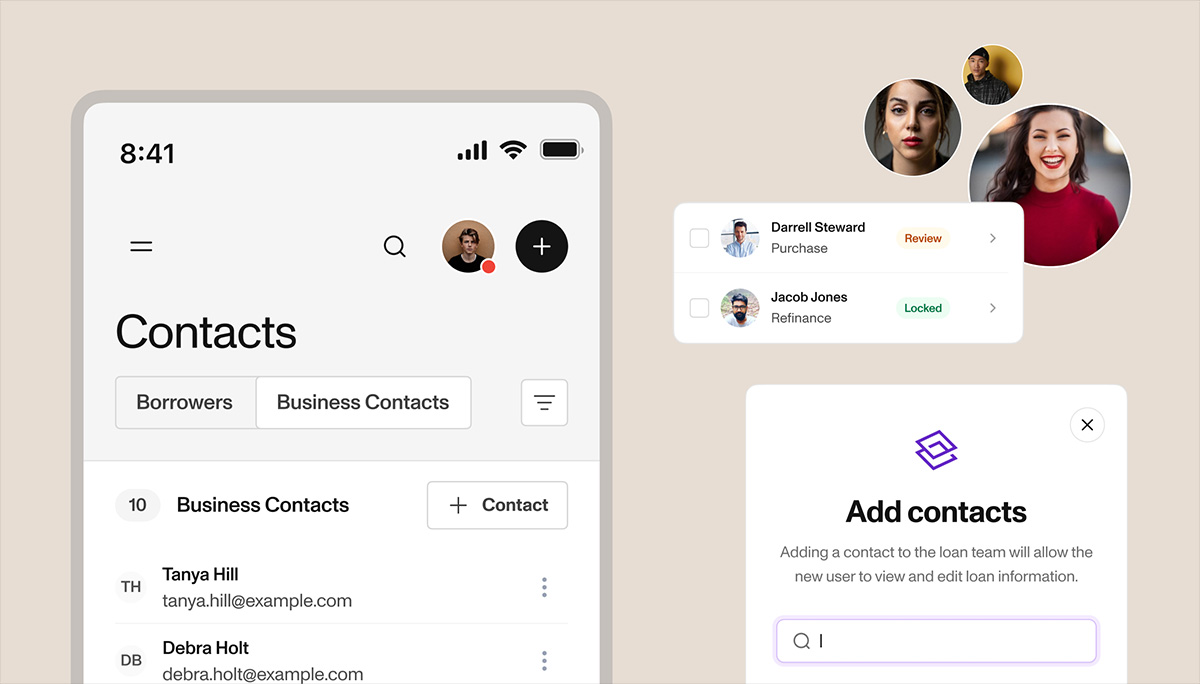

Sonar is a comprehensive LOS platform with advanced CRM capabilities. We combine the functionality of LOS and CRM software with a product pricing engine (PPE) and point-of-sale (POS) system, allowing you to customize the entire loan origination process.

From lead capture to document management and loan processing, Sonar offers complete visibility and transparency into every loan. Our configurable dashboard enables the customization of workflows, automatic compliance checks, and regular reporting. The system also supports multiple users so teams can stay better connected.

Are you considering an integrated LOS and CRM platform? Sonar is the best choice for a complete loan origination system for originators.

Discover the power of Sonar's integrated LOS & CRM firsthand. Schedule a demo now.