Mortgage originators cannot depend on legacy systems if they want to appeal to homebuyers. Mountains of paperwork, slow processing times, costly mistakes —these issues destroy your reputation.

Digitation has become mandatory, with more borrowers turning to online mortgage lenders—the change showers benefits on your company. Updating your processes to include integrated mortgage solutions eliminates hours of tedious work and gives you the space to increase your customer load.

The software covers the entire mortgage lifecycle, from origination to post-closing.

5 Ways An Integrated Mortgage Software Can Grow Your Business

Streamlining Workflow and Efficiency

Integrated mortgage software brings automation to your operations, streamlining every step. Repetitive tasks can occur in the background instead of stealing your originators’ time. Task management becomes a breeze. Originators can check the status of a loan in seconds, allowing them to focus on more critical tasks.

With integrated software, you also get process optimization. The system suggests improvements based on data analytics, highlighting lingering inefficiencies. For example, you might notice that you’re generating voluminous leads but only contacting them once. Good software will make this deficiency readily apparent.

Or, you may discover that most of your leads come from referral sources. You can assign a specialty originator to handle those specific leads and better nurture relationships with brokers or agents.

Enhancing Client Experience

A happy customer results in free marketing. Borrowers who face easy mortgage approval love bragging about it to their friends. But how do you make home buying easier? With integrated software.

One prominent feature of integrated mortgage software is the client portal. Clients can upload documents securely, check loan status in real-time, and communicate with their originator directly—no more endless games of phone tag.

The improved communication works for your team, too. You can send automated texts or emails to customers at different stages of the loan process, keeping them informed and satisfied with little effort.

Data Centralization and Accuracy

Data centralization simply means one source of truth. Why shuffle between multiple spreadsheets when you can store all your information in one place?

With integrated mortgage software, data accuracy increases significantly. Manual data entry or transfer between systems disappears, minimizing human errors that creep into your pipeline. Everything from credit scores to loan amounts is readily available for analysis.

Having centralized and accurate data also means you can analyze it better. Data analytics gives you insights into growth opportunities. You’ll see which campaigns your customers respond to, how long it takes for loans to close, etc.

Comprehensive Reporting and Analytics

Speaking of data analytics, integrated software provides comprehensive reporting and analytics dashboards. You’ll get a real-time bird’s eye view of your business, allowing you to handle problems before they escalate.

Reporting lets you track various metrics such as loan volume, time-to-close loans, and average loan amounts. You can see which loan types generate the most revenue and adjust your strategy accordingly.

Analytics dive deeper into your data, identifying trends and patterns you may have overlooked. Data-driven decision-making becomes second nature with integrated mortgage software, helping you make informed decisions that impact business expansion.

Scalability and Flexibility

Integrated mortgage software is designed to adapt to your business as customer traffic ebbs and flows. It can handle increased volumes without any significant changes. You won’t have to worry about investing in new systems or hiring additional staff to meet short-term demand increases. Automation can handle the work originators don’t have time for.

Flexibility is also a key benefit of utilizing integrated mortgage software. The system can be customized to fit your unique processes and workflows, making learning more manageable for your team. You’re free to add new features as needed. If a new regulation or compliance measure arises, the system will automatically adjust to reflect the change.

Choosing the Right Integrated Mortgage Software

Mortgage software is diverse and varied. The ultimate purpose is to enhance your business through automation, analytics, and digital tools. However, vast differences exist between platforms.

Before purchasing new software, think about what you expect from it. Here are some key considerations:

- Scalability: As discussed, ensure the software can handle increased customer demand without significant changes. You don’t want to upend your processes because you hit a short rush.

- Compatibility: The integrated software should be able to integrate with other systems and programs you currently use, or its value is limited. You need a compatible system unless you’re ready to start from scratch.

- Support: Even with the best software, you will run into a few hiccups. Choose a platform that’s loaded with ample support options. Onboarding help is instrumental as well.

- Price: Mortgage software is available at a wide range of prices depending on the features and capabilities you need. Make sure you’re investing in what will benefit your business most.

- Features: Think about the features you want before you enter an agreement. This is a good idea whether you have a large or small budget.

Take time to sort through your options. The right software makes a noticeable difference in your profitability and stress.

Integrated mortgage software grows your business. It improves workflow and efficiency by maintaining data fidelity and centralization. Client experience improves as well, resulting in free referrals.

If the software is less helpful than you expected, comprehensive data analytics and reporting will show you why. You can then quickly make the necessary changes.

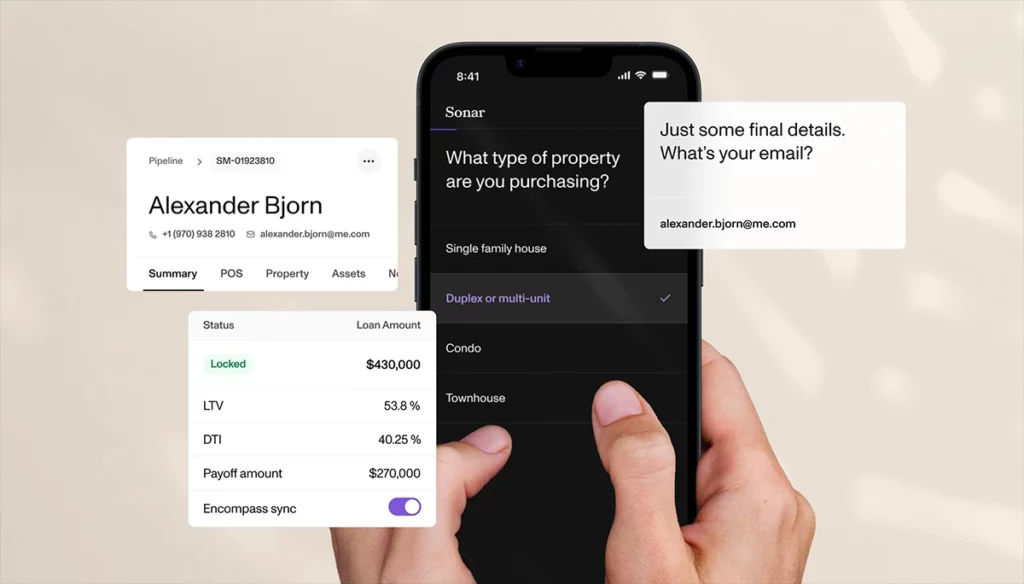

At Sonar, we offer industry-leading mortgage solutions that are customizable, scalable, and compatible with most existing systems. Our software provides comprehensive reporting and analytics to help you make data-driven decisions for business growth. Scalability and flexibility mean that the system is ready to adapt as needed.

With Sonar, customers experience frictionless mortgage applications and approvals while originators remain organized.

Ready to revolutionize your mortgage origination process? Schedule a Sonar demo today!