Choosing the right point of sale (POS) vendor can be daunting, especially for mortgage lenders and brokers who must ensure their vendor meets stringent regulatory requirements. Many options exist, and each one promises to optimize your pipeline.

So how do you know which point-of-sale providers align with your specific needs? To make the decision easier, we've compiled 6 questions you should ask. By asking these questions in advance, you can identify the best fit for your business and create an ongoing partnership that meets your needs.

6 Questions to Ask Your Loan Origination System Vendor

A reliable POS system that improves the lending experience for your customers keeps your business strong. If the POS falters, approval times will lag, and applicants will look for more efficient options.

Discuss the following six questions with your vendor. Let their answers guide your decision.

1. How Does the POS Help to Convert More Buyers?

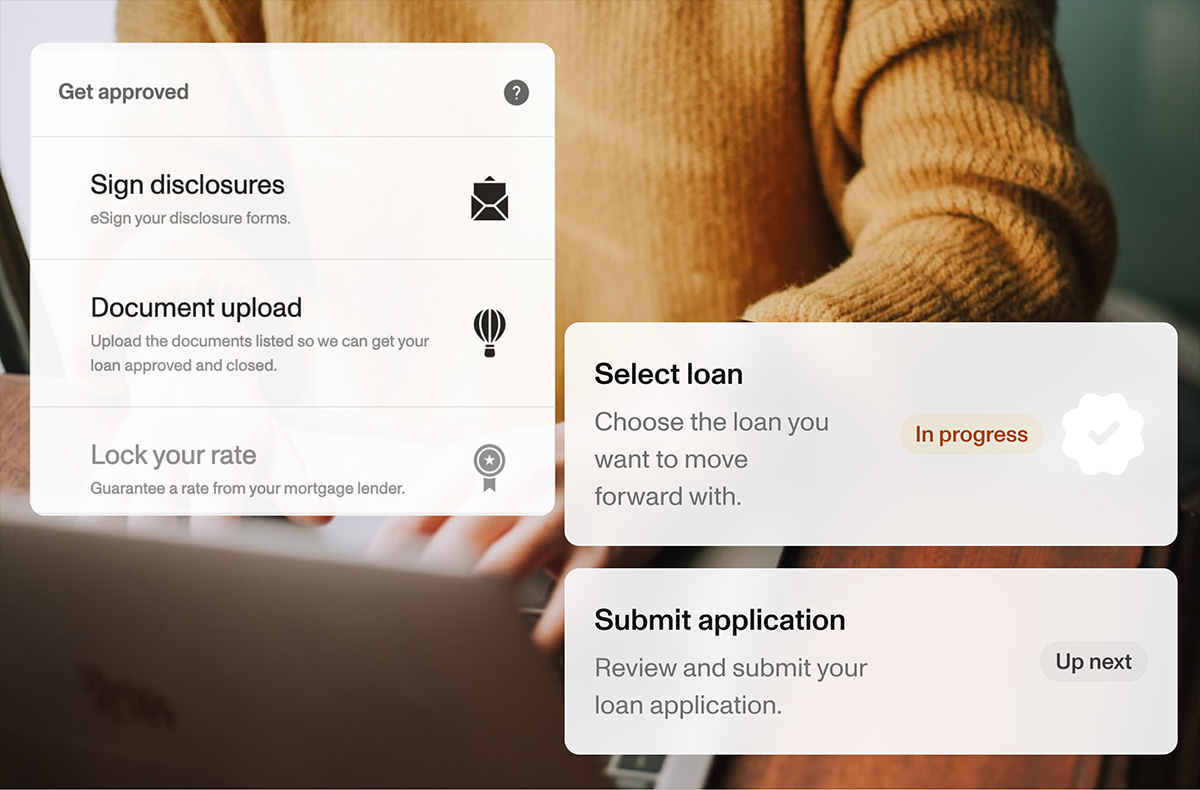

The right POS system can help you close deals faster, but this only happens when equipped with features that make it easy to start and finish loan applications. Many customers dread long, consulted paperwork and want a hassle-free alternative.

Ask potential vendors if they offer pre-filled forms or automated identity verifications, which can dramatically reduce the time it takes to approve a loan. Also, look for mobile support, which makes it easier for borrowers to complete applications while on the go.

2. Is the Solution Customizable?

When evaluating POS systems, ask if the solution is customizable or has “white label” options — meaning you can brand it with your logo and color scheme. This effort creates brand cohesion between your website, emails, and other touchpoints.

It's a good idea to explore options for customizing the system’s user interface. Does your vendor provide a way to create customized workflows based on specific customer scenarios? Do they offer appealing design templates? Does the platform permit integrations with other tools, such as your CRM?

3. Is the Solution Scalable?

Your LOS must be agile enough to adapt to changing demands. Ask your vendor whether the solution can handle more applications and additional loan officers. The system should easily integrate with the tools necessary for a more extensive operation.

4. How Much Does it Cost?

Ensure you understand what gets included in the cost of the system and any additional fees you will incur. Most point-of-sale software vendors charge a regular subscription fee. You may also run into costs for:

- Software: The initial software costs tend to be higher for more advanced POS systems.

- Support: Some vendors charge an additional fee for ongoing support.

- Credit Card Processing Fees: This charge will vary depending on your chosen provider and processor.

Remember to check if setup or cancellation fees are associated with your contract.

5. How Does the POS System Deal With Pricing?

Pricing is integral to your POS. It should be well-integrated into the system to stay updated with current fees. Sonar's loan origination system (LOS) and POS platform allow users to send accurate proposals in seconds, freeing loan officers from hours of tedious work. Rate refreshes are instant, and customers can lock in their rates, features that are absent from most POS providers.

Accurate pricing means you can always identify the best-fitting loan options for your clients.

Discover how Sonar is revolutionizing mortgage pricing.

6. Does The LOS System Also Include POS?

Finally, consider whether your vendor offers a complete suite of solutions, including LOS and POS software. Using two platforms will slow you down and heighten the possibility of mistakes.

Sonar is unique in that it provides both a LOS and POS and a Product & Pricing Engine (PPE). Mortgage brokers can manage the entire loan process from a single system. There's no need to worry about complicated integrations or sharing data.

Explore how Sonar's integrated LOS & POS can benefit your business

Finding the right point-of-sale vendor is critical to meeting your customers' needs and creating a thriving business. Asking the right questions can help you find a vendor that offers an integrated solution tailored to your specific needs. The ideal POS is customizable, scalable, and rich with features that appeal to customers.

Why Brokers & Lenders Choose Sonar for their LOS & POS Vendor

When it comes to finding the best LOS and POS vendor, brokers and lenders choose Sonar. Our platform provides a fully configurable loan origination system with a POS and integrated pricing. Setup and implementation are free and can be completed in one day. Mortgage professionals who rely on Sonar know their customers experience a seamless application process.

Please contact our team if you have any further questions about our POS system or how it can help your business. We'd love to help.

Ready to revolutionize your mortgage businesses with an integrated point-of-sale system? Request a demo to step into the future of lending success.