Understanding the Role of CRM in Mortgage Loan Origination

In the fiercely competitive mortgage industry, excellent loan origination sets the winners apart. The key lies in streamlined processes, cultivating relationships, and perfecting customer interactions. Mortgage Customer Relationship Management (CRM) systems can help achieve these goals. This piece will provide a condensed guide to exploiting CRM tools for your mortgage business, highlighting the advantages of integrating a mortgage CRM system.

Secure a brighter future for both your borrowers and your bottom line. Schedule a demo today to discover how Sonar is revolutionizing the origination process.

The Advantages of Mortgage CRM Software

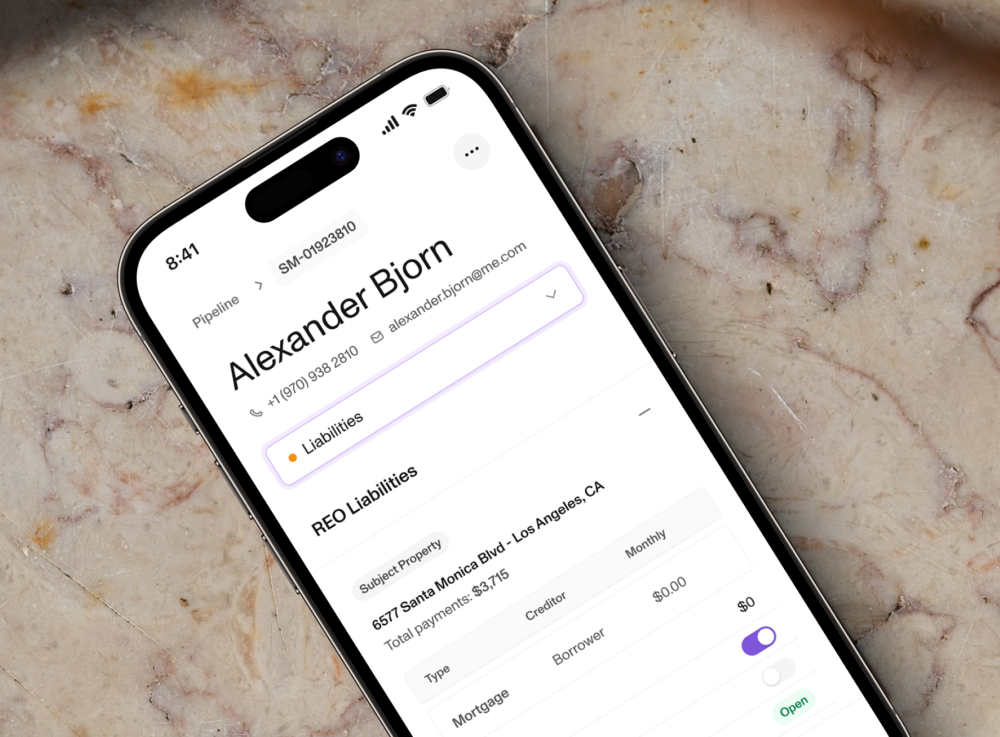

Mortgage CRM software, a unique solution designed for mortgage professionals, consolidates customer data, automates routine tasks, and optimizes the loan origination process. By centralizing data, it enables loan officers to efficiently manage leads, communicate with borrowers, and monitor loan applications.

Lead Capture and Management

A mortgage CRM system allows effortless capture, tracking, and management of leads. It integrates with your website or lead generation platforms to automate lead capture and assignment, enhancing lead distribution and ensuring prompt follow-ups, thereby increasing conversion rates.

Workflow Automation and Task Management

Mortgage CRM software automates workflows and removes redundant manual processes. It can handle a variety of tasks from automated emails to generating customized loan documents, freeing up time for loan officers to build relationships and close deals.

Communication and Transparency in the Loan Origination Process

Effective communication is crucial in the mortgage industry. A mortgage CRM system offers a central communication platform, making it easy for loan officers to engage with borrowers and other stakeholders. Integrated email and text messaging features allow personalized communication, maintaining transparency throughout the loan origination process.

Simplifying Document Management

A mortgage CRM system simplifies document management by providing a secure repository for storing and retrieving loan-related documents. It eliminates the need for physical paperwork and reduces the risk of misplacement.

Enhancing Mortgage CRM Capabilities Through Integration

Integration of your mortgage CRM system with other key software can boost its capabilities, providing a complete end-to-end solution. Integration with loan origination software streamlines the entire loan origination process, eliminates duplicate data entry, and improves overall efficiency.

Integration with Marketing Automation Tools

Integration with marketing automation tools enables personalized, targeted marketing campaigns. You can segment leads, send automated marketing emails, and track campaign performance. This fosters lead nurturing, increases engagement, and improves conversion rates.

Integrating CRM with Customer Support Software

Integration with customer support software allows efficient management of borrower inquiries and ensures timely resolution of issues, promoting customer satisfaction and building long-term relationships.

The Impact of Mortgage CRM Systems on Loan Origination

In the modern mortgage landscape, leveraging CRM tools is key to boosting loan applications. Mortgage CRM systems offer myriad benefits, from streamlining lead management to improving communication. Integration with other systems further enhances its capabilities.

Experience the Benefits of a Tailored Mortgage CRM System

To fully comprehend the potential of a mortgage CRM system tailored to your needs, we encourage you to schedule a demo. Experience how our integrated mortgage CRM software can revolutionize your loan origination process, enhance efficiency, and stimulate business growth. Don’t miss this chance to optimize your processes, cultivate valuable relationships, and perfect customer interactions with a top-notch mortgage CRM system.

Secure your demo today and take the leap towards heightened efficiency, unparalleled customer satisfaction, and resounding business success.